It certainly seems that technological advances make our lives better. Instead of writing a letter, stamping it, and mailing it (which was vastly more personal), we now send emails. Rather than driving to a local retailer or manufacturer, we order it online. Of course, we mustn’t dismiss the rise of social media, which connects us to everyone and everything more than ever. Economists and experts have long argued that technological advances drive U.S. economic...

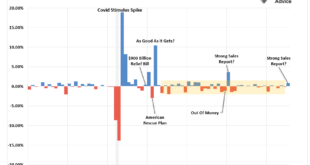

Read More »Risks Facing Bullish Investors As September Begins

Since the end of the “Yen Carry Trade” correction in August, bullish positioning has returned with a vengeance, yet two key risks face investors as September begins. While bullish positioning and optimism are ingredients for a rising market, there is more to this story. It is true that “a rising tide lifts all boats,” meaning that as the market rises, investors begin to chase higher stock prices, leading to a virtual buying spiral. Such leads to an improvement in...

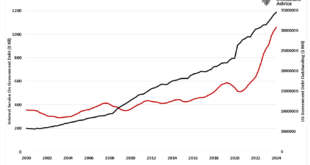

Read More »Japanese Style Policies And The Future Of America

In a recent discussion with Adam Taggart via Thoughtful Money, we quickly touched on the similarities between the U.S. and Japanese monetary policies around the 11-minute mark. However, that discussion warrants a deeper dive. As we will review, Japan has much to tell us about the future of the U.S. economically. Let’s start with the deficit. Much angst exists over the rise in interest rates. The concern is whether the government can continue to fund itself, given...

Read More »Red Flags In The Latest Retail Sales Report

The latest retail sales report seems to have given Wall Street something to cheer about. Headlines touting resilience in consumer spending increased hopes of a “soft landing” boosting the stock market. However, as is often the case, the devil is in the details. We uncover a more troubling picture when we peel back the layers of this seemingly positive data. Seasonal adjustments, downward revisions, and rising delinquency rates on credit cards and auto loans suggest...

Read More »What Happens When Rampant Asset Inflation Ends?

The collapse of asset inflation will implode all the fiscal and financial promises based on ever-inflating assets. In effect, central banks and states have masked the devastating stagnation of real income by encouraging households to take on debt to augment declining income and by inflating assets via quantitative easing and lowering interest rates and bond yields to near-zero (or more recently, less than zero). The...

Read More »Where Will All the Money Go When All Three Market Bubbles Pop?

Since the stock, bond and real estate markets are all correlated, it’s a question with no easy answer. The Everything Bubble Everyone who’s not paid to be in denial knows stocks, bonds and real estate are in bubbles of one sort or another. The Housing Bubble Real estate is either an echo bubble or a bubble that exceeds the previous bubble, depending on how attractive the market is to hot-money investors. S&P /...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org