Swiss Franc Switzerland SVME Purchasing Managers Index (PMI), January 2017(see more posts on Switzerland SVME PMI, ) Source: Investing.com - Click to enlarge GBP / CHF The pound still remains on the back foot against the Swiss Franc with rates for GBP CHF sitting just below 1.25 for this pair. The pound is struggling to gain momentum against all of the major currencies as Brexit is just around the corner. The...

Read More »Trade is Trump’s Centerpiece

Investors are anxiously awaiting more details on the new US Administration’s economic policies and priorities. Part of the challenge is that the cabinet represents a wide range of views and it is not clear where the informal power lies, or whose call is it. In terms of economic policy, trade is being given priority. It is seen as the key to the jobs and growth objectives. There have been two initiatives: formally...

Read More »Trump and the Dollar

Summary: US official comments on the FX market appear to have increased in frequency. They are mostly warnings about a strong dollar, but not all comments are dollar-negative. Policy is the ultimate driver but comments pose headline risk. Although in office less than a fortnight, the new US Administration is showing a disregard not only for the domestic convention but international agreements like on...

Read More »FX Daily, January 31: Markets Look for Solid Footing

Swiss Franc EUR/CHF - Euro Swiss Franc, January 31(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The immigration imbroglio in the United States is being cited in various accounts for the price action, including yesterday’s drop in the S&P 500, where the intraday loss was the largest since before the election. The drama is also being blamed for the dollar’s losses yesterday, which it is...

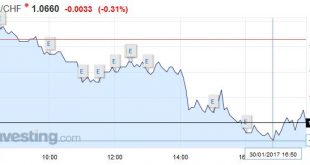

Read More »FX Daily, January 30: EUR/CHF falls further to 1.650

Swiss Franc The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 – 1.0700 that constituted the previous intervention area. Reasons can be found in the weak U.S. GDP weak, in Trump’s foreign trade policy and in the strong Swiss trade balance. Who has understand the principles of the balance of payments, knows that private investors and the SNB must export the equivalent of the current account...

Read More »Weekly Speculative Position: Net Short Euro and Yen Are Falling. Short CHF Stable

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Yellen nor Kuroda nor Carney will Take the Spotlight from Trump

Summary: Fed, BOJ, and BOE meet next week, each may adjust economic assessments in more favorable direction. Key challenge for many investors is the new US Administration. US employment, EMU inflation, Q4 GDP, and China’s PMI are among the data highlights. Three major central banks meet in the week ahead, and there are several important reports due out that will give investors more insight into how the...

Read More »FX Weekly Review, January 23 – 28: Dollar Downwards and CHF Upwards Correction, for how long?

Swiss Franc Currency Index The Swiss Franc index has a solid performance of 2.5% in the last month, while the dollar index is down nearly 3%. Trade-weighted index Swiss Franc, January 28(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three...

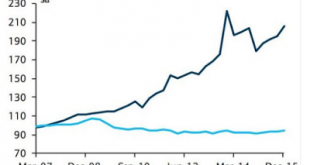

Read More »Great Graphic: Mexico and China Unit Labor Costs

Summary: Mexico has been gaining competitiveness over China before last year’s depreciation of the peso. The depreciation of the peso, and other US actions can contribute to the destabilization of Mexico. An economically prosperous and stable Mexico has long been understood to be in the US interest. This Great Graphic was posted by David Merkel on his AlephBlog with a hat tip to Sober Look. It looks at the...

Read More »The Grand Strategy: Fixed Spheres of Influence or Variable Shares?

Summary: The US has a direct investment strategy for historical reasons. It competes against export-oriented strategies. The FDI strategy does make low-skilled domestic labor compete with low-skilled foreign worker, but skilled workers abroad complement the skilled domestic worker. The rise of the populist-nationalism over the past year or so is partly predicated on a realist view of international relations. ...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org