Further economic deceleration is expected ahead.The official Chinese manufacturing purchasing manager indices (PMIs) came in at 49.4 in December, down from 50 in November and below the recent trough in early 2016. This brings PMI survey results below the crucial level of 50, entering contraction territory.The sharp deceleration was evident for both large enterprises and small- and medium-sized enterprises (SMEs), with the latter showing more weakness. The official PMI figure for large enterprises came in at 50 in December, compared to 50.6 in November, while it was at 48.4 for SMEs in December, down from 49.1 in the previous month.The decline in headline PMIs was driven by weak demand from both domestic and overseas markets. On the domestic front, the production, new orders and imports

Topics:

Dong Chen considers the following as important: China economy, China PMI, Chinese consumption, Chinese manufacturing, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Further economic deceleration is expected ahead.

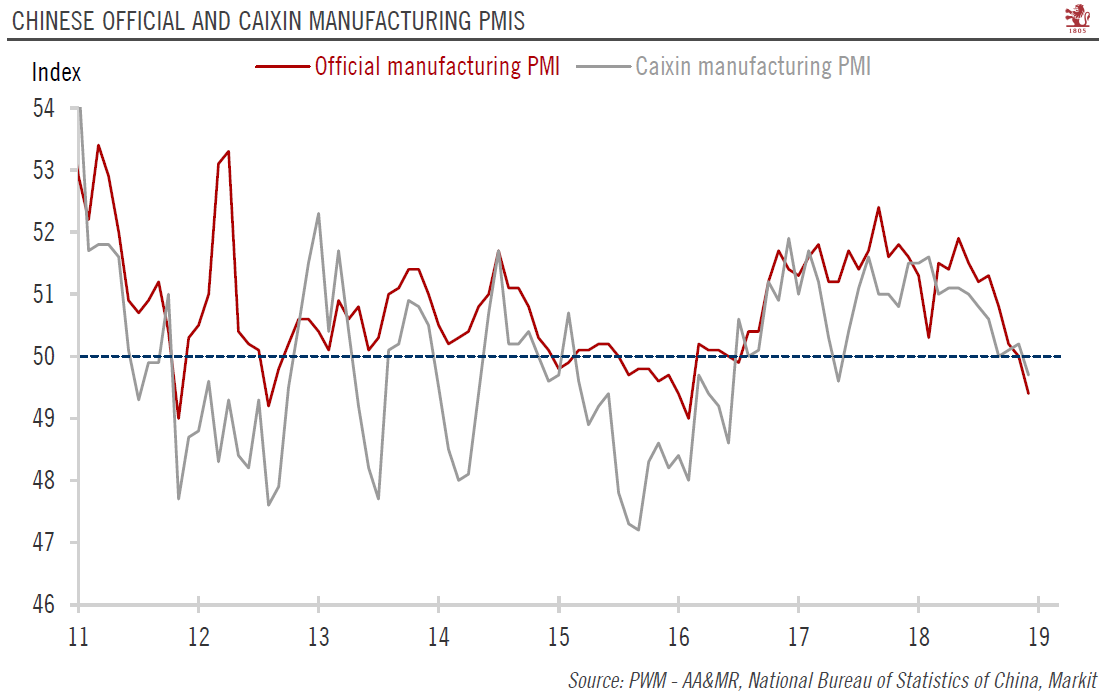

The official Chinese manufacturing purchasing manager indices (PMIs) came in at 49.4 in December, down from 50 in November and below the recent trough in early 2016. This brings PMI survey results below the crucial level of 50, entering contraction territory.

The sharp deceleration was evident for both large enterprises and small- and medium-sized enterprises (SMEs), with the latter showing more weakness. The official PMI figure for large enterprises came in at 50 in December, compared to 50.6 in November, while it was at 48.4 for SMEs in December, down from 49.1 in the previous month.

The decline in headline PMIs was driven by weak demand from both domestic and overseas markets. On the domestic front, the production, new orders and imports sub-indices all extended their slide in December. The new orders sub-index dropped below 50 in December for the first time in 33 months.

The non-manufacturing sectors generally did better than the manufacturing sector, but the services PMI was still at a fairly low level.

Both PMI surveys and hard data are pointing to the continued weakening of China’s growth momentum. We expect Chinese growth to continue decelerating in the near term, and that the Chinese government may step up stimulus measures, especially on the fiscal front. Growth momentum may not stabilise until Q2 2019.

Looking forward, we expect Chinese growth to continue decelerating in the near term, and that the Chinese government may step up stimulus measures, especially on the fiscal front. Growth momentum may not stabilise until Q2 2019. We keep our Chinese GDP forecasts for 2018 and 2019 unchanged at 6.6% and 6.1%, respectively.

We keep our Chinese GDP forecasts for 2018 and 2019 unchanged at 6.6% and 6.1%, respectively.