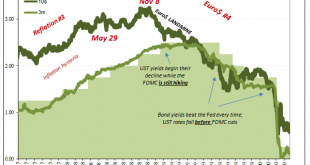

It’s always something. There’s forever some mystery factor standing in the way. On the topic of inflation, for years it was one “transitory” issue after another. The media, on behalf of the central bankers it holds up as a technocratic ideal, would report these at face value. The more obvious explanation, the argument with all the evidence, just couldn’t be true otherwise it’d collapse the technocracy right down to the ground. And so it was also in the bond market....

Read More »The Fallen Kings & The Bond Throne of Collateral

There is no schadenfreude at times like these, no time to dance on anyone’s grave. Victory laps are a luxury that only central bankers take – always prematurely. The world already coming apart because of GFC1, what comes next with GFC2 and then whatever follows it? Another “bond king” has thrown in the towel. Franklin Templeton’s candidate for the title has been Michael Hasenstab, and like all the other Kings he’d been betting that interest rates would have...

Read More »U.S. Treasuries: Not Really Wrong On Bonds

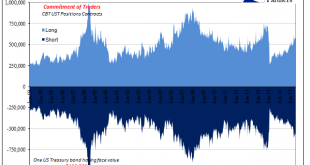

It is often said that the market for US Treasuries is the deepest and most liquid in the world. While that’s true, we have to be careful about what it is we are talking about. There is no single US Treasury market, and often differences can be striking. The most prominent example was, of course, October 15, 2014. In truth, the liquidity side of cash market UST’s has been diminished since around 2013. Largely as a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org