Will EUR/CHF fall to 1.00 The reader might have seen the latest Swiss Consumer Sentiment and the UBS consumption indicator. They suggest that the Swiss boom phase should finally come. I anticipated the boom already in my slides for the CFA Society. The Swiss boom was postponed when the SNB decided to remove the euro peg in early 2015. What is the definition of a “boom”? It is economic activity mostly driven by...

Read More »Largest Retail FX Broker FXCM Banned By CFTC, Fined $7 Million For Taking Positions Against Clients

The CFTC on Monday fined Forex Capital Markets, parent FXCM Holdings LLC and founding partners Dror Niv and William Ahdout to pay $7 million to settle charges it defrauded retail foreign exchange customers and engaging in false and misleading solicitations. As part of the settlement, FXCM agreed to withdraw its registration and never seek to register with the CFTC again, effectively banning it from operating in the...

Read More »Great Graphic: Interesting Sterling Price Action

Sterling is having an interesting day. It fell in the face of the US dollar’s bounce but has recovered fully. It has not yet traded above yesterday’s high (~$1.2510) but it may. It does appear to be tracing out a hammer in Japanese candle stick terms. Demand emerged (support) near the 50% retracement objective of advance off the January 16 dip below $1.20. That retracement was $1.2346 and today’s low was one hundredth...

Read More »The Dollar: Real or Nominal Rates?

Real interest rates are nominal rates adjusted for inflation expectations. Inflation expectations are tricky to measure. The Federal Reserve identifies two broad metrics. There are surveys, like the University of Michigan’s consumer confidence survey, and the Fed conducts a regular survey of professional forecasters. There are also market-based measures, like the breakevens, which compare the conventional yield to the...

Read More »FX Weekly Preview: Politics Not Economics is Driving the Markets

Summary: The Fed is more confident this year of stable growth and rising inflation. The new US Administration’s economic agenda is beginning to take shape, though it is not clear that consumer interests will be pursued. There are several considerations, including politics in Europe, that are driving European rates higher. The RBA and RBNZ meet next week. Neither is expected to change policy. United States The...

Read More »FX Weekly Review, January 30 – February 04: Reversal of Trump Reflation Trade Continues

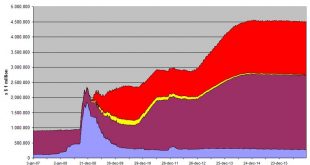

Swiss Franc Currency Index The Swiss Franc index remained around the 2% gain that for the last month, the recovery from the Trump reflation trade. In this trade, investors preferred U.S. against European stocks. This tendency, however, is reversing now – and with it the franc recovered. Trade-weighted index Swiss Franc, February 04(see more posts on Swiss Franc Index, ) Source: market.ft.com - Click to...

Read More »FX Daily, February 03: US Jobs Trump Europe’s Service PMIs

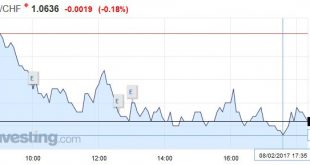

Swiss Franc EUR/CHF - Euro Swiss Franc, February 03(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Ahead of the weekend, there are two series of economic reports. The first are Europe’s service PMI reports and the second is the US employment report. Neither report is likely to alter views significantly, but the latter has greater potential to move the market. It is important too to recognize the...

Read More »The Future of Globalization

(draft of monthly column for a Chinese paper) The cross-border movement of goods, services, and capital increased markedly for the thirty years up to the Great Financial Crisis. Although the recovery has given way to a new economic expansion in the major economies, global trade and capital flows remain well below pre-crisis levels. It had given rise to a sense globalization is ending. The election of Donald Trump as...

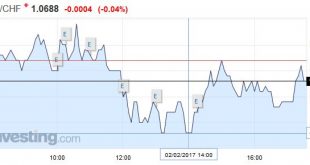

Read More »FX Daily, February 02: Dollar Remains on Back Foot After ADP and FOMC

Swiss Franc EUR/CHF - Euro Swiss Franc, February 02(see more posts on EUR/CHF, ) - Click to enlarge GBP / CHF Sterling vs the Swiss Franc exchange rate remains tentative this morning with the release of the Brexit strategy due to come out later today. A white paper is going to be published later with MPs backing the European Bill by 498 vote against 114 last night. The bill will be debated further in parliament...

Read More »Thoughts about the Fed’s Balance Sheet

Summary: Several regional Fed presidents want to begin talking about shrinking Fed’s balance sheet. Leadership does not appear to have great urgency, so don’t expect anything in this week’s statement. First step more hikes, then refrain from reinvesting payments and maturities, but slowly. The Federal Reserve meets this week, but there is, for all practical purposes, no chance that a rate hike is delivered....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org