Sorry, I've looked everywhere but I can't find the page you're looking for. If you follow the link from another website, I may have removed or renamed the page some time ago. You may want to try searching for the page: Search Searching for the terms %3Futm+source%3Drss%26utm+medium%3Drss%26utm+campaign%3Dpaige+all+about+benjamins+why+dollar+determines+policies ...

Read More »New Week, but same Old Stocks (Heavier) and Dollar (Stronger)

Overview: The start of the new week has not broken the bearish drive lower in equities. Several Asia Pacific centers were closed, including Japan, Taiwan, and South Korea. China’s markets re-opened, and the new US sanctions coupled with the disappointing Caixin service and composite PMI took its toll. The CSI 300 was off 2.2% and the Hang Seng dropped nearly 3%. After falling 1.2% at the end of last week, Europe’s Stoxx 600 gapped lower today and is off almost...

Read More »Uber to roll-out Swiss-wide ‘dual model’ for drivers

Uber’s disruptive model faces resistance from unions and authorities in various countries, not just Switzerland. Keystone / Caroline Brehman The ride-hailing company says it will offer drivers the possibility of remaining independent or becoming official employees of a subcontractor firm. The “dual model” will be extended gradually across the country – with the exception of Geneva – from October, Uber’s Swiss director Jean-Pascal Aribot told the Tribune de Genève...

Read More »The Economy Is a Process Not a Factory

[Chapter 4 of Per Bylund’s new book How to Think about the Economy: A Primer.] To help us understand what is going on in the economy, what is important is not the types and number of goods that sit on store shelves. It is why and how they got there. To answer this question is not simply a matter of pointing out that they arrived by truck last week, because that only tells us about how they were transported to the store. This doesn’t tell us anything about all the...

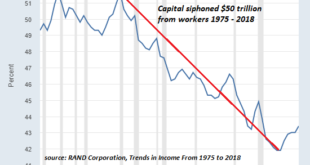

Read More »‘Quiet Quitting’ Isn’t Just About Jobs; It’s About a Crumbling Economy

The unraveling of hyper-Globalization and hyper-Financialization will generate consequences few conventional analysts and pundits anticipate. TikTok videos on ‘Quiet Quitting’–doing the minimum at work, giving nothing extra to the employer– have gone viral, and The Wall Street Journal quickly picked up the thread: If Your Co-Workers Are ‘Quiet Quitting,’ Here’s What That MeansSome Gen Z professionals are saying no to hustle culture; ‘I’m not going to go extra.’ The...

Read More »Payrolls. OPEC. Consumers borrow every last cent. Clearing up a week of ambiguity. Tricks or Treats.

Getting ready for Halloween, where rate hikes are the trick and recession is no one's treat. Every big data release last week was two-faced. Payrolls: will lead to rate hikes while showing recession. OPEC production cuts: rate hikes and recession. ISM: rate hikes and recession. Consumer credit: you get it. Eurodollar University's Weekly Recap, Featuring Steve Van Metre Twitter: https://twitter.com/JeffSnider_AIP https://www.eurodollar.university https://www.marketsinsiderpro.com...

Read More »Were the UK pension funds just the canary in the gold mine?

This week we ask if the wobble experienced by UK pension funds, last week, was just the canary in the gold mine for the global economy. If not for other central banks then this was certainly a reminder for individuals, who were prompted to ask about the levels of counterparty risk their savings and pensions were exposed to, and how they might better protect themselves in the coming months and years. UK pension funds’ lack of liquidity is only the first fault line in...

Read More »Is the Dollar Vulnerable to Buy Rumor Sell Fact after the CPI?

We suggested that the US jobs data and the CPI would be a 1-2 punch that would strengthen the greenback after it pulled back from extremes seen in late September. The US employment data were sufficiently strong, and the unemployment rate fell back to cyclical lows (3.5%), which prodded the market to again toy with the idea that the Fed funds terminal rate may be 4.75% rather than 4.50% and in Q2 next year rather than Q1. The dollar rose against most G10 currencies...

Read More »How to Do Economics

[Chapter 3 of Per Bylund’s new book How to Think about the Economy: A Primer.] Economics is often faulted for being “ideological”—for promoting free markets. This is a misunderstanding. The free market in economics is a model—an analytical tool. It excludes complicating circumstances and influences and allows us to study core economic phenomena on their own so that they are not mistaken for other effects. In economics, we are interested in understanding the nature...

Read More »How to decrypt bitcoin for Wall Street

The fluctuating price of bitcoin bears a repetitive hallmark: true believers hoard the vast majority of bitcoin in circulation and wait for the next wave of new disciples to push up the value by fighting for the scraps. When not covering fintech, cryptocurrencies, blockchain, banks and trade, swissinfo.ch’s business correspondent can be found playing cricket on various grounds in Switzerland – including the frozen lake of St Moritz. More from this author |...

Read More » SNB & CHF

SNB & CHF