Swiss Franc The Euro has fallen by 0.10% to 1.1496 CHF. EUR/CHF and USD/CHF, August 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The high-flying dollar-bloc currencies may be a preliminary sign market change. The US dollar is gaining on the Canadian dollar for the fourth consecutive session. It is probing resistance we identified in the .2620 area. The US dollar has not traded above its 20-day moving average since the Fed hiked rates on June 14. It is found today near CAD1.2625. A smaller than expected trade surplus (A6mln, half of what was anticipated) provided the fodder to extend the Australian dollar’s fall to a third session. After spiking to

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Eurozone Markit Composite PMI, Featured, France Services PMI, FX Trends, GBP, Germany Composite PMI, Italy Services PMI, JPY, newslettersent, South Korea, Spain Services PMI, U.K. Services PMI, U.S. Markit Composite PMI, U.S. Services PMI, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.10% to 1.1496 CHF. |

EUR/CHF and USD/CHF, August 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

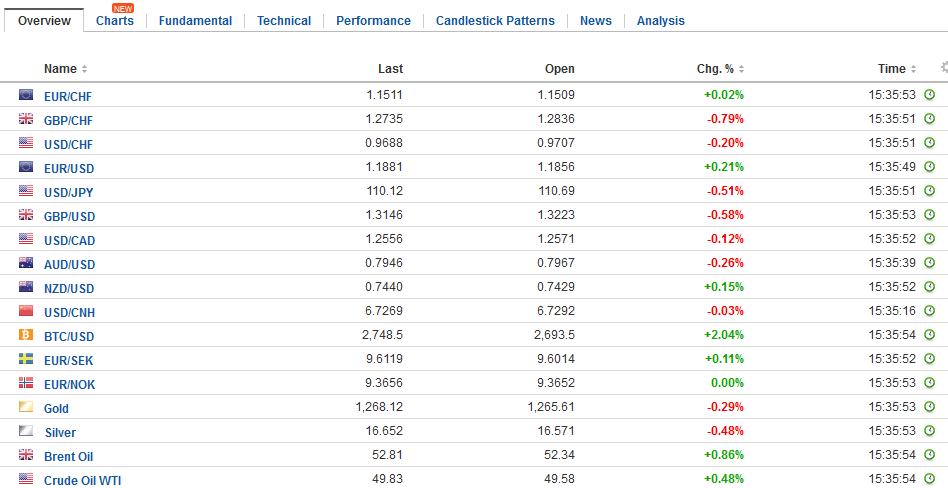

FX RatesThe high-flying dollar-bloc currencies may be a preliminary sign market change. The US dollar is gaining on the Canadian dollar for the fourth consecutive session. It is probing resistance we identified in the $1.2620 area. The US dollar has not traded above its 20-day moving average since the Fed hiked rates on June 14. It is found today near CAD1.2625. A smaller than expected trade surplus (A$856mln, half of what was anticipated) provided the fodder to extend the Australian dollar’s fall to a third session. After spiking to $0.8065 last week, it has drifted lower. A break of $0.7875 (and the 20-day moving average is found near $0.7865) would suggest the consolidation is folding into an outright correction. |

FX Daily Rates, August 03 |

| The focus today is on the Bank of England and its “Super Thursday” when the Quarterly Inflation Report is also released along side the MPC minutes. A rate hike is highly unlikely. The focus will be on the vote and if Haldane votes to hike as he indicated he has considered. We suggest that if Haldane sticks with the majority, the quid pro quo may a more hawkish inflation report. This could be expressed in part, for example, by lowering in the growth forecast and lifting the inflation forecast. This means that a reaction to a 6-2 vote (rather than 5-3 as was the case previously) may be tempered by the forward guidance and Carney’s press conference.

The dollar is in about a quarter of a yen range against the Japanese currency. While the dollar found a bid under JPY110 earlier this week, it has found offers near JPY111.00. In Asia, the South Korean won stands out. It slid 0.4% and is off for the third consecutive session. Foreign investors were have been selling Korean equities. They were net sellers every day this week and have been sellers this week except for yesterday. Over the nine sessions, foreign investors have sold an average of KRW234 mln a day. The Kospi has held up this week, rising for the past three sessions (~1.1%), but giving it all up with today’s 1.7% slide. The ostensible trigger was a report suggesting the government was considering corporate tax increases and macro-prudential measures to cool the property market. |

FX Performance, August 03 |

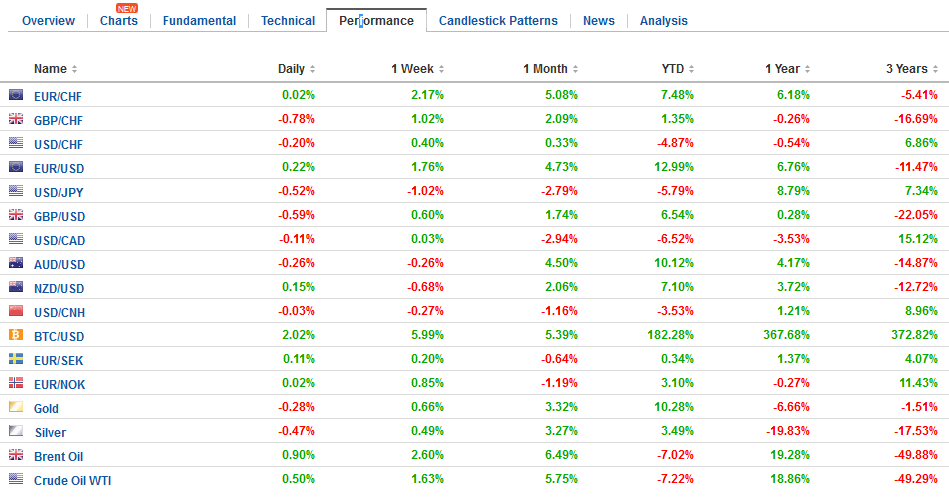

United KingdomSeparately, the UK reported the service and composite PMI. The former rose to 53.8 from 53.4, and this fed into a rise in the later to 54.1 from 53.8. The composite average 54.7 in Q2 and 54.6 in Q1. This would suggest the UK economy is seeing little improvement at the start of Q3. Nevertheless, sterling is firm ahead of the BOE meeting. It made a new high for the move, a little above $1.3265. It is an 11-month high. Some unwinding long euro-short sterling positions may have lent sterling support against the greenback. The euro is trading in a less than a third of a cent range today around where North American dealers left it yesterday. It has pulled back a little more than three-quarters of a cent after poking through $1.1900 briefly yesterday. Support is seen near $1.1780. |

U.K. Services PMI, July 2017(see more posts on U.K. Services PMI, ) Source: Investing.com - Click to enlarge |

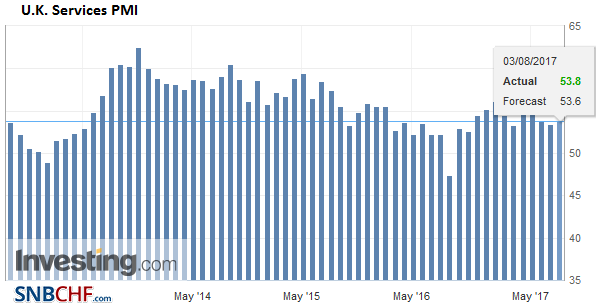

EurozoneFor all practical purposes, the euro has shrugged off a disappointing PMI report. The composite for the region slipped to 55.7 from 56.3. It is the lowest since January. It averaged 56.6 in Q2.This is a 10-month low. |

Eurozone Markit Composite PMI, July 2017(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

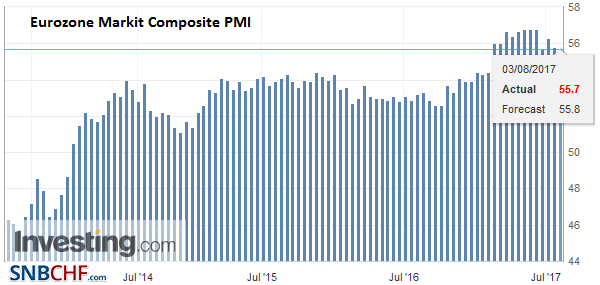

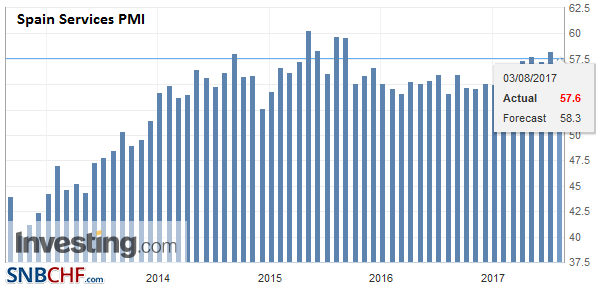

SpainAlthough we find that international comparisons of headline PMI readings not very helpful, it is interesting that for the first time in a dozen years, Germany’s composite is below the France, Italy, and Spain. And Spain like Germany disappointed, with a larger than expected pullback from June. The service PMI fell to 57.6 from 58.5, and the composite eased to 56.7 from 57.1. |

Spain Services PMI, July 2017(see more posts on Spain Services PMI, ) Source: Investing.com - Click to enlarge |

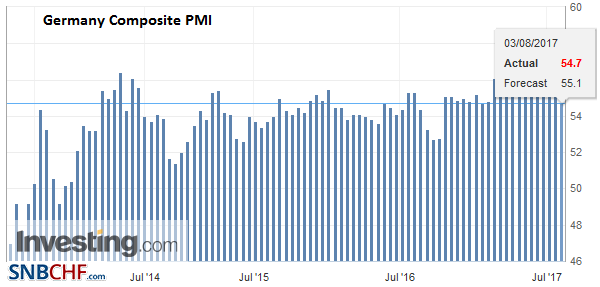

GermanyGerman was a downside surprise. With the service PMI falling more than the flash reading had suggested, the composite was revised to 54.7 from 55.1 and 56.4 in June. |

Germany Composite PMI, July 2017(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

ItalyItaly offered a pleasant upside surprise. Its service PMI rose to 56.3 from 53.6, and the composite rose to 56.2 from 54.9. |

Italy Services PMI, July 2017(see more posts on Italy Services PMI, ) Source: Investing.com - Click to enlarge |

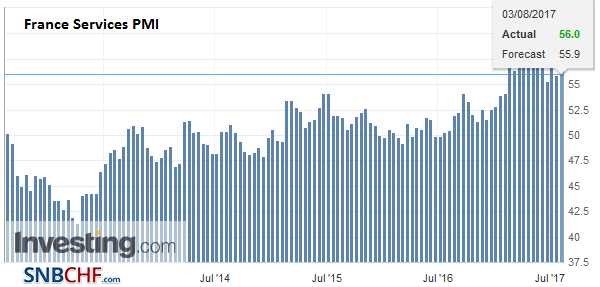

FranceThe French service PMI was a little better than the flash at 56.0 (vs. 55.9), but still lower than the 56.9 reading in June. The composite PMI fell to 55.6 from 56.6 in June. |

France Services PMI, July 2017(see more posts on France Services PMI, ) Source: Investing.com - Click to enlarge |

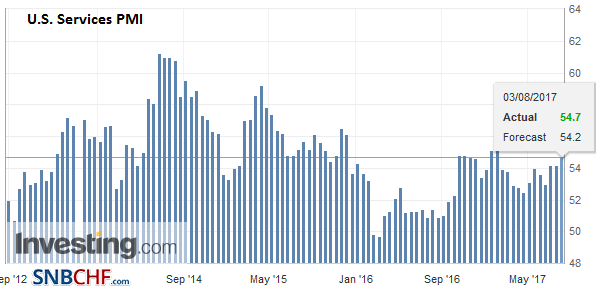

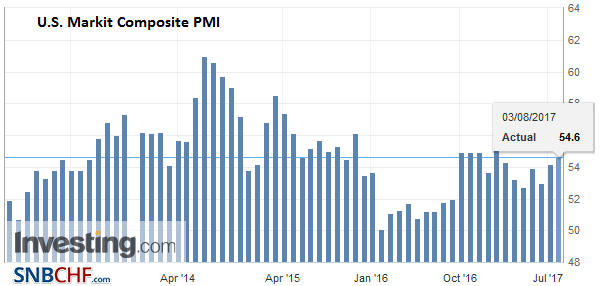

United StatesAhead of US jobs data tomorrow and after the first look at Q2 GDP, today’s US data may pose little more than headline risk. The July PMI and ISM may be the most important, with the price and employment components the most interesting. June factory orders are likely to have been bolstered by Boeing orders from the Paris Air Show. |

U.S. Services PMI, July 2017(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

| Reports that the US may launch another investigation into Chinese trade practices (intellectual property) has had little immediate impact. The effort to cut legal immigration by half may counter efforts to boost growth given the current demographic situation. On the other hand, there have some reports suggesting that an optimistic case of Congress is passing next month some continuing resolution for spending in lieu of a new budget, and attaching a rise in the debt ceiling to that. The White House seeks a $2.5 trillion increase, while the conservative Freedom Caucus is more willing to concede $1.5 trillion. |

U.S. Markit Composite PMI, July 2017(see more posts on U.S. Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Eurozone Markit Composite PMI,Featured,France Services PMI,Germany Composite PMI,Italy Services PMI,newslettersent,South Korea,Spain Services PMI,U.K. Services PMI,U.S. Markit Composite PMI,U.S. Services PMI,USD/CHF