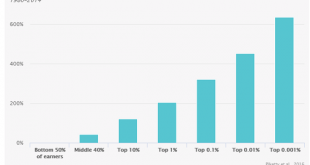

If we look at these charts, it looks like only the top 10%, or perhaps the top 20% at best, might qualify as “middle class” by the metrics described below. The conventional definition of working class is based on income and education:the working class household earns between $30,000 and $69,000 annually, and the highest education credential in the household is a two-year community college degree or trade certification....

Read More »When Verizons Multiply, Macro In Inflation

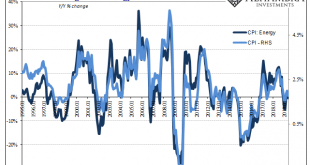

Inflation always brings out an emotional response. Far be it for me to defend Economists, but their concept is at least valid – if not always executed convincingly insofar as being measurable. An inflation index can be as meaningful as averaging the telephone numbers in a phone book (for anyone who remembers what those things were). If you spend $1,000 a month on food for your family, and food prices rise 6% generally...

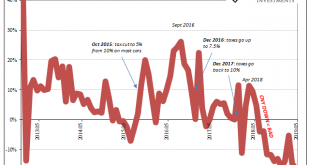

Read More »Dimmed Hopes In China Cars, Too

As noted earlier this week, the world’s two big hopes for the global economy in the second half are pinned on the US labor market continuing to exert its purported strength and Chinese authorities stimulating out of every possible (monetary) opening. Incoming data, however, continues to point to the fallacies embedded within each. The US labor market is a foundation of non-inflationary sand, and China’s “stimulus” is...

Read More »A Stock Market Crash Scenario

Herds get spooked and run. That’s the crash scenario in a nutshell. We have all been trained by a decade of central bank saves to expect any stock market swoon will soon be reversed by central bank sweet talk and/or rate cuts. As a result of such ever-present central bank willingness to intervene in the stock market, participants have been trained to believe a stock market crash is no longer possible: should the market...

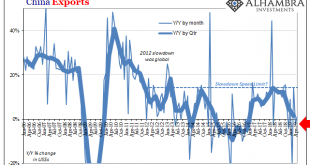

Read More »Commodities And The Future Of China’s Stall

Commodity prices continued to fall last month. According to the World Bank’s Pink Sheet catalog, non-energy commodity prices accelerated to the downside. Falling 9.4% on average in May 2019 when compared to average prices in May 2018, it was the largest decline since the depths of Euro$ #3 in February 2016. Base metal prices (excluding iron) also continue to register sharp reductions. Down 16% on average last month,...

Read More »What Would It Take to Spark a Rural/Small-Town Revival?

Recent research supports the idea that this under-the-radar migration is already under way. The decline of rural regions and small towns is a global phenomenon, and the causes are many but boil down to two primary dynamics: 1. Cities and megalopolises (aggregations of cities, suburbs and exurbs) attract capital, infrastructure, markets and talent, and these are the engines of job creation. People move to cities to find...

Read More »All Of US Trade, Both Ways, And Much, Much More Than The Past Few Months

The media quickly picked up on Jay Powell’s comments this week from Chicago. Much less talked about was why he was in that particular city. The Federal Reserve has been conducting what it claims is an exhaustive review of its monetary policies. Officials have been very quick to say they aren’t unhappy with them, no, no, no, they’re unhappy with the pitiful state of the world in which they have to be applied. That’s not...

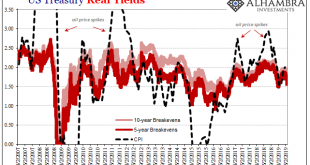

Read More »Janus Powell

Again, who’s following who? As US Treasury yields drop and eurodollar futures prices rise, signaling expectations for lower money rates in the near future, Federal Reserve officials are catching up to them. It was these markets which first took further rate hikes off the table before there ever was a Fed “pause.” Now that the Fed is paused, it’s been these same markets increasingly projecting not just a rate cut or two...

Read More »Monthly Macro Monitor – June 2019 (VIDEO)

[embedded content] Alhambra Investments CEO reviews economic charts from the past month and his opinion of what they mean. Related posts: Monthly Macro Monitor – March 2019 (VIDEO) Monthly Macro Monitor – February (VIDEO) Monthly Macro Monitor – December 2018 (VIDEO) Monthly Macro Chart Review – April 2019 (VIDEO) Monthly Macro Monitor – January...

Read More »Is the Tech Bubble Bursting?

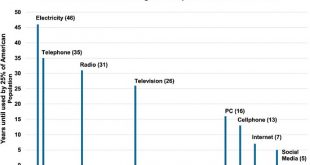

There are two other trends that don’t attract quite the media attention that soaring profits do. Is the decade-long tech bubble finally popping? Tech bulls are overlooking the fundamental reality that the drivers of Big tech’s phenomenal growth–financialization and expansion into mobile telephony– are both losing momentum. A third dynamic–Big Tech monetizing privately owned assets such as vehicles and homes– has also...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org