Blake (@PipCzar) interviews Marc Chandler. Marc Chandler has been covering the global capital markets in one fashion or another for more than 25 years, working at economic consulting firms and global investment banks. Chandler attended North Central College for undergraduate work, where he majored in political science and the humanities. He holds master's degrees from Northern Illinois University and University of Pittsburgh in American History and International Political Economy. Currently...

Read More »The Morning Edge With Blake Morrow – SPECIAL – Marc Chandler along with Chris Bayer – 03/17/16

Blake (@PipCzar) interviews Marc Chandler. Marc Chandler has been covering the global capital markets in one fashion or another for more than 25 years, working at economic consulting firms and global investment banks. Chandler attended North Central College for undergraduate work, where he majored in political science and the humanities. He holds master's degrees from Northern Illinois University and University of Pittsburgh in American History and International Political Economy. Currently...

Read More »Great Graphic: Dollar Index Retracement, Too Soon To Say Top is In

The cry that the dollar has peaked is gaining ground. We are not convinced. The macro-fundamental case remains intact. Divergence between the US and other high income countries continues, even if at a more gradual pace than the Federal Reserve expected a few months ago. This Great Graphic of the Dollar Index, created on Bloomberg, shows that shows the broad consolidation over the past year continues to hold. The break of 95.00 today seems to point to a test on the low from last...

Read More »Dollar Drop Extends Post-Fed, Stocks, Bonds and Commodities Rally

The Federal Reserve's cautiousness has sent the dollar reeling. The Fed's backtracking to two hikes this year from four is still met with skepticism by the market. It previously had a June hike nearly discounted but has not pushed that out until September. With a backdrop of BOJ, and ECB and PBOC easing policy, and the Federal Reserve reducing the number of hikes it anticipates, the recovery from the turbulent start to the year continues. Although the Nikkei slipped, the MSCI...

Read More »Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly in the Yuan's stronger fixing overnight) at the expense of Europe and Japan, both of which want the USD much stronger. ECB, BOJ don't want a weak dollar; China does not want a strong dollarFed sides with China for now — zerohedge (@zerohedge)...

Read More »Producer/Import Prices February 2016: 0.6% m/m and 4.6% y/y

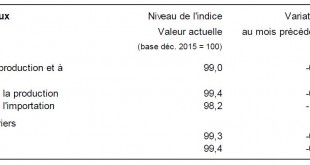

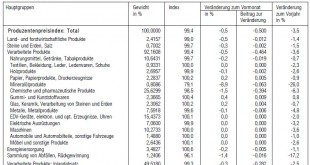

Producer and Import Price Index in February 2016 0.6% decline in Producer and Import Price Index Neuchâtel, 17.03.2016 (FSO) – The Producer and Import Price Index fell in February 2016 by 0.6% compared with the previous month, reaching 99.0 points (base December 2015 = 100). Whereas the Producer Price Index declined by 0.5%, the Import Price Index fell by 1.0%. The decline is due mainly to lower prices for chemical and pharmaceutical products as well as petroleum products. Compared with...

Read More »Producer and Import Price Index in February 2016: 0.6% decline in Producer and Import Price Index

17.03.2016 09:15 - FSO, Prices (0353-1602-50) Producer and Import Price Index in February 2016 0.6% decline in Producer and Import Price Index Neuchâtel, 17.03.2016 (FSO) – The Producer and Import Price Index fell in February 2016 by 0.6% compared with the previous month, reaching 99.0 points (base December 2015 = 100). Whereas the Producer Price Index declined by 0.5%, the Import Price Index fell by 1.0%. The decline is due mainly to lower prices for chemical and pharmaceutical products...

Read More »Fed Pulls Back to Two Hikes, Dollar Drops and Stocks Rally

The Federal Reserve halved the number of rate hikes it anticipates this year from four to two. The market has been moving toward this as well after having thought the would be no hikes this year. The dollar sold off. The dollar-bloc currencies and emerging market currencies are have rallied sharply. Risk assets in general like the idea of a less hawkish Federal Reserve. The Fed's dot plots point to a Fed somewhat less confident on the near-term outlook but maintained the...

Read More »Brexit, Cyprus and the EU Summit

The EU leaders summit on refugees begins tomorrow. A conclusive agreement will likely be elusive. There are three main obstacles. First, the effort to reinforce the external borders to allow free internal movement requires Turkey's cooperation, but it won't be represented. Second, that is important because Cyprus is demanding more concessions by Turkey. Third, others such as Spain, are concerned that the strategy contravenes EU and international law by abridging the right to...

Read More »Dollar Firm Ahead of the FOMC, UK Budget Looms

Since the Federal Reserve hiked rates in December, both the European Central Bank and the Bank of Japan have eased policy further. The idea that because they cut rates means that the Fed cannot raise rates is a not a particularly helpful way to think about that is happening. The market attributes practically no chance for a Fed hike today. But the FOMC is expected not to back off very much from its view that contrary to what some have argued, the December rate hike was not a mistake,...

Read More » SNB & CHF

SNB & CHF