As central banks try (yet again) to bolster faltering growth and inflation, it is important to grasp how the ‘style’ and aims of monetary policy-making have changed over time and how they need to evolve in the future. The world is being disrupted by structural trends such as populism, demographic and climate change and technological innovation. Likewise, with previous approaches producing fewer results, we believe it is time to envisage monetary policies that address...

Read More »New monetary policies for new challenges

As central banks try (yet again) to bolster faltering growth and inflation, it is important to grasp how the ‘style’ and aims of monetary policy-making have changed over time and how they need to evolve in the future.The world is being disrupted by structural trends such as populism, demographic and climate change and technological innovation. Likewise, with previous approaches producing fewer results, we believe it is time to envisage monetary policies that address these sources of...

Read More »The Bank of England’s “Future of Finance Report”

Huw van Steenis’ summarizes his report as follows (my emphasis): A new economy is emerging driven by changes in technology, demographics and the environment. The UK is also undergoing several major transitions that finance has to respond to. What this means for finance Finance is likely to undergo intense change over the coming decade. The shift to digitally-enabled services and firms is already profound and appears to be accelerating. The shift from banks to market-based finance is...

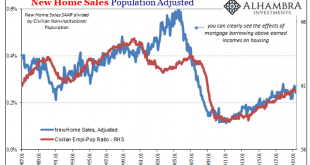

Read More »What Does It Mean That Real Estate, Not Equities, Is Driving Monetary Policy?

In the world of assets classes, I don’t believe it is equities which hold the Federal Reserve’s attention. After the 2006-11 debacle, the big bust, you can at least understand why policymakers might be more attuned to real estate no matter how the NYSE trades. It may be a decade ago, but that’s the one thing out of the Global Financial Crisis which was seared into the consciousness of everyone who lived through it....

Read More »“Digitales Zentralbankgeld (Central Bank Digital Currency),” FuW, 2019

Finanz und Wirtschaft, June 29, 2019. PDF. It is not central bank digital currency (CBDC) per se which might act as a game changer in financial markets. What will be key is how central banks accommodate the introduction of CBDC. In principle, this accommodation can go very far, to the point where the introduction of CBDC does not affect macroeconomic outcomes. But such complete accommodation is unlikely. On the one hand, central banks will want to exploit the new monetary policy options...

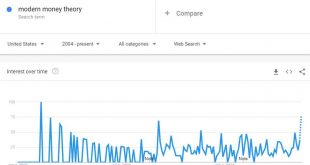

Read More »“Moderne monetäre Theorie: Ein makroökonomisches Perpetuum mobile (The Macroeconomic Perpetuum Mobile),” NZZ, 2019

NZZ, April 25, 2019. PDF. Modern monetary theory (MMT) is neither a theory, nor modern, nor exclusively monetary. I discuss fallacies related to MMT. Dynamic inefficiency requires permanent, not transitory, r<g. For now, policy makers should rely on common sense rather than MMT.

Read More »“Moderne monetäre Theorie: Ein makroökonomisches Perpetuum mobile (The Macroeconomic Perpetuum Mobile),” NZZ, 2019

NZZ, April 25, 2019. PDF. Modern monetary theory (MMT) is neither a theory, nor modern, nor exclusively monetary. I discuss fallacies related to MMT. Dynamic inefficiency requires permanent, not transitory, r<g. For now, policy makers should rely on common sense rather than MMT.

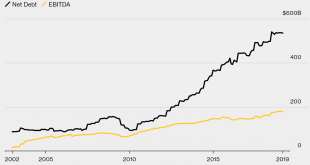

Read More »What Causes Loss of Purchasing Power, Report 7 Apr

We have written much about the notion of inflation. We don’t want to rehash our many previous points, but to look at the idea of purchasing power from a new angle. Purchasing power is assumed to be intrinsic to the currency. We have said that the problem with the word inflation is that it treats two different phenomena as if they are the same. One is the presumed effect of rising quantity of dollars. The other is the...

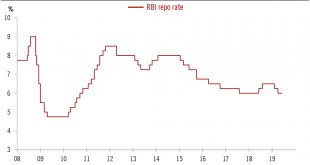

Read More »India: RBI cuts interest rate again

As widely expected, the Reserve Bank of India announced a cut to its policy interest rate last week. We expect that monetary policy will likely stay accommodative in order to support growth going forward.The Reserve Bank of India (RBI) cut its policy interest rate (RBI repo rate) by 25 basis points (bps) last week, bringing it down to 6.0%. This was the RBI’s second interest rate cut this year under its new governor Shaktikanta Das. With this move, the RBI has fully reversed last year’s rate...

Read More »Albert Edwards: Investors Should Brace For A World Of Negative Rates, 15percent Budget Deficits And Helicopter Money

Eariler this week, when the San Fran Fed published a paper that suggested that the recovery would have been stronger if only the Fed had cut rates to negative, we proposed that this is nothing more than a trial balloon for the next recession/depression, one in which the Federal Reserve will seek affirmative “empirical evidence” that greenlights this unprecedented NIRPy step (in addition to QE of course). Today, in his...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org