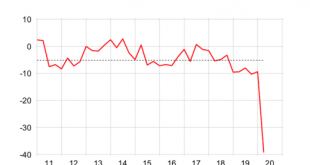

Consumer sentiment in Switzerland in April 2020 reached a historic low. The coronavirus has dampened expectations for general economic development and employment and the population is bracing itself for tough financial times, according to the survey. © Michael Müller | Dreamstime.comSwiss consumer sentiment fell from −9 points in January 2020 to −39 points in April 2020, a level well below the level seen in the 2008-2009 financial crisis. The only other time consumer sentiment was...

Read More »Unemployment up sharply in April in Switzerland

The unemployment rate in Switzerland rose to 3.3% in April 2020, up from 2.9% the month before, a rise of nearly 14%. © Spacedrone808 | Dreamstime.comBy 30 April 2020, there were 153,413 people registered as unemployed at Switzerland’s regional placement offices. Young workers were the hardest hit. Unemployment among those aged 15 to 24 rose by 18.1% compared to March 2020 and by 61.3% compared to April 2019. By the end of April 2020 there were 17,191 people in this age group out of...

Read More »Coop and Migros: customers required to queue

Coop and Migros, Switzerland’s two largest supermarkets have decided to limit the number of people entering their stores, creating queues outside, according to RTS. To reduce the spread of Covid-19, shopper density has been reduced to one person per 10 m2, which drastically reduces the number of people allowed inside simultaneously. In addition, shopping in the two chains has been restricted to the food section. Other areas have been closed. On top of the hassle of needing to queue,...

Read More »Swiss National Bank to distribute 4 billion francs of profit

© Michael Müller | Dreamstime.com In 2019, the Swiss National Bank (SNB) made a profit of around CHF 49 billion. These profits came mainly from the rising value of the assets on the bank’s balance sheet. In 2019, the value of its holdings of foreign currency and gold rose substantially. When combined with interest, dividend income and gains on shares total profits for the year were CHF 49 billion. When combined with past retained profits, the SNB’s total accumulated...

Read More »Swiss National Bank to distribute 4 billion francs of profit

In 2019, the Swiss National Bank (SNB) made a profit of around CHF 49 billion. © Michael Müller | Dreamstime.comThese profits came mainly from the rising value of the assets on the bank’s balance sheet. In 2019, the value of its holdings of foreign currency and gold rose substantially. When combined with interest, dividend income and gains on shares total profits for the year were CHF 49 billion. When combined with past retained profits, the SNB’s total accumulated profits rose to CHF 88...

Read More »Potential relief for some Swiss renters

Every three months the rate of interest used to benchmark Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time the reference rate fell from 1.50% to 1.25%. © Ocskay Mark | Dreamstime.comThe last time it dropped was 2 June 2017 when it fell to 1.5%. The rate is based on the average Swiss mortgage rate over three months. This rate is then rounded to the nearest 0.25%. On 31 December 2019 that rate was 1.37%, which is closer to...

Read More »Potential relief for some Swiss renters

© Ocskay Mark | Dreamstime.com Every three months the rate of interest used to benchmark Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time the reference rate fell from 1.50% to 1.25%. The last time it dropped was 2 June 2017 when it fell to 1.5%. The rate is based on the average Swiss mortgage rate over three months. This rate is then rounded to the nearest 0.25%. On 31 December 2019 that rate was 1.37%,...

Read More »Close to one fifth of households in Switzerland behind on debt payments

In 2017, 18.9% of Switzerland’s population lived in a household with outstanding debt repayments, a percentage that has rose from 17.7% over the proceeding 4 years. © Kawee Srital On | Dreamstime.comThe most common forms of outstanding debts were taxes, health insurance premiums and phone bills. 9.9% of households had outstanding tax payments, 7.3% owed health insurance money and 5.2% had an outstanding telecommunications bill. The most common reason for going into debt was to buy a...

Read More »The labels that show how much more international retailers charge Swiss

To simplify labelling, many international retailers put recommended retail prices (RRP) for multiple nations on the same label, like the one below. The Swiss retail price premium laid bare.Labels such as these show how much more Swiss customers are being charged compared to customers in other countries. The label above, from an item of clothing sold in Switzerland, shows how much more Swiss customers are charged. The RRP for Switzerland is the highest. The Swiss pre-VAT price is 21%...

Read More »Geneva looks at sugar tax but excludes one of the worst products

A commission for the canton of Geneva’s government supports a tax on added sugar to fight obesity, according to the newspaper Le Temps. © Lightpoet | Dreamstime.comBertrand Buchs and Delphine Bachmann, two elected officials active in the medical sector, are behind the initiative. The text required to implement the tax, which takes aim at added sugar, is likely to be put to a government vote in March 2020. The money collected would be spent on raising awareness of the damaging health...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org