Switzerland’s high current account surplus is far from being a good proxy for assessing the fair value of the Swiss franc.Switzerland has run a current account surplus since the 1980s. In 2017, it stood at around 9.8% of GDP, CHF66bn. This was CHF4bn higher than in 2016.Economic theory suggests that a large current account surplus is a function of an undervalued currency. Based on this premise, there may be question marks over the SNB’s contention that the Swiss franc was “overvalued”.In a speech last year, SNB President Thomas Jordan pointed to structural factors and a number of statistical distortions that contribute to Switzerland’s persistent current account surplus, suggesting the current account is far from a good proxy for determining the fair value of the Swiss franc.The Swiss

Topics:

Nadia Gharbi considers the following as important: Macroview, Swiss current account surplus, swiss franc valuation, Switzerland Balance of Payments, Switzerland surplus

This could be interesting, too:

Swiss National Bank writes Swiss Balance of Payments and International Investment Position: Q2 2022

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Switzerland’s high current account surplus is far from being a good proxy for assessing the fair value of the Swiss franc.

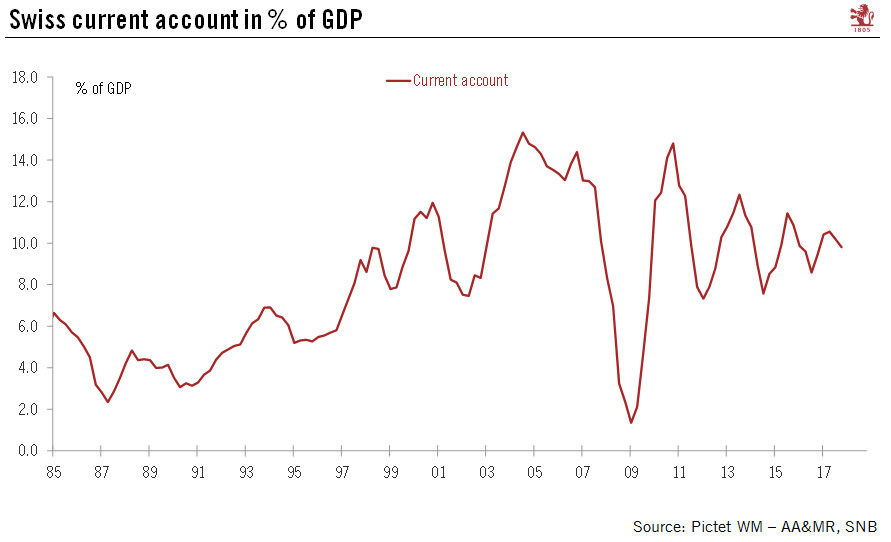

Switzerland has run a current account surplus since the 1980s. In 2017, it stood at around 9.8% of GDP, CHF66bn. This was CHF4bn higher than in 2016.

Economic theory suggests that a large current account surplus is a function of an undervalued currency. Based on this premise, there may be question marks over the SNB’s contention that the Swiss franc was “overvalued”.

In a speech last year, SNB President Thomas Jordan pointed to structural factors and a number of statistical distortions that contribute to Switzerland’s persistent current account surplus, suggesting the current account is far from a good proxy for determining the fair value of the Swiss franc.

The Swiss franc has displayed an upward secular trend over many years. Since the financial crisis, the SNB has geared its monetary policy towards easing pressure on the currency and making investments in Swiss francs less attractive by lowering its main interest rate deep into negative territory. Moreover, the SNB has countered any unwarranted appreciation of the Swiss franc by intervening in the foreign exchange market.

Overall, the SNB is likely to remain cautious in the near term and stick to its two-pillar strategy (namely negative interest rates and a readiness to intervene in the FX market if needed). Importantly, the SNB will keep its base interest rate below the ECB’s deposit rate to make investments in Swiss francs less attractive and thus avoid putting additional upward pressure on the Swiss franc.