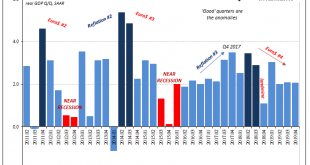

Headline GDP growth during the fourth quarter of 2019 was 2.05849% (continuously compounded annual rate), slightly lower than the (revised) 2.08169% during Q3. For the year, the Bureau of Economic Analysis (BEA) puts total real output at $19.07 trillion, or annual growth of 2.33% and down from 2.93% in 2018. Last year was weaker than 2017, the second lowest out of the six since 2013. And that’s where the good news ends. Eurodollar Disruption, Peaks &...

Read More »With No Second Half Rebound, Confirming The Squeeze

It’s a palpable impatience. Having learned absolutely nothing from the most recent German example, there’s this pervasive belief that if the economy hasn’t fallen apart by now it must be going the other way. The right way. Those are the only two options for mainstream analysis (which means it isn’t analysis). You can see it in how everything is framed. When first presented with this “unexpected” globally synchronized downturn early on in 2019 (they ignored all the...

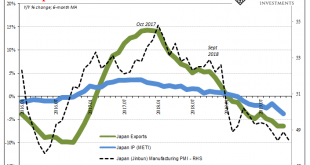

Read More »The Big And Small of Leading Japan

In the middle of 2018, Japan, they said, was riding so high. Gliding along on the tidal wave of globally synchronized growth, Haruhiko’s courage and more so patience had finally delivered the long-promised recovery. The Japanese economy had healed to a point that its central bank officials believed it time to wean the thing off decades of monetary “stimulus.” They even publicly speculated on just when QQE would be terminated. At least that was the story, one which...

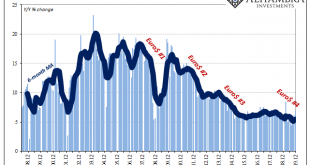

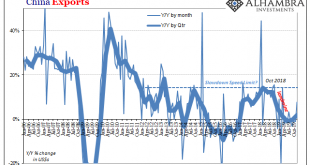

Read More »China Enters 2020 Still (Intent On) Managing Its Decline

Chinese Industrial Production accelerated further in December 2019, rising 6.9% year-over-year according to today’s estimates from China’s National Bureau of Statistics (NBS). That was a full percentage point above consensus. IP had bottomed out right in August at a record low 4.4%, and then, just as this wave of renewed optimism swept the world, it has rebounded alongside it. Rather than suggest the global economy is picking up, or ended last year in a “good...

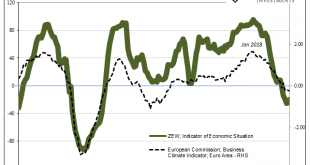

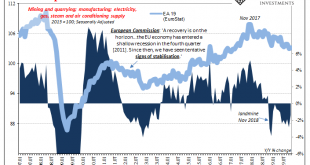

Read More »Germany, Maybe Europe: No Signs Of The Bottom

For anyone thinking the global economy is turning around, it’s not the kind of thing you want to hear. Germany has been Ground Zero for this globally synchronized downturn. That’s where it began, meaning first showed up, all the way back at the start of 2018. Ever since, the German economy has been pulling Europe down into the economic abyss along with it, being ahead of the curve in signaling what was to come for the whole rest of the global economy. The ECB, many...

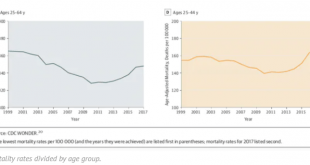

Read More »Inflation, But Only At The Morgue

Why is everyone so angry? How can socialism possibly be on such a rise, particularly among younger people around the world? Why are Americans suddenly dying off? According to one study, two-thirds of millennials are convinced they are doing worse when compared to their parents’ generation. Sixty-two percent say they are living paycheck to paycheck, with no savings and no way to get any (though they also tend to “overspend” when compared to other age groups). Worst of...

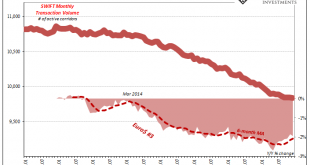

Read More »De-dollarization By Default Is Not What You Might Think

Last month, a group of central bank governors from across the South Pacific region gathered in Australia to move forward the idea of a KYC utility. If you haven’t heard of KYC, or know your customer, it is a growing legal requirement that is being, and has been, imposed on banks all over the world. Spurred by anti-money laundering efforts undertaken first by the European Union, more and more governments are forcing global banks to take part. KYC is a particularly...

Read More »Clarida Picks Up Some Data

I should know better than to make declarative all-or-none statements like this. I said there isn’t any data which comports with the idea of a global turnaround, this shakeup in sentiment which since early September has gone right from one extreme to the other. Recession fears predominated in summer only to be (rather easily) replaced by near euphoria (again). Narrative yes, sentiment maybe, data nope. The vast majority of the economic accounts, anyway. There are a...

Read More »Very Rough Shape, And That’s With The Payroll Data We Have Now

The Bureau of Labor Statistics (BLS) has begun the process of updating its annual benchmarks. Actually, the process began last year and what’s happening now is that the government is releasing its findings to the public. Up first is the Household Survey, the less-watched, more volatile measure which comes at employment from the other direction. As the name implies, the BLS asks households who in them is working whereas the more closely scrutinized Establishment...

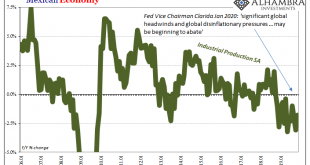

Read More »Not Abating, Not By A Longshot

Since I advertised the release last week, here’s Mexico’s update to Industrial Production in November 2019. The level of production was estimated to have fallen by 1.8% from November 2018. It was up marginally on a seasonally-adjusted basis from its low in October. That doesn’t sound like much, -1.8%, but apart from recent months this would’ve been the third worst result since 2009. Mexico has rarely experienced that kind of seemingly mild contraction. It signals...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org