Read More »

Rebuilding Greece and Europe

Greece’s crisis is fiscal, monetary, and structural, exacerbated by political and social volatility, stresses on European unity, and now, a large influx of refugees. Despite this “nightmare” and major near-term concerns, former Greek Prime Minister Antonis Samaras believes that “we can and will make it’. The Greeks have faced a unique and debilitating confluence of challenges – excessive deficits and debt, diminishing competitiveness, increasing non-performing loans, political...

Read More »US Economy: From Model Student to Problem Child?

For several years, the United States has been the bright spot in the world economy, with the strongest growth recovery among developed nations, sustained labor market improvement, and climbing stock markets. But that’s the past. What about the future? From the perspective of senior European executives, the outlook for the U.S. market has become increasingly worrisome of late. In the most recent installment of a twice-yearly survey, a panel of those executives told Credit Suisse that their...

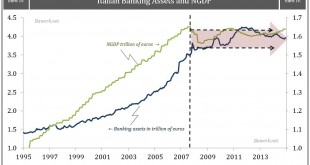

Read More »How Italy will fail and drag down the European Project

Italy is big enough to matter (it is the eight largest economy on the planet), but so uneventful that most does not pay any attention to what is going on there. We contend that Italy will, during the next year or two, be on everyone’s radar screen as it has the potential to derail the European project for real. Greece, Portugal and Ireland were mere test subjects for what will come. Spain would have been a challenge, but were narrowly avoided. Italy will drag the whole structure down if...

Read More »How Italy will fail and drag down the European Project

Italy is big enough to matter (it is the eight largest economy on the planet), but so uneventful that most does not pay any attention to what is going on there. We contend that Italy will, during the next year or two, be on everyone’s radar screen as it has the potential to derail the European project for real. Greece, Portugal and Ireland were mere test subjects for what will come. Spain would have been a challenge, but were narrowly avoided. Italy will drag the whole structure down if...

Read More »The End of European Austerity?

Since 2009, Europe’s peripheral economies – Greece, Ireland, Italy, Portugal, and Spain – have tried to dig their way out of a debt crisis by cutting public spending and raising taxes. This year, however, will be different. Fiscal policy in the euro zone is expected to ease for the first time since 2010. The European economists in Credit Suisse’s Global Markets division say it’s high time fiscal policy loosened in the Eurozone. Had it done so earlier, the region might now be...

Read More »What to Expect from a Brexit Vote

The threat of secession has dogged both European governments and the region as a whole for the last four years. Greece has come perilously close to leaving the euro a number of times since 2012, Scottish voters rejected a proposition to leave the United Kingdom in 2014, and 80 percent of those who voted in Spain’s Catalonia region said they would like to be an independent state in a non-binding poll the same year. (Catalonian separatists plan another push for independence over the next 18...

Read More »Diverging Toward Europe and Switzerland

December could be a big month for central bankers. The Federal Reserve is expected to make its first rate hike in nine years on December 16, while the European Central Bank is expected to announce further easing measures on December 3. The Swiss National Bank is likely to follow the ECB’s footsteps, sending deposit rates in the country even further into negative territory. Those moves, particularly combined with the divergence from American monetary policy, should provide a boost to European...

Read More »Europe’s Labor Market: It’s Not What You Think

Playing Defense: European High-Yield

It’s not an easy time to be a fixed-income investor, particularly for those seeking opportunities in the United States. The Federal Reserve’s stated intention to raise benchmark interest rates this year for the first time since 2006 hangs over the U.S. fixed-income market like a pall, threatening to drive bond prices down, introduce volatility, and even create a liquidity crunch. Investors who want (or need) to maintain exposure to fixed income through the rate hike might try looking across...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org