Along with extending its asset-buying programme, the ECB has made a number of changes to the parameters of that programme in a bid to deal with the issue of ‘bond scarcity’. But will it succeed?In December, the ECB made important changes to its quantitative easing (QE) programme, deciding to extend it by at least nine months to December 2017 while scaling down the pace of its asset purchases from EUR80 bn to EUR60 bn from April. The ECB also announced the easing of technical constraints through the removal of the deposit yield floor and the broadening of the maturity spectrum (to 1-30 years).Under the new QE rules, we estimate that issue share limits on German bonds will not be hit until Q2 2018. However, the ECB will have to further deviate from capital keys in some of the smaller countries like Portugal. More generally, the ECB’s choice of instruments to mitigate bond scarcity concerns is a net negative for the periphery, in our view.In 2017, we expect the ECB to continue to exploit the flexibility of its QE programme across countries via ‘soft deviations’ from its capital keys (a calculation combining the GDP and population of each euro area country, used by the ECB to determine how much of each country’s bonds it can buy) and issuers (via larger purchases of supranational, agency and regional government debt).

Topics:

Frederik Ducrozet considers the following as important: bond scarcity, capital keys, ECB quantitative easing, ECB tapering, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Along with extending its asset-buying programme, the ECB has made a number of changes to the parameters of that programme in a bid to deal with the issue of ‘bond scarcity’. But will it succeed?

In December, the ECB made important changes to its quantitative easing (QE) programme, deciding to extend it by at least nine months to December 2017 while scaling down the pace of its asset purchases from EUR80 bn to EUR60 bn from April. The ECB also announced the easing of technical constraints through the removal of the deposit yield floor and the broadening of the maturity spectrum (to 1-30 years).

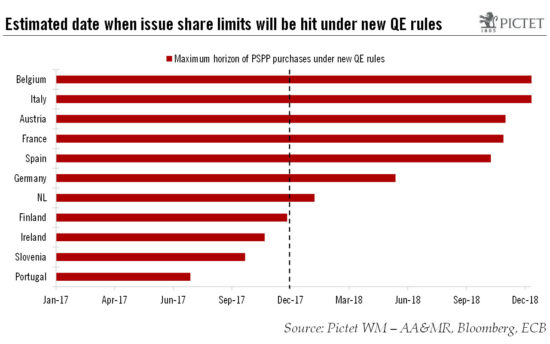

Under the new QE rules, we estimate that issue share limits on German bonds will not be hit until Q2 2018. However, the ECB will have to further deviate from capital keys in some of the smaller countries like Portugal. More generally, the ECB’s choice of instruments to mitigate bond scarcity concerns is a net negative for the periphery, in our view.

In 2017, we expect the ECB to continue to exploit the flexibility of its QE programme across countries via ‘soft deviations’ from its capital keys (a calculation combining the GDP and population of each euro area country, used by the ECB to determine how much of each country’s bonds it can buy) and issuers (via larger purchases of supranational, agency and regional government debt).

If QE is extended into 2018, further technical changes could eventually be required, in our view, regardless of the pace of the ECB’s bond buying. Even if the ECB announces a plan for tapering bond purchases late in 2017 and implemented in early 2018, the winding down of purchases will likely last for six to nine months, in our view, with Germany and smaller countries still facing scarcity constraints.

We would not rule out the ECB turning to ‘soft deviations’ from its capital keys again at some point in H2 2017. This would be particularly helpful for the euro area periphery. The ECB has proved in the past that it is ready to take difficult decisions when all alternatives have been exhausted.