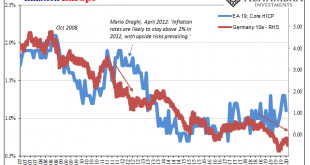

When Mario Draghi sat down for his scheduled press conference on April 4, 2012, it was a key moment and he knew it. The ECB had finished up the second of its “massive” LTRO auctions only weeks before. Draghi was still relatively new to the job, having taken over for Jean-Claude Trichet the prior November amidst substantial turmoil. The non-standard “flood of liquidity” was an about-face from his predecessor (who had been raising rates in 2011 before the wheels...

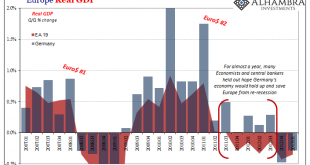

Read More »What’s Germany’s GDP Without Factories

It was a startling statement for the time. Mario Draghi had only been on the job as President of the European Central Bank for a few months by then, taking over for the hapless Jean Claude-Trichet who was unceremoniously retired at the end of October 2011 amidst “unexpected” chaos and turmoil. It was Trichet who contributed much to the tumult, having idiotically raised rates (twice) during 2011 even as warning signs of...

Read More »Euro Saves Germany, Slaughters the PIGS, & Feeds the BLICS

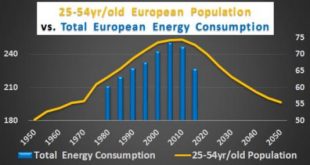

Authored by Chris Hamilton via Econimica, The change in nations Core populations (25-54yr/olds) have driven economic activity for the later half of the 20th century, first upward and now downward. The Core is the working population, the family forming population, the child bearing population, the first home buying, and the credit happy primary consumer. Even a small increase (or contraction) in their quantity drives...

Read More »European Banks and Europe’s Never-Ending Crisis

Landfall of a “Told You So” Moment… Late last year and early this year, we wrote extensively about the problems we thought were coming down the pike for European banks. Very little attention was paid to the topic at the time, but we felt it was a typical example of a “gray swan” – a problem everybody knows about on some level, but naively thinks won’t erupt if only it is studiously ignored. This actually worked for a...

Read More »ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It’s official, I’m calling a banking crisis in Europe. Things didn’t go well the last time I did this. Of course, many will say, “But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks are close to going bust, right?!!!”. Yeah, right! Reference our past research note on so-called trusted parties in private blockchains for banks. Those interested in purchasing the 22 page report on what is likely the first major bank to fall...

Read More »ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It's official, I'm calling a banking crisis in Europe. Things didn't go well the last time I did this. Of course, many will say, "But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks are close to going bust, right?!!!". Yeah, right! Reference our past research note on so-called trusted parties in private blockchains for banks. Those interested in purchasing the 22 page report on what is likely the first...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org