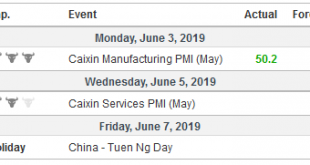

The first week of June features the Reserve Bank of Australia meeting, an ECB meeting, and the US employment data. The RBA is expected to deliver its first rate cut in three years. The market appears to have discounted not only a second cut in H2 but has priced nearly half of a third cut as well. A soft inflation reading after the seasonal bump in April and disappointing survey data, with Brexit and trade tensions,...

Read More »Cool Video: A Tentative Answer to the Low Vol Question

I had the privilege of joining the set of anchors Julie Cchatterley, ScarletFu, and Joe Weisenthal on the set of “What’d You Miss” today. The unrehearsed discussion took an unexpected turn when Joe asked about the low volatility. The anchors were patient and gave me time to provide a sketch of the thesis of my book, Political Economy of Tomorrow, where I suggest a under appreciated factor in the low price of capital is...

Read More »Two Overlooked Takeaways from Draghi at Jackson Hole

The consensus narrative from the Jackson Hole Symposium was the Yellen and Draghi used their speeches to argue against dismantling financial regulation and the drift toward protectionism. Many cast this as a push against US President Trump, but this may be too narrow understanding. Many investors were looking for policy clues, but these were not forthcoming. The December Fed funds futures contract was unchanged,...

Read More »A Few Thoughts about the US Labor Market

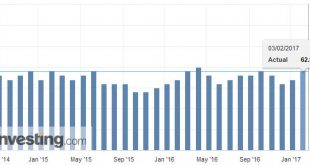

Summary The 94 mln people POTUS claims are not working is true but terribly misleading. What happened to agriculture a century ago is happening to manufacturing. New industries are less labor intensive than smokestack industries. In a speech to the joint session of Congress that was widely recognized as “presidential,” US President Trump said twice that there are 94 mln Americans out of the labor market. It is...

Read More »Lies, Damn Lies, and Taxes

President Trump hinted at the end of last week that the Administration’s tax proposals would be aired in the next two or three weeks. This seems to be a signal of its inclusion in his address to both houses of Congress on February 28. This is not quite a State of the Union speech, but similar and precisely what Obama did in February 2009. Taxes are complicated. Much of the discussion so far has been on the border...

Read More »New Book: Political Economy of Tomorrow

My new book,Political Economy of Tomorrowhas just been published, and it is available on Amazon. The book is not so much of a sequel to my first book,Making Sense of the Dollar. There is very little about the foreign exchange market in the new book. However, it is not wholly new cloth either. There is a journalist-cum-presidential adviser at the turn of the 20th century, Charles Conant, that I introduce in the first...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org