Modern American media has become so politicized that a once-venerable institution now cannot be trusted. Original Article: "Politics Has Infected Everything in Our Society, Especially the Media" [embedded content] Tags: Featured,newsletter

Read More »Breaking Free: How Open Protocols Foster Entrepreneurship, Spontaneous Order, and Individual Sovereignty

The open protocols on the internet would seem to create chaos, but it turns out that they produce the opposite results, encouraging a digital spontaneous order. Original Article: "Breaking Free: How Open Protocols Foster Entrepreneurship, Spontaneous Order, and Individual Sovereignty" [embedded content] Tags:...

Read More »Voting with Their Feet: The Lure of Migration

People migrate for many reasons, including moving to a better economy and escaping political persecution. But one thing is certain: people are going to vote with their feet. Original Article: "Voting with Their Feet: The Lure of Migration" [embedded content] Tags: Featured,newsletter

Read More »September 2023 Monthly

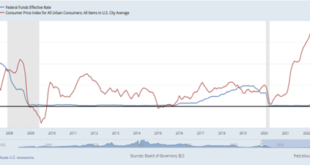

There is a sense of new divergence. Most economists, including the staff at the Federal Reserve, no longer think the US is recession-bound. Unprecedented in modern times, inflation has fallen sharply, and unemployment has not risen, and the economy appears to be enjoying its third consecutive quarter, and the fourth in the past five, above what the Federal Reserve regards as the non-inflationary pace (1.8%). At the same time, and despite being among the fastest...

Read More »Navigating by the Stars on a Cloudy Night

In this episode, Mark examines Fed Chairman Jay Powell's recent confession that the Fed is "navigating by the stars on a cloudy night." This reveals the fundamental methodological weakness of the Fed's economic policy and mainstream economics in general ("data dependency"). In contrast, it also reveals the strengths of Austrian economics, economic theory, and the self regulation of the free market. Mark suggests that we all be prepared for big negative surprises in...

Read More »Why Stabilization Policy is Destabilizing

U.S. presidential candidate Vivek Ramaswamy took aim at the Federal Reserve recently: The reality is, if the dollar is volatile, it’s as bad as if the number of minutes in an hour fluctuated. None of us would be here at the same time. […] When the number of dollars [in relation] to a unit of gold or an agricultural commodity is wildly fluctuating, money doesn’t go to the right projects. It’s just wild—it doesn’t make any sense. That’s been an impediment to economic...

Read More »Why the “Just Wage” Theory Doesn’t Make Much Sense

The concept of the "fair wage" or the "just wage" is centuries old. It dates back at least to the Middle Ages and was founded on the idea that "just" prices of goods must be sufficient to provide "a reasonable wage to maintain the craftsman or merchant in his appropriate station of life." In its modern form, the idea of the just wage is often known as a "living wage." But whatever its form, the notion comes down to the idea that an employer must pay his workers a...

Read More »There Is No Fed Magic Trick to Achieve a Soft Landing

Economic growth in the United States accelerated to a 2.4 percent annualized rate in the second quarter of 2023, picking up from 2.0 percent in the first quarter, and climbing well above the 1.8 percent rate predicted by economists. Many analysts are surprised that the US economy has continued to expand at a robust pace despite the Federal Reserve’s (Fed) aggressive tightening on monetary policy. The Fed raised interest rates by more than 500 basis points (bps) since...

Read More »CBDCs: The Ultimate Tool of Financial Intrusion

While the government promotes CBDCs as tools for "inclusion," it is more likely that they will be another vehicle for federal intrusion. Original Article: "CBDCs: The Ultimate Tool of Financial Intrusion" [embedded content] Tags: Featured,newsletter

Read More »Updating Böhm-Bawerk and Fixing Finance

Peter Lewin joins Bob to discuss his work with Nicolás Cachanosky on uniting Austrian capital theory with mainstream finance. Peter's New Book on Capital and Finance: Mises.org/LewinBook Updating Böhm-Bawerk and Fixing Finance Video of Updating Böhm-Bawerk and Fixing Finance Join us in Nashville on September 23rd for a no-holds-barred discussion against the regime. Use Code "HA23" for $45 off admission:...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org