On this episode of Radio Rothbard, Ryan McMaken and Tho Bishop address whether the Ohio train disaster is an example of “capitalism gone amuck”. They discuss Murray Rothbard’s views on pollution, the secondary consequences of the regulatory state, and the decaying qualities of modern financialization. Also, join the Mises Institute in Tampa this month for a special event featuring Per Bylund, Jeff Deist, Tho Bishop, and Brett Lindell, on February 25. Learn more at...

Read More »The Global Currency Plot

—from the Summary … Democratic socialism—the ideology that dominates the world today—aspires to become a world state. The route toward it requires a single world currency to be created. That would undoubtedly create a dystopia. Might this become a reality? And if so, how can it be averted? This book aims to find answers to these questions. Part 11. Concerning Right Thinking: Logic The arguments in this book claim to be strictly logical. For a better understanding, a...

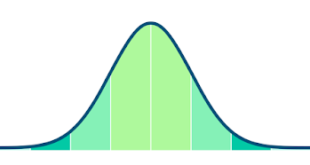

Read More »Week Ahead: Market Seeks Proper Balance after Exaggerating in Both Directions

The pendulum of market sentiment swung from fear of a synchronized recession in the US and Europe to optimism that a recession can be avoid. The perceived reduction of downside risks had driven the upside performance of equities and bonds. Just as the data seems to confirm it, the rally in in stocks and bonds faltered. The MSCI Emerging Markets equity index gained 7.8% last month but is off almost 3.8% this month, and has fallen for three consecutive weeks. The...

Read More »Switzerland sees surge in numbers of foreign workers

The number of new foreign workers moving to Switzerland on long-term contracts increased by a quarter last year compared to 2021, according to official statistics. In 2022, 166,919 foreign workers immigrated to Switzerland, comprising 76,286 people (+15%) for temporary work and 90,633 workers (+26%) on longer contracts. + Switzerland’s allure for wealthy foreigners The increase in longer-term stays was driven by job vacancies mainly in the industrial, construction...

Read More »Why Ron Paul Is Right

The great Dr. Ron Paul has been right about all the major issues that confront the world today. He is right about the Fed, the Ukraine war, the FBI, and so much else. How has he managed to do that? What has given him wisdom unique on the political scene today? The answer is simple. He has consistently applied the teachings of the greatest political thinker of the twentieth century, Murray Rothbard. Ron Paul is a consistent Rothbardian. Let’s look at a few cases...

Read More »Will AI Learn to Become a Better Entrepreneur than You?

Contemporary businesses use artificial intelligence (AI) tools to assist with operations and compete in the marketplace. AI enables firms and entrepreneurs to make data-driven decisions and to quicken the data-gathering process. When creating strategy, buying, selling, and increasing marketplace discovery, firms need to ask: What is better, artificial or human intelligence? A recent article from the Harvard Business Review, “Can AI Help You Sell?,” stated, “Better...

Read More »6d.) P: Bitcoin News aus aller Welt 1970-01-01 02:00:00

[unable to retrieve full-text content] [embedded content] Tags: Featured,newsletter

Read More »Dramatic Swing in Sentiment Extends the Greenback’s Rally

Overview: A series of strong US high-frequency data points after a poor finish to last year has spurred a dramatic shift in market expectations. And talk among a couple of (non-voting) FOMC members of a 50 bp hike has provided added fodder. The greenback is extending its recovery today against all the major currencies, with the Australian and New Zealand dollars hit the hardest. Emerging market currencies have also been knocked back. This is part of a larger risk...

Read More »Hefty fines against Swiss pharma giants lifted

Age-related macular degeneration is an eye disease that can blur your central vision. It happens when aging causes damage to the macula — the part of the eye that controls sharp, straight-ahead vision. (Symbolic photo) Keystone / Martin Ruetschi An appeals court in France has overturned a record fine imposed by the French competition authority against the Swiss pharmaceutical companies Novartis and Roche. The verdict was announced by a court in Paris on Thursday....

Read More »Joe Biden Calls for the FTC to Resurrect the Robinson Patman Act. It’s a Very Bad Idea

As former Federal Trade Commission (FTC) chairman Timothy J. Muris has recently noted, “President Biden rejects the economics-driven antitrust policies of the past 40 years.” In contrast, President Joe Biden “promised to return to earlier antitrust traditions.” Unfortunately, “those traditions were abandoned for good reason: they harmed consumers.” An important illustration Muris uses is the 1936 Robinson-Patman Act (RPA), which used to be a lynchpin of antitrust...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org