The influence of the oil price on financial markets has grown in importance recently. The dampening effect of low oil prices on import prices makes the work of central bank work more difficult as they are already struggling to bring back low inflation closer to their targets.

The fall in the oil price has increased concerns about deflation and exacerbated investors’ sentiment that monetary authorities are running out of effective tools to reflate economies.

We have argued in the past few weeks that a recovery in oil prices could be one of three factors to drive a sustained equity market rally.

Looking at the fundamentals can give a glimpse into what might be the future for oil prices over a 12-month horizon.

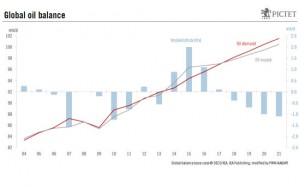

Current crude oil over-supply is acting as a dampener on the pace of recovery in oil prices. The International Energy Agency (IEA) expects that the mismatch between supply and demand will not be absorbed until 2017.

The long-term relationship between the oil price, the US dollar and world economic activity can also help us to guess how the future of oil prices might pan out. Indeed, the rising oil price in the 2000s and its recent fall is largely attributable to this relationship.

Current low oil prices are to a large extent justified by the long-term relationship. Over a 12-month horizon, however, if world real GDP grows as expected (3.