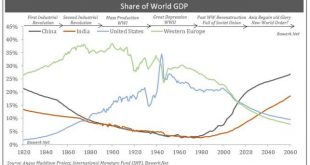

Share of World GDP A Brave New World is coming? Perhaps. We had a recent discussion with a group of people in the hopeless business of doing long term forecasting. This made us think about what the world will look like over the next 20 to 40 years. A pretty thankless task, but the bottom line is without a damn good war, Asia will be the way of the future. As an experiment, assume, as most long term forecasters do,...

Read More »US Political Anxiety Stems Bond Sell-Off

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Bond yields have been rising in the US and Europe since the summer. There are some country-specific considerations and some generalized factors. Anxiety over US politics has helped bonds recover some lost ground. One of the most significant market...

Read More »US Political Anxiety Stems Bond Sell-Off

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Bond yields have been rising in the US and Europe since the summer. There are some country-specific considerations and some generalized factors. Anxiety over US politics has helped bonds recover some lost ground. One of the most significant market...

Read More »Great Graphic: Consumer Inflation: US, UK, EMU

Summary: Price pressures appear to have bottomed for the US, UK, and to a lesser extent, EMU. Rise in prices cannot be reduced solely to the increase of oil. Core prices are also rising. Back in the early post-crisis days, many pundits consumed lots of ink and column inches warning the strong inflationary pressures would be fueled by the orthodox and unorthodox monetary policy. Not only did this not...

Read More »The Road to Fascism in Just Two Charts

[unable to retrieve full-text content]Laws of politics have been turned upside down. The Intellectuals Yet Idiots can make no sense of it. The underdog who ‘tell it how it is’ appeal to people while established reasoning does not.

Read More »Next Up for Central Banks: Infrastructure Investments?

In the years following the global financial crisis, the world’s leading economies have found relief through aggressive monetary policy. But with interest rates slashed to historic lows and central bank balance sheets significantly larger as a percent of GDP than they were before the financial crisis, policymakers will need alternatives to interest rate cuts and conventional quantitative easing when the next recession comes along. U.S. central bankers have cut real interest rates between...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org