We have been discussing the impossibility of China nuking the Treasury bond market. We covered a list of challenges China would face. Then last week we showed that there cannot be such a thing as a bond vigilante in an irredeemable currency. Now we want to explore a different path to the same conclusion that China cannot nuke the Treasury bond market. To review something we have said many times, the dollar is borrowed....

Read More »Brent’s Back In A Big Way, Still ‘Something’ Missing

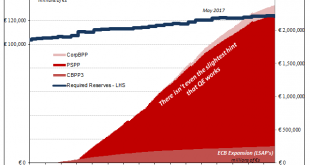

The concept of bank reserves grew from the desire to avoid the periodic bank runs that plagued Western financial systems. As noted in detail starting here, the question had always been how much cash in a vault was enough? Governments around the world decided to impose a minimum requirement, both as a matter of sanctioned safety and also to reassure the public about a particular bank’s status. Later on, governments...

Read More »Europe Is Booming, Except It’s Not

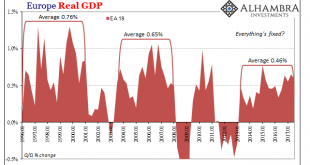

European GDP rose 0.6% quarter-over-quarter in Q3 2017, the eighteenth consecutive increase for the Continental (EA 19) economy. That latter result is being heralded as some sort of achievement, though the 0.6% is also to a lesser degree. The truth is that neither is meaningful, and that Europe’s economy continues toward instead the abyss. At 0.6%, that doesn’t even equal the average growth rate exhibited from either...

Read More »Global Inflation Continues To Underwhelm

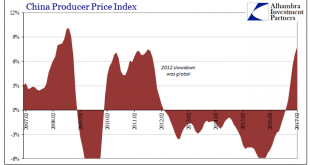

Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months...

Read More »The Power of Oil

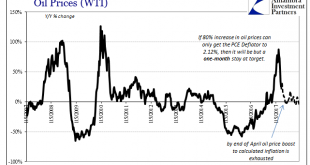

For the first time in 57 months, a span of nearly five years, the Fed’s preferred metric for US consumer price inflation reached the central bank’s explicit 2% target level. The PCE Deflator index was 2.12% higher in February 2017 than February 2016. Though rhetoric surrounding this result is often heated, the actual indicated inflation is decidedly not despite breaking above for once. In many ways 2.12% is hugely...

Read More »Same Country, Different Worlds

To my mind, “reflation” has always proceeded under false pretenses. This goes for more than just the latest version, as we witnessed the same incongruity in each of the prior three. The trend is grounded in mere hope more than rational analysis, largely because I think human nature demands it. We are conditioned to believe especially in the 21st century that the worst kinds of things are either unrealistic or apply to...

Read More »Same Country, Different Worlds

To my mind, “reflation” has always proceeded under false pretenses. This goes for more than just the latest version, as we witnessed the same incongruity in each of the prior three. The trend is grounded in mere hope more than rational analysis, largely because I think human nature demands it. We are conditioned to believe especially in the 21st century that the worst kinds of things are either unrealistic or apply to...

Read More »Who Lends to the Fed?

Recently, I wrote to argue against the populist idea that the Federal Reserve prints money. I say populist because it’s not supported by economic or banking theory, and it is not accurate in describing Fed practice in the market. It used to stir up emotion against the Fed. The Fed causes a lot of harm, but we should stick to the facts. I argued that the Fed does not print; it borrows. I illustrated this point with a series of examples of borrowing, starting with a homeowner who takes a...

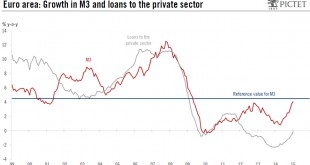

Read More »The 2015 Update: Risks on the Rising SNB Money Supply

Since the financial crisis central banks in developed nations increased their balance sheets. The leading one was the American Federal Reserve that increased the monetary base (M0, often called “narrow money”), followed by the Bank of Japan and recently the ECB. In most cases the extension of narrow money did neither have an effect on banks’ money supply, the so called “broad money” (M1-M3), nor on price inflation. For the Swiss, however, the rising money supply concerned both narrow and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org