Laughing at Blue Monday

On May 28, 1962 – dubbed “Blue Monday” – the market fell 6%… its worst single-day slide since 1929.

Peter Stormonth Darling was an investment manager at investment bank S. G. Warburg & Co. at the time. He strolled in to tell his boss, Tony Griffin, how much the market had fallen.

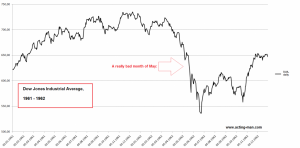

Dow Jones Industrial Average, 1961-1962

The DJIA in 1961 – 1962. March – June 1962 delivered quite a scare to investors – in May the decline accelerated, as panic began to spread – click to enlarge.

Dow Jones Industrial Average, 1961-1962

Darling recounts:

Tony sat back, paused to reflect a moment, and just laughed. This was not because he had anticipated the crash or sold his own investments – he had not. It was his way of keeping the event in perspective. I’m sure it was the right way to act.

It was a useful lesson, and it helped me to view with some equanimity subsequent market collapses, such as those in 1974, 1987, and 1998.

Darling would eventually become chairman of Mercury Asset Management from 1979 up until Merrill Lynch acquired it in 1992. During his storied career, he came to know a number of wealthy people, some of whom are also shrewd investors.

He studied them, trying to discover their methods. And he learned what successful investing is all about.