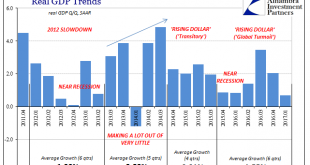

Back in October, the Bureau of Economic Analysis released GDP figures that suggested what those behind “reflation” had hoped. After a near miss to start 2016, the economy had shaken off the effects of “transitory” weakness, mainly manufacturing and oil, poised to perform in a manner consistent with monetary policy rhetoric. The Federal Reserve had been since 2014 itching to “raise rates” if for no other reason than to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org