Every day, more and more Americans are awakening to the reality that the institutions in control of this nation are failing them. From violence in the streets, inflation in our stores, increasing tyranny and censorship, and absolute buffoonery on public display in halls of political power. The ruling class is getting richer while most of us suffer, and new generations are becoming increasingly warped by the dangerous ideologies of the left. Recorded at The Depot...

Read More »Three Lies They’re Telling You about the Debt Ceiling

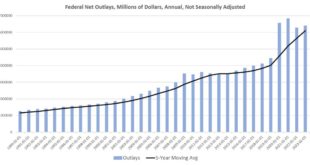

Negotiations over increasing the federal debt ceiling continue in Washington. As has occurred several times over the past twenty years, Republicans and Democrats are presently using increases in the debt ceiling as a bargaining chip in negotiating how federal tax dollars will be spent. Most of this is theater. We know how these negotiations always end: the debt ceiling is always increased, massive amounts of new federal debt are incurred, and federal spending...

Read More »How Markets Self-Corrected during the 1819 and 1919–21 Recessions

As the first signs of an economic tempest move through the United States—an alarming increase in bank failures, a surge in unemployment claims, and a troubling decline in retail sales—we find ourselves perched on the edge of a deep recession. Staring into this uncertain abyss, the self-designated guardians of our financial destiny, the Federal Reserve and the US government, are confronted with a monumental task. When the recession bells toll, how will they respond?...

Read More »Argentina Sleepwalks into Hyperinflation (Yet Again)

A century ago, Argentina was one of the world's wealthiest nations and the Argentine peso rivaled the dollar. Today, Argentina is famous for periodic hyperinflation. Original Article: "Argentina Sleepwalks into Hyperinflation (Yet Again)" [embedded content] Tags: Featured,newsletter

Read More »Taking Notes out of Rothbard’s Taiwan Playbook

Writing pseudonymously in a series of articles for Faith and Freedom in the 1950s, Murray Rothbard took on the question of whether or not the United States should defend Formosa (Taiwan) from attack by mainland China. While his conclusions will surprise no one familiar with his work (that war is the health of the state, that individuals concerned with the fate of Taiwan should do as they will privately, but that their lives and property are not for the government to...

Read More »Yen Recovers from New 2023 Low, while Sterling Sets a New Low for the Month

Overview: The dollar is bid. Only the Japanese yen is holding its own against the greenback but only after it fell to new lows for the year. The Scandis and Antipodeans are the heaviest among the G10 currencies, while sterling has fallen to a new low for the month. The prospect of a rate hike tomorrow has not protected the New Zealand dollar much and it is off nearly 0.5%. Emerging market currencies are more mixed. Outside of the Russian rouble, the South Korean...

Read More »Washington Has No Moral Authority to Ban Guns

Another mass shooting, another call for gun control. However, when it comes to mass killings, Washington sets the sorry example. Original Article: "Washington Has No Moral Authority to Ban Guns" [embedded content] Tags: Featured,newsletter

Read More »Committing Domestic Violence against Men . . . Just for a Giggle

Decades ago, Hollywood brought the neglected problem of domestic violence (DV) against women into the spotlight and helped to create cultural change. Today, Hollywood encourages people to dismiss or laugh at the neglected problem of DV against men. After all, the man must have had it coming; either that or he is too weak to stand up for himself and so deserves no sympathy. A general acceptance of women beating up men continues. A recent episode (aired on April 20,...

Read More »Shedding Light on the Law of Unintended Consequences

It is the right of the consumer, not the regime, to determine what lighting sources work best for them. Original Article: "Shedding Light on the Law of Unintended Consequences" [embedded content] Tags: Featured,newsletter

Read More »The Drug War: An Irrational Crusade

It’s been over five decades since the war on drugs began in the United States, and billions of dollars coerced from taxpayers have been spent on this frivolous operation. The General Accounting Office’s report found that the Drug Abuse Resistance Education (DARE) program did not deter youth from drug abuse. How exactly has this war benefited taxpayers when drug use has increased, and more potent drugs are being consumed? Even the diabolical Charles Manson distributed...

Read More » SNB & CHF

SNB & CHF