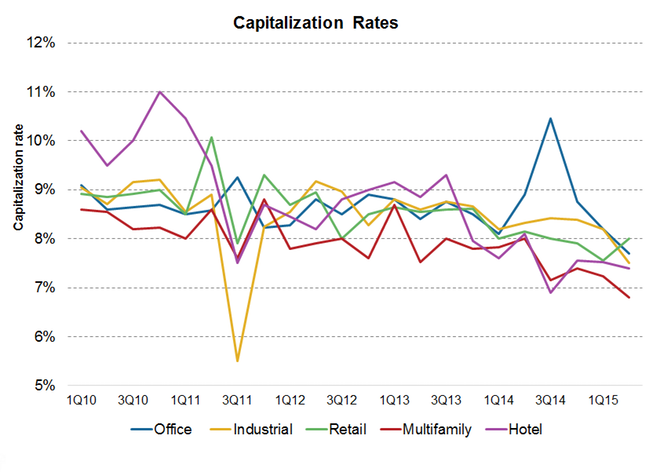

Is it Time to Buy Income-Producing Real Estate? No, No, No. Much to the dismay of my real estate buddies, who are complaining about how high prices while watching the cash flow of their portfolios bursting at the seams from a few good years of rent increases, the answer is no. Capitalization Rates REIT cap rates (as of mid 2015, they have declined further since then) Capitalization Rates Valuation is one big red flag. There is so much money chasing yield that somewhat decent apartments in San Diego are asking for 3% cap rates. The current cap rates are about as low as I have ever experienced. It wasn’t that long ago (measured by my investment lifetime) that a 10% cap was not that rare. This is equivalent to the S&P trading at record high PE. The cost of debt is at record low, which has a similar effect on the stock market. Rents are at record highs. Where is the upside going to come from – even higher rents, even lower cap rates and/or lower debt service costs? Valuation is not my biggest concern. The biggest risk is income stability. I have been trying to digest the Report on the Economic Well-Being of the US Households in 2015 since it was released by the Federal Reserve a few weeks ago.

Topics:

Ramsey Su considers the following as important: Capitalization Rates, Debt and the Fallacies of Paper Money, Featured, National Average Rent, newsletter, Real estate, Year-Over-Year Rent Growth

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Is it Time to Buy Income-Producing Real Estate?

No, No, No. Much to the dismay of my real estate buddies, who are complaining about how high prices while watching the cash flow of their portfolios bursting at the seams from a few good years of rent increases, the answer is no.

Capitalization RatesREIT cap rates (as of mid 2015, they have declined further since then) |

Valuation is one big red flag. There is so much money chasing yield that somewhat decent apartments in San Diego are asking for 3% cap rates. The current cap rates are about as low as I have ever experienced. It wasn’t that long ago (measured by my investment lifetime) that a 10% cap was not that rare.

This is equivalent to the S&P trading at record high PE. The cost of debt is at record low, which has a similar effect on the stock market. Rents are at record highs. Where is the upside going to come from – even higher rents, even lower cap rates and/or lower debt service costs?

Valuation is not my biggest concern. The biggest risk is income stability. I have been trying to digest the Report on the Economic Well-Being of the US Households in 2015 since it was released by the Federal Reserve a few weeks ago. It is really a poorly designed survey but what jumped out at me was the part about Economic Preparedness:

Nearly half of adults are ill-prepared for a financial disruption and would struggle to cover emergency expenses should they arise.

- Forty-six percent of adults say they either could not cover an emergency expense costing $400, or would cover it by selling something or borrowing money.

- Twenty-two percent of respondents experienced a major unexpected medical expense that they had to pay out of pocket in the prior year, and 46 percent of those who say they had a major medical expense report that they currently owe debt from that expense.

If you read other sections of the report, I think you will come away with the conclusion that households are financially stressed, especially at the lower end, i.e., the segment of the population which is most likely to be renting.

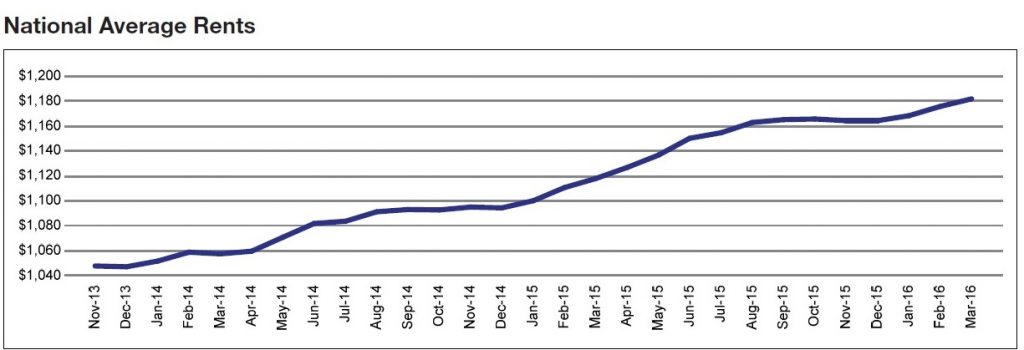

National Average RentUS national average rent – renters are increasingly coming under pressure (you wouldn’t know it from the CPI). |

Years ago, I had an most interesting exchange with a tenant which I evicted for non-payment of rent. When I asked him when he was going to pay the back rent, he replied, “Ramsey, I know you have money and I don’t. Why do you need rent from me?”

I have to admit his question caught me by surprise and I did not know how to answer him. It made me realize that income inequality is not just a subject of discussion over cocktails but it has real consequences. Maybe that is why Bernie Sanders is still in the running for whatever.

If we conduct a real stress test on this segment of the population, the renters, how prepared are they for any unfavorable economic events? Furthermore, what is the size of this class of at-risk renters? Is our government going to allow evil landlords to kick families into homeless shelters?

In reality, it is taking longer and longer to evict a tenant. Not only is the legal process longer, the court system and the sheriff’s department can easily be overwhelmed by an increase in their caseload. Just scheduling issues may buy a tenant more time, as was the case for borrowers who defaulted in judicial foreclosure States during the sub-prime crisis.

|

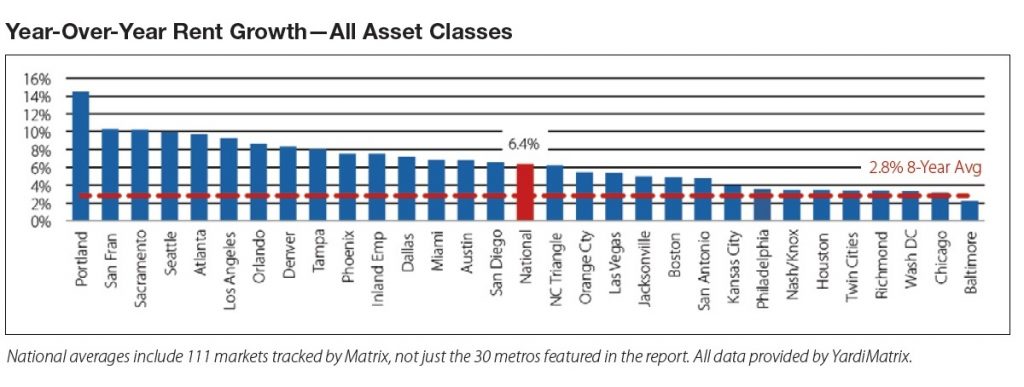

Year-Over-Year Rent Growth – All Asset Classes Year-on-year increase in rents across different US markets as of March 2016 – last year’s national average of 6.4% was vastly higher than the 8-year average of 2.8%. One of the many unintended consequences of QE and ZIRP. |

For high rent cities like San Diego, it would be easy for a small time politician to push through rent controls or more creative ordinances that may be detrimental to apartment ownership.

Can you imagine the nightmarish scenario in which landlords cannot evict, cannot sell, and end up stuck with having to maintain the asset while paying taxes and debt obligations?

Is it Time to Buy a Home?

Yes, Yes. Yes. Allow me to clarify. This strategy is a defensive move for the struggling middle class – people who are working their ass off, have decent credit, have very little in the bank and are having a real tough time building up a nest egg. The intent here is not so much to buy a house but to take out a mortgage with the highest loan-to-value possible.

Some economists opine that a recession is coming. Others believe the worst is behind us and happy days are here again. Personally, I think it will be the former, but the beauty of this strategy is that it does not matter.

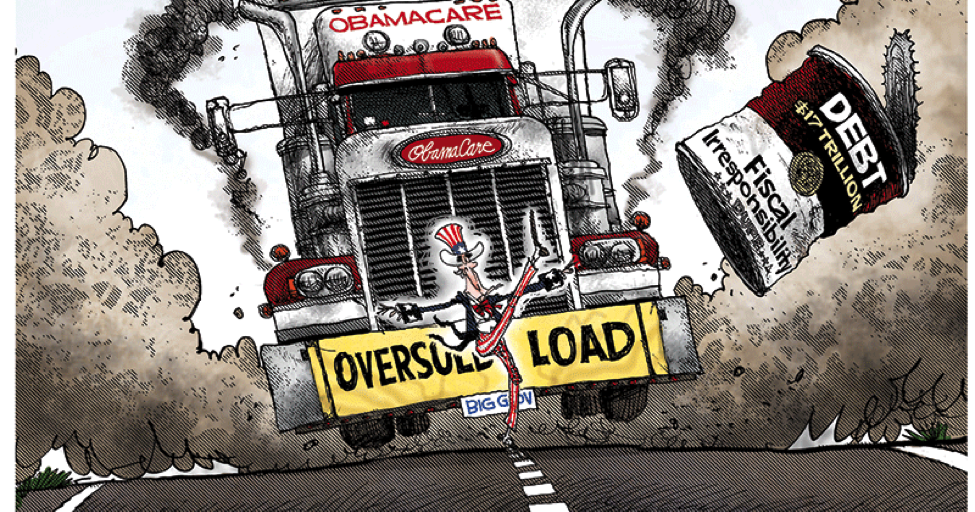

Is it Time to Buy Real Estate? Yes and NoIf they can do it….you can do it too! Certain prominent economists have been arguing that even the central bank must “credibly promise to be irresponsible”, so why shouldn’t you follow the example? Cartoon by Michael Ramirez

If the market goes up, great, declare yourself a genius and enjoy the profits. If the economy turns sour, enough so that you, along with many others, cannot make your mortgage payments, the government will take care of you since it is your lender.

You will receive counseling, forbearance, work-out schemes, lower interest, term extensions and mortgage reduction in addition to new and improved ideas that have not been tested during the sub-prime crash.

The sub-prime bubble has taught consumers that irresponsible actions will be rewarded. This time around, if market conditions deteriorate, you will at least receive free housing until the recession is over and probably a lot more.

Debt is the new normal. Governments of the world use it to finance their empty promises. Ride the coattails of these big borrowers. They have no intention of paying back their debt and neither should you.

Conclusion

In conclusion, “landlords” are going to be easy targets when income inequality stretches beyond the breaking point. I don’t think I want to be in the company of Blackstone, the REITs or other REO-rental investors.

On the other hand, homeowners with big mortgages are going to be the protected class, along with tenants. I think we are already at the later part of this cycle and it should not be long before we will see the end game. Stay tuned.

Charts by Market Realist/ National Association of Realtors, Yardi-Matrix

Chart and image captions by PT

Previous post Next post