Economic growth in the United States accelerated to a 2.4 percent annualized rate in the second quarter of 2023, picking up from 2.0 percent in the first quarter, and climbing well above the 1.8 percent rate predicted by economists. Many analysts are surprised that the US economy has continued to expand at a robust pace despite the Federal Reserve’s (Fed) aggressive tightening on monetary policy. The Fed raised interest rates by more than 500 basis points (bps) since March 2022. And yet, the labor market remains tight with a very low unemployment rate at 3.6 percent while the Standard and Poor 500 stock index is up almost 20.0 percent since the beginning of the year. Economists are optimistic that the Fed could deliver a soft landing by reducing inflation close to

Topics:

Mihai Macovei considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Economic growth in the United States accelerated to a 2.4 percent annualized rate in the second quarter of 2023, picking up from 2.0 percent in the first quarter, and climbing well above the 1.8 percent rate predicted by economists. Many analysts are surprised that the US economy has continued to expand at a robust pace despite the Federal Reserve’s (Fed) aggressive tightening on monetary policy.

The Fed raised interest rates by more than 500 basis points (bps) since March 2022. And yet, the labor market remains tight with a very low unemployment rate at 3.6 percent while the Standard and Poor 500 stock index is up almost 20.0 percent since the beginning of the year. Economists are optimistic that the Fed could deliver a soft landing by reducing inflation close to the 2.0 percent target while avoiding a recession. But will the Fed’s magic really work?

Insufficient Monetary Tightening

Since the financial crisis of 2008, the Fed had followed an “easy money” policy, but during the pandemic, the Fed leaned even further into this stance. As Consumer Price Index (CPI) inflation accelerated toward 5.0 percent, Fed Chair Jerome Powell belatedly admitted that inflation wasn’t transitory and shifted course. In March 2022, the Fed started raising interest rates but could not prevent inflation from surging to a peak of 9.1 percent in June 2022.

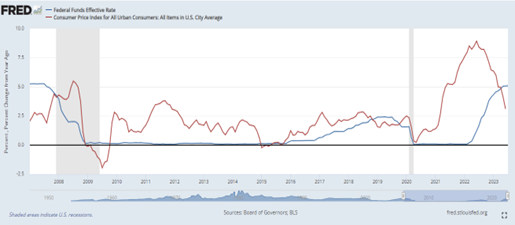

In 2022, it became apparent that the Fed’s tightening on monetary policy was not hawkish enough and that it was more concerned with avoiding a recession and instability of the financial sector. The interest rate hikes were piecemeal, and largely insufficient, as the real interest rate (the difference between the federal funds rate and the inflation rate) remained negative until April 2023 (figure 1).

The current positive real interest rate of about 2.0 percent is still rather low by historical standards and likely continues to artificially stimulate growth. Headline CPI inflation, helped by declining energy prices, may have decelerated to 3.1 percent in June but remains above the Fed’s 2.0 percent target. Moreover, core inflation—which excludes volatile food and energy prices—was at a sticky 4.8 percent in June as wage increases sustained strong consumer spending and second-round inflationary effects.

Figure 1: Federal funds rate and CPI

Source: Data from the Board of Governors of the Federal Reserve System and the Bureau of Labor Statistics.

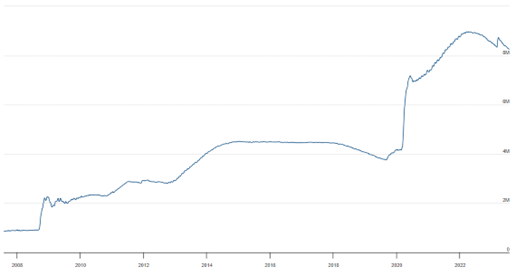

Most important, the Fed cannot rely only on interest rate hikes to tighten monetary policy. It needs to also shrink its balance sheet via quantitative tightening (QT) to reverse its previous quantitative easing, a policy of massive purchases of Treasury and mortgage-backed securities to boost commercial banks’ reserves and liquidity while lowering longer-term interest rates. Quantitative easing made the Fed’s balance sheet explode to a whopping $9 trillion, as of May 2022 (figure 2), and analysts agree that by reducing bank reserves, QT should exert upward pressure on interest rates while curtailing lending.

Figure 2: Total Fed assets (millions)

Source: Data from the Board of Governors of the Federal Reserve System.

In June 2022, the Fed started implementing its QT policy by shedding its holdings of US Treasuries and mortgaged-backed securities at a rate of $95 billion per month. But this process was undermined by the need to provide liquidity to the banking sector after banks, such as the Silicon Valley Bank, experienced hefty deposit runs. As a result, the Fed’s balance sheet declined by around $600 billion (or about 8.0 percent) from its peak to about $8.3 trillion by the end of July 2023, although the volume of held securities outright dropped by about $900 billion over the same period.

Still Abundant Bank Reserves

Some analysts claim that the Fed can use QT while also providing additional liquidity to select banks in distress (i.e., have its cake and eat it too). This is obviously not true. The main purpose of QT is to withdraw bank reserves via asset sales to reduce the banks’ lending capacity. But what we see is that bank reserves remained at historically high levels (figure 3) despite the Fed’s attempts at monetary tightening. Since the Fed’s Board of Governors reduced reserve requirement ratios on net transaction accounts to 0.0 percent as of March 2020, these reserves are de facto excess reserves on top of which banks can multiply credit. This means that banks still have ample room to lend even if the Fed has hiked the federal funds rate, which may also explain the uneven rise of loan interest rates and resilience of credit activity.

Figure 3: Total bank reserves

Source: Data from the Board of Governors of the Federal Reserve System.

Impact on Interest Rates and Credit

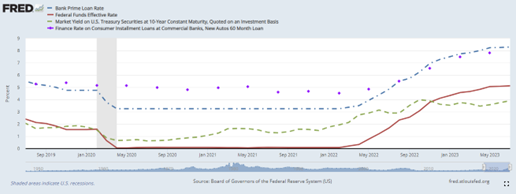

Market interest rates went up since the Fed started its monetary tightening (but not proportionally), reflecting lending maturities and other credit market specificities. The Fed hiked the federal funds rate by 525 bps between March 2022 and July 2023. The bank prime loan rate, which is one of several base rates used by banks to price short-term business loans, mirrored the increase in the Fed’s key rate almost one to one (figure 4).

On the other hand, although longer-term ten-year US Treasury yields rose above 4.0 percent, they went up by less than 200 bps over the same period. The same goes for other bank loan interest rates such as five-year car loans (which went up on average by 330 bps until May 2023), two-year personal loans (which increased by 210 bps), and fifteen- and thirty-year fixed mortgage rates (which rose by close to 300 bps).

Figure 4: Market interest rates

Source: Data on the bank prime loan rate, the federal funds rate, the ten-year Treasury yield, and the finance rate on new auto loans from the Board of Governors of the Federal Reserve System.

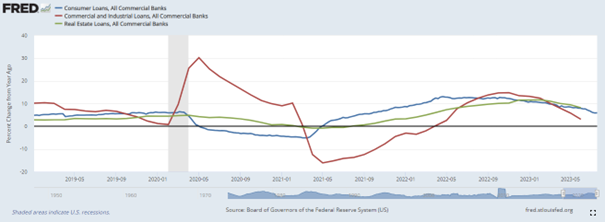

This shows that a majority of large and well-capitalized US banks increased loan interest rates much less than the Fed while also paying close to zero interest rates on bank deposits. They can afford it because they have plenty of reserves and liquidity, which the Fed did not mop up, and they continue to lend to the economy. Although the annual growth in total bank credit decelerated from close to 7.0 percent in 2022 to −0.9 percent in the second quarter of 2023, it was primarily driven by the decline in credit to the government, or investment in Treasury securities. At the same time, consumer and real estate loans grew annually by more than 6.0 percent and 5.0 percent respectively in the second quarter of 2023, while commercial and industrial loans recorded a small dip and remained flat in the first half of 2023 (figure 5). As lending to the private sector remained positive, it is unsurprising that economic output also continued to expand.

Figure 5: Private sector credit

Source: Data on consumer loans, real estate loans, and commercial and industrial loans from the Board of Governors of the Federal Reserve System.

Conclusion

The Fed’s magic trick to achieve a soft landing while aggressively tackling inflation is only smoke and mirrors. The Fed’s piecemeal interest rate hikes were not only insufficient to slow the economy down, but they also received very little support from quantitative tightening (i.e., the withdrawal of the liquidity that was previously injected into the system). Left with plenty of reserves, banks helped the economy to grow by continuing to lend while also refraining from increasing lending rates as much as the Fed. As a result, taming inflation is not yet a done deal, as core inflation remains sticky and well above the Fed’s target.

The money supply shrinkage signals economic trouble ahead when the monetary overhang is likely to be worked out in earnest. The Fed’s dovishness has just pushed forward a day of reckoning. Moreover, a steady deterioration of fiscal deficits alongside Gargantuan public projects to boost domestic demand and spur high-tech green infrastructure investment magnify recession risks as the Fed may be forced to further tighten to reduce inflation pressures. Fitch’s recent downgrade of the US’s long-term credit rating over rising public debt and deterioration of governance is just another confirmation that macroeconomic policies have been unsound for too long.

Tags: Featured,newsletter