(The sporadic updates continue while I am on a two-week business trip. Now in Barcelona, participating in TradeTech FX Europe) Several developments have attracted our attention, but the key take away is that the global capital markets have stabilized after appearing downright frightful at the end of last week, as stocks, yields, and the dollar plummeted. Equities rallied om Monday and there was follow through buying in Asia on Tuesday. The US S&P 500 gapped higher yesterday, leaving a four-day island in its wake (after gapping lower on September 5) and posting a new record closing high. The dollar was two-three standard deviations below its 20-day moving average at the end of last week, and the recovery on Monday

Topics:

Marc Chandler considers the following as important: EUR, EUR/CHF, Featured, France Non-Farm Payrolls, FX Trends, GBP, JPY, newslettersent, Norwegian Krone, NZD, SPY, TLT, U.K. Consumer Price Index, U.K. Core Consumer Price Index, U.K. House Price Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

(The sporadic updates continue while I am on a two-week business trip. Now in Barcelona, participating in TradeTech FX Europe)

Several developments have attracted our attention, but the key take away is that the global capital markets have stabilized after appearing downright frightful at the end of last week, as stocks, yields, and the dollar plummeted. Equities rallied om Monday and there was follow through buying in Asia on Tuesday. The US S&P 500 gapped higher yesterday, leaving a four-day island in its wake (after gapping lower on September 5) and posting a new record closing high. The dollar was two-three standard deviations below its 20-day moving average at the end of last week, and the recovery on Monday helped ease the over-extended condition of the market. The US 10-year yield is about 10 bp above the low hit last week, amid optimism that the Irma storm may not have been as devastating as initially feared before hitting Cuba sapped some of its energy.

There are three macro developments to note. First, after tough rhetoric, the Trump Administration chose to dilute some of its demands for another round of sanctions on North Korea in order to ensure Chinese and Russian consent. It succeeded in winning a unanimous decision from UN Security Council. South Korea’s Kospi advanced for the second consecutive session. Its gains are modest (0.75% this week) in line with the MSCI Asia Pacific Index (except that the MSCI benchmark is at new 10-year highs). The Korean won itself remains a little lower on the week (~-0.2%). Of course, the underlying challenge has not been addressed, and many seem to be increasingly skeptical that the sanction regime result in a change in behavior of North Korea.

Second, the center-right appears to have won a third term in Norway. The Conservative Party will continue to lead the government, but will rely on four smaller parties rather than three. At least on the surface, this makes its somewhat more fragile. Labour suffered a sharp defeat. It had been polling near 40% a few months ago, but garnered slightly more than a quarter of the vote.

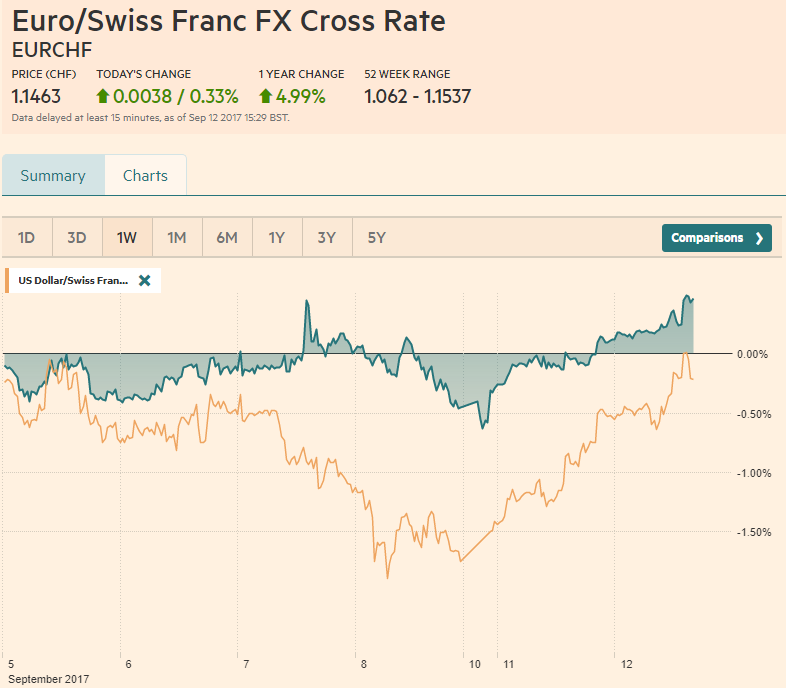

Swiss FrancThe Euro has risen by 0.33% to 1.1463 CHF. |

EUR/CHF and USD/CHF, September 12(see more posts on EUR/CHF, USD/CHF, ) |

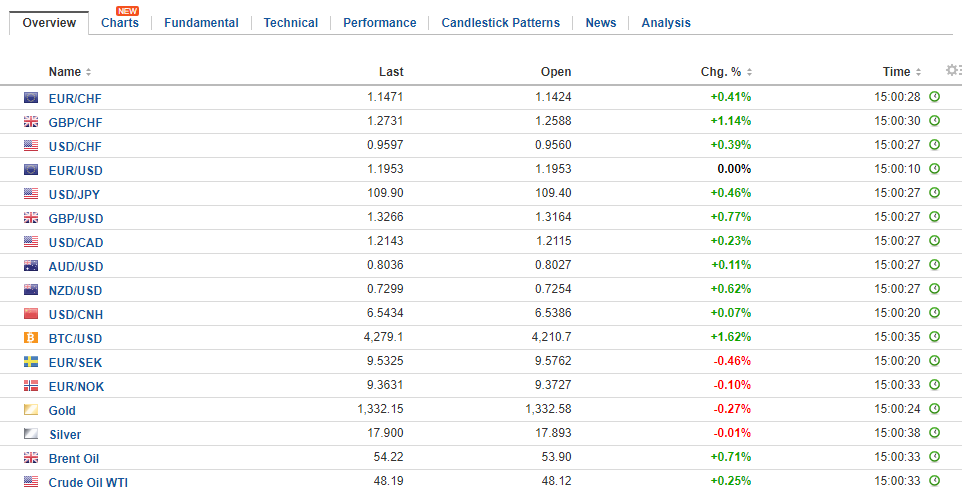

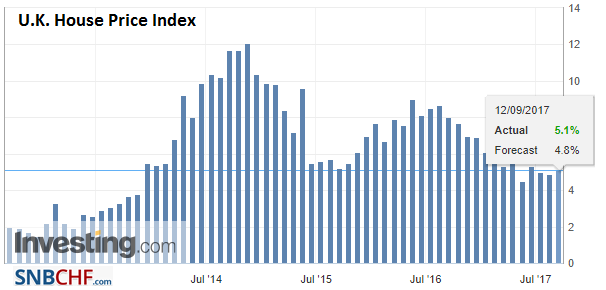

FX RatesThe euro advanced yesterday from NOK9.30 to NOK9.40. It is consolidating in a tight range today. The election results may have been a bit closer than expected, but the weight on the krone yesterday seemed to stem more from the unexpectedly soft inflation report. The median forecasts expected an increase in price pressures, but they fell. Headline CPI eased to 1.3% from 1.5% rather than increase to 1.7%. Underlying inflation, which excludes energy and tax changes, slowed to 0.9% from 1.2%. The median expectation in the Bloomberg survey was for a small rise. After sterling, the New Zealand dollar is the strongest of the major currencies. It is up about 0.2%. The ostensible trigger are polls suggesting that the National Party is doing better than it seemed last week when it appeared the opposition Labour was moving ahead. The election is September 23. The New Zealand dollar has been the worst performer since the start of last month, losing nearly 3% against the otherwise heavy US dollar through yesterday. A move now above the $0.7330-$0.7345 area would confirm a low is in place and suggest another run at $0.7500. |

FX Daily Rates, September 12 |

| The euro’s pullback from the post-weekend high, just shy of $1.21 was extended slightly in Asia. It overshot our $1.1960-$1.1980 target to trade near $1.1945. Below there, support is seen around $1.1925. The technical indicators are mixed, though a bullish divergence is seen in the Slow Stochastics. Initial resistance is seen in the $1.2000-$1.2020 band.

Yesterday, the dollar recovered smartly from its pre-weekend plunge toward JPY107.30 to test resistance in the JPY109.40 area. It has edged slightly higher today (~JPY109.60). It may take greater follow through selling of US Treasuries encourage a move to JPY110. The US 10-year yield has not traded above its 20-day moving average in nearly a month. It is found near 2.15% today. The December 10-year note futures gapped lower yesterday. That upside gap is potentially an important technical development, especially if it is not closed in the next several days. The real test may come later in the week when core CPI is expected to have eased again. The 20-day moving average of the futures contract is seen near 126-24. |

FX Performance, September 12 |

| Great Repeal Bill that is the legal basis for Brexit was approved by Parliament. The fight within the Tory Party seemed to have been deferred, as the fundamental issue of ministerial powers remains a divisive issue. |

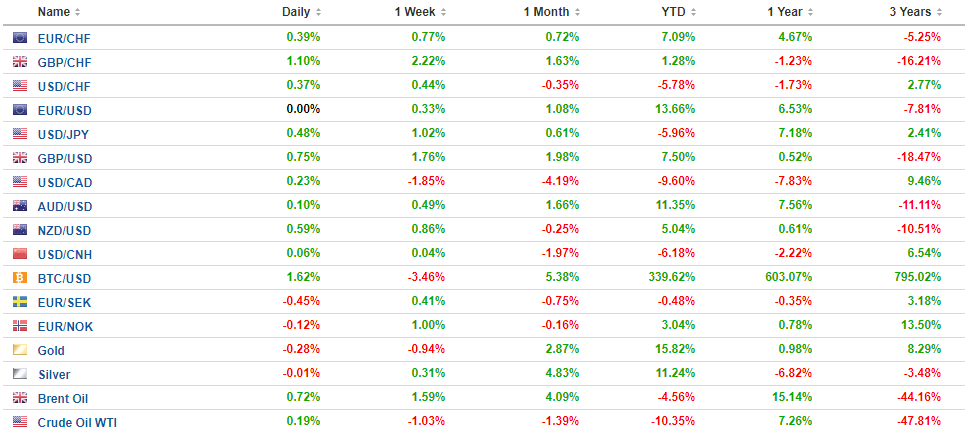

U.K. House Price Index YoY, Aug 2017(see more posts on U.K. House Price Index, ) Source: Investing.com - Click to enlarge |

| In some ways, the UK government is fight a two-front battle. The first is with the EU, and it does not appear yet that sufficient progress has been made on the terms of the separation from the EU’s vantage point that would allow the next stage in the negotiations to start next month as some had hoped. |

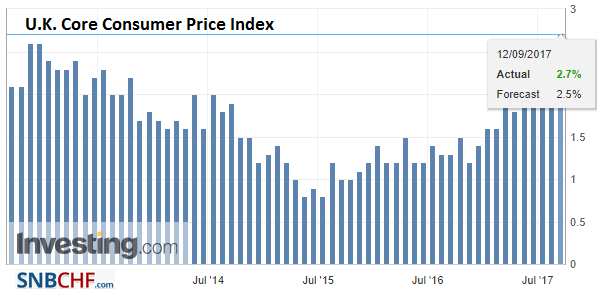

U.K. Core Consumer Price Index (CPI) YoY, Aug 2017(see more posts on U.K. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

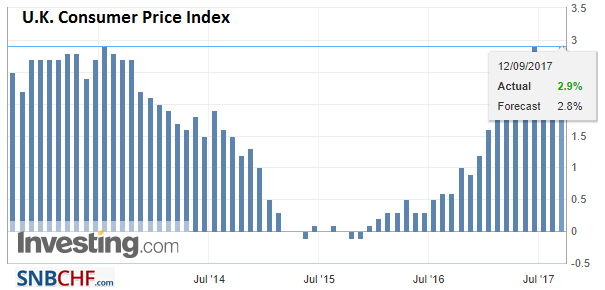

| Sterling is trading firmer ahead of the August CPI report, which is expected to edge higher. The pass through of last year’s decline in sterling is not quite complete yet, though it is expected to peak in the next couple of months. Initial support may be pegged near $1.3140. |

U.K. Consumer Price Index (CPI) YoY, Aug 2017(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

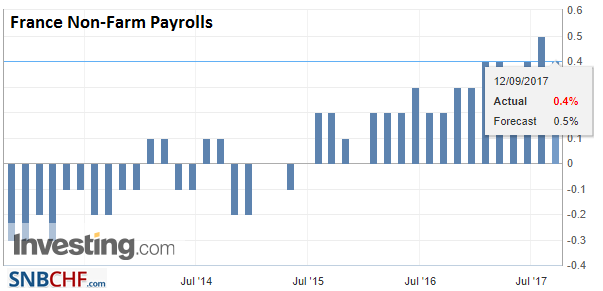

France |

France Non-Farm Payrolls QoQ, Q2 2017(see more posts on France Non-Farm Payrolls, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,$TLT,EUR/CHF,Featured,France Non-Farm Payrolls,newslettersent,Norwegian Krone,NZD,SPY,U.K. Consumer Price Index,U.K. Core Consumer Price Index,U.K. House Price Index,USD/CHF