Swiss Franc The Euro has risen by 0.08% to 1.0992 EUR/CHF and USD/CHF, November 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Indications that a phase one agreement between the US and China would include rolling back some existing tariffs is boosting risking appetites, sending stocks higher, and pushing up yields. However, this appears to be simply a restating of China’s views rather than a new breakthrough....

Read More »Negative interest rates ‘harm Swiss economy’

Swiss firms fear that savers and pensioners will suffer from negative interest rates. (Keystone / Gaetan Bally) A survey of Swiss companies commissioned by UBS bank concludes that negative interest rates are harming the wider economy. Switzerland’s largest bank, UBS, asked 2,500 companies about the impact of negative interest rates. “Nearly two-thirds of respondents said that the cost…for the economy outweighed their benefits overall,” UBS said in a press...

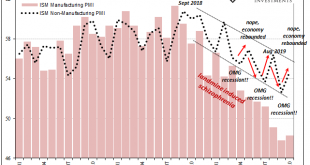

Read More »You Have To Try Really Hard Not To See It

In early September, the Institute for Supply Management (ISM) released figures for its non-manufacturing PMI that calmed nervous markets. A few weeks before anyone would start talking about repo, repo operations, and not-QE asset purchases, recession and slowdown fears were already prevalent. It hadn’t been a very good summer to that end, the promised second half rebound failing to materialize being more and more replaced by central banker backpedaling here as well...

Read More »USD/CHF technical analysis: Greenback hanging near the November highs against CHF

USD/CHF is trading flat on the day, consolidating the gains of the last two days. The level to beat for bulls is the 0.9940/0.9956 resistance zone. USD/CHF daily chart On the daily chart, USD/CHF is trading in a range below its 200-day simple moving average (DMA). The market is holding just above the 50 SMA today at the 0.9916 level. USD/CHF daily chart(see more posts on USD/CHF, ) - Click to enlarge USD/CHF four-hour chart USD/CHF is trading near the monthly...

Read More »Swiss train problems being solved, says manufacturer

Bombardier says its trains offer shorter journey times and more passenger comfort, but they have been beset by problems. Bombardier says it expects to deliver all 62 double-decker express trains ordered by Swiss Federal Railways by summer 2021. Deliveries should have been made as early as 2013 but have been fraught with technical problems. The trains were ordered in 2010 for a total of CHF 1.9 billion ($1.9 billion), making it the largest contract in the history of...

Read More »Why is solar power struggling to take off in Switzerland?

Solar energy is the main source of renewable energy in Switzerland, after hydroelectric power. But its potential is far from being exploited, according to industry experts. In 1982 Switzerland became the first country in Europe to connect a photovoltaic plant to the electricity network. Ten years later it inaugurated what at the time was the continent’s largest solar power station. And in 2015, the world’s largest off-grid solar panel system on the roof of a sports...

Read More »Sound Money Scholarship Winners Announced – 7 Outstanding Thinkers Earn Nearly $10,000 in Tuition Assistance

Eagle, ID (November 6, 2019) – Seven outstanding students beat out over 100 of their high-school and college peers in making the best case for sound money through an international, gold-backed scholarship competition… …and the winners walked away with almost $10,000 in scholarship awards for their exceptional, thought-provoking essays. For the fourth-straight year, Money Metals Exchange, the national precious-metals dealer that was recently ranked “Best in the USA,”...

Read More »QE by any other name

“The essence of the interventionist policy is to take from one group to give to another. It is confiscation and distribution. “ – Ludwig von Mises, Human Action In less than a year, we have witnessed an unprecedented monetary policy rollercoaster by the Federal Reserve, which began with a momentous U-turn in the central bank’s guidance in January, and has continued to escalate ever since. It is easy to forget that less than a year ago, all official statements and...

Read More »Nestlé accused of sourcing palm oil linked to forest fires in Indonesia

A 2013 fire in Korindo’s palm oil concession in Papua. Nestlé suspended Korindo last year but Greenpeace claims it still sources from Korindo’s subsidiary PT Mitra Indo Cemerlang. (Ardiles Rante/Greenpeace) The environmental group Greenpeace claims that the Swiss food giant procured palm oil from suppliers linked to around 9,700 fire hotspots in Indonesia this year. A Greenpeace reportexternal link released on Monday examines the supply chain of four major food...

Read More »Dollar Rally Stalls as Fresh Drivers Awaited

US-China relations continue to improve with news of cooperation in a major fentanyl case Eurozone final services and composite PMIs surprised on the upside; UK Parliament will be dissolved today Poland is expected to keep rates steady at 1.5%; Russia October CPI is expected to rise 3.8% y/y China sold €4 bn in its first euro-denominated bond since 2004; Thailand cut rates 25 bp to 1.25%, as expected The dollar is mostly softer against the majors as its recent rally...

Read More » SNB & CHF

SNB & CHF