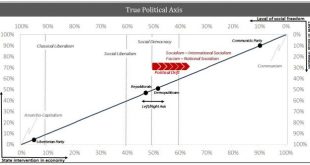

True Political Axis One of the most widespread misconceptions in the realm of politics is the notion of a left-right axis. This has been used over and over to explain political outcomes and paint the various factions as polar opposites. For example, in the US the two main parties, the Republicans (right) and Democrats (left), are often portrayed as a fight between good and evil. Which party representing good and...

Read More »Toward Stagflation

Norway Real House Price Per M2 We have all heard the incredible stories of housing riches in commodity producing hotspots such as Western Australia and Canada. People have become millionaires simply by leveraging up and holding on to properties. These are the beneficiaries of a global money-printing spree that pre-dates the financial crisis by decades. The road toward such outsized gains in property is not paved...

Read More »Europe’s New M&A Patron: China

It’s not shaping up to be a banner year for mergers and acquisitions in Europe. Deal value totaled about $400 billion as of July 26 and is on track to reach $800 billion by year-end, which will put it some $200 billion short of last year. And parts of the horizon beyond that aren’t exactly compelling, either: A Credit Suisse survey of European executives shortly after the U.K.’s June vote to leave the European Union found that the Brexit shock had already made business leaders more...

Read More »Brexit or not, the pound will crash

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience we believe it says something...

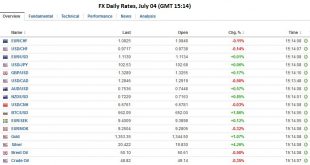

Read More »FX Daily, July 04: Four Things that Happened on the Anniversary of the Original Brexit

Summary Inflation expectations fall in Japan. UK construction PMI fell sharply before Brexit. The Australian dollar recovers from the dip as investors await more results. It is not clear that Brexit has sparked a wave of nationalism or anti-EU sentiment. FX Rates Monday, while Americans were celebrating the original Brexit, the US dollar drifted lower. The Australian dollar fully recovered from electoral...

Read More »Money confuses and blurs economic relations

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized. Why? Because politics is about power and distribution of real wealth. And since money affect almost every single transaction,...

Read More »The Brexit Effect: What’s Next for Markets

To say that the Brexit vote on June 23 took financial markets by surprise would be an understatement. The pound, British stocks, and Gilt yields had all risen sharply in the week leading up to the vote, only to crash once the results started coming in. Broadly speaking, strategists on Credit Suisse’s Global Markets and Investment Solutions and Products (IS&P) teams expect markets to remain volatile in the coming days and for investors to prefer safe assets to risky ones. Below, we...

Read More »Macro Thinking: FOMC, USD, and EU

The Federal Reserve modified its stance yesterday without changing rates. It is not just about how fast the Fed sees itself normalizing monetary policy but also where the level of the equilibrium rate. The FOMC statement, but especially the officials’ forecasts (dot plots) effective unwound the impact of the earlier Fed talk of the likely appropriateness of a rate hike this summer. Although the Fed did not rule out a...

Read More »Democratic Deficit: Is the UK Referendum the Tip of the Iceberg?

One of the most profound criticisms of the EU that it remains, even at this late date, primarily an elite project. The democratic deficit has grown, according to the latest Pew Research multi-country poll. The Pew Research survey covered ten countries that represent 80% of the EU28 population and 82% of the region’s GDP. The poll surveyed nearly 10.5k people between April 4 and May 12. It found that 2/3 of the both...

Read More »Interest Rates: How Low Can They Go?

When Denmark introduced negative interest rates in 2012, it was a pioneer. But the policy has become such an accepted part of central banks’ toolbox in the years since that financial pundits hardly batted an eyelash when Hungary became the world’s sixth central bank to introduce negative rates in March 2016. As the practice becomes more widespread, the question of how low interest rates can go has become increasingly relevant for investors. While every country (or region, in the case...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org