Zurich is one of the busiest train stations in the world. It rarely comes to a standstill. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel: http://www.youtube.com/swissinfovideos Subscribe:...

Read More »Possible Sign of Silver Turn, Report 31 Jan, 2016

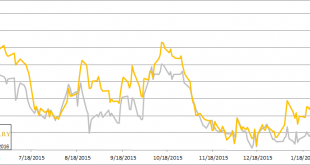

The price of the dollar was down 50mg gold, to 27.8mg, or if you prefer 0.04g silver to 2.18g. Why do we measure the volatile dollar in terms of gold and silver? There’s nothing else to measure it, certainly not the dollar-derivatives called euro, pound, franc, yen, and yuan. In the common tongue, gold was up $20 and silver rose 25 cents. More importantly, we want to know what happened to the fundamentals. Read on for the only proper fundamental analysis of the gold and silver markets… But...

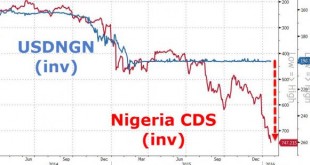

Read More »“Time To Panic”? Nigeria Begs World Bank For Massive Loan As Dollar Reserves Dry Up

Having urged "don't panic" just 4 short months ago, it appears Nigeria just did just that as the global dollar short squeeze forces the eight-month-old government of President Muhammadu Buhari to beg The World Bank and African Development Bank for $3.5bn in emergency loans to help fund a $15bn deficit in a budget heavy on public spending amid collapsing oil revenues. Just as we warned in December, the dollar shortage has arrived, perhaps now is time to panic after all. In September,...

Read More »New Month, Same Drivers

On the very first trading day of the year, the Nikkei, DAX, and S&P 500 gapped lower, setting the tone to a particularly challenging month for investors.The last week and a half has been better, and this will likely carry over into the start of the new month. Before January could slip into the history books, the Bank of Japan sprung a last-minute surprise by adopting a tiered system that includes a minus 10 bp charge to new excess reserves. BoJ goes negative, not completely unexpected...

Read More »Speculators Added to Long Yen Position Ahead of BOJ

The latest CFTC Commitment of Traders report covers the five sessions through January 26, the day before the FOMC concluded its two-day meeting and three days before the BOJ's announcement. Speculators hardly changed their positioning during the period. There was no gross position adjustments that we call significant, a bar we set at 10k contracts. Indeed, in the most recent reporting period, there were only four gross position changes larger than 5k contracts. The bears added 5.8k...

Read More »The Dollar: Now What?

The US dollar turned in a mixed performance last week. Firmer oil and commodity prices more generally helped lift the Australian and Canadian dollars, and many emerging market currencies. These currencies initially extended their gains ahead of the weekend in response to the Bank of Japan's surprise 20 bp cut on some excess reserves ( to -10 bp). The yen lost 2.25% on the week, its biggest weekly decline since the BOJ's surprise expansion of its Qualitative and Quantitative Easing in...

Read More »Emerging Markets: What has Changed

1) Korea’s Financial Services Commission will introduce a so-called “omnibus account” for foreigners investing in local stocks2) Malaysian Attorney General Apandi Ali closed the investigation into transfers of foreign money into Prime Minister Najib Razak’s personal bank accounts 3) The South African Reserve Bank increased the pace of its tightening 4) The Egyptian central bank eased restrictions on dollar cash deposits 5) The Turkish central bank raised its 2016 and 2107 inflation...

Read More »Beware the Ides of the Earnings Season!

It is critical for an investor to be very vigilant during the earnings season, which already began on January 11 with Alcoa (AA) reporting its results. Not only do companies report their financials, but they also make other significant announcements, such as either raising or lowering their earnings guidance for the coming months. Given the importance of this information, it is no surprise that a company’s stock can often soar or plunge on these disclosures. Therefore, investors need to be...

Read More »How airlines cater for their rich customers

Today flying is cheap. Airlines are undercutting one another and many are even doing away with luxury classes. But now there are signs of a counter-trend. Airlines from Asia and the Gulf States are investing huge amounts in first class – and Swiss International Air Lines is following suit. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international...

Read More »Why Switzerland takes asylum seekers’ assets

Denmark’s decision to confiscate valuables from asylum seekers is similar to the practice in Switzerland, which has been in effect for more than 20 years. It is coming in for criticism too. (SRF/swissinfo.ch) Swiss law states that asylum seekers have to disclose their assets. According to certain criteria – such as the amount and/or lack of proof of the origin of the assets – the authorities can demand that it be handed over. According to Léa Wertheimer from the State Secretariat for...

Read More » SNB & CHF

SNB & CHF