Chinese trade statistics were for May 2017 better than expected by economists, but on the export side questions remain as to their accuracy. Earlier this year discrepancies between estimates first published by the General Administration of Customs (GAC), those you find reported in the media, and what is captured by the National Bureau of Statistics (NBS), backed up by data from the Ministry of Commerce, became...

Read More »Europe’s Non-linear

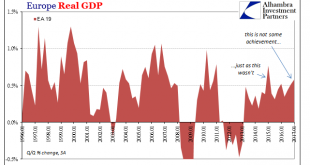

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant. For one, the European economy underperformed before 2008, too. Second, after 2008, really August 9, 2007, there isn’t nearly as much difference as...

Read More »Dollars And Sent(iment)s

Both US manufacturing PMI’s underwhelmed just as those from China did. The IHS Markit Index was lower than the flash reading and the lowest level since last September. For May 2017, it registered 52.7, down from 52.8 in April and a high of 55.0 in January. Just by description alone you can appreciate exactly what pattern that fits. The ISM Manufacturing PMI was slightly higher in May than April, 54.9 versus 54.8, but...

Read More »Not Do We Need One, But Do We Need A Different One

On March 24, 2009, then US President Barack Obama gave a prime time televised press conference whose subject was quite obviously the economy and markets. The US and global economy was at that moment trying to work through the worst conditions since the 1930’s and nobody really had any idea what that would mean. As President, Obama’s main task was not to deliver specifics about auto lending or the inner workings at...

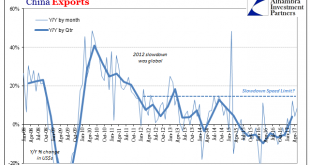

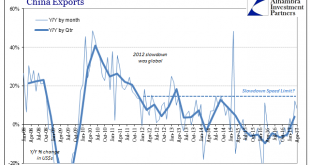

Read More »Lackluster Trade, China April Edition

China’s trade statistics for April 2017 uniformly disappointed. They only did so, however, because expectations are being calibrated as if the current economy is actually different. It is instead merely swinging between bouts of contraction and low-grade growth, but so low-grade it really doesn’t qualify as growth. Positive numbers do get the mind racing, but since the end of 2011 there is almost a speed limit on how...

Read More »The Wrong People Have An Innate Tendency To Stand Out

I don’t think Milton Friedman would have made much of chess player. For all I know he might have been a grand master or something close to that rank, but as much as his work is admirable it invites too the whole range of opposite emotion. He was the champion libertarian of the free market who rescued economics from the ravages of New Deal socialism, but in doing so he simply created the avenue for where Economics of...

Read More »Noose Or Ratchet

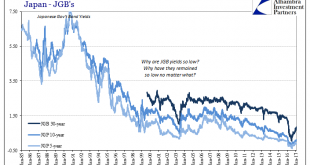

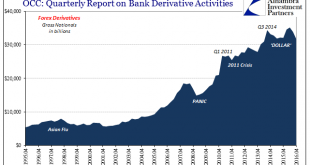

Closing the book on Q4 2016 balance sheet capacity is to review essentially forex volumes. The eurodollar system over the last ten years has turned far more in this direction in addition to it becoming more Asian/Japanese. In fact, the two really go hand in hand given the native situation of Japanese banks. As expected, data compiled by the Office of Comptroller of the Currency (OCC) shows the same negative tendencies...

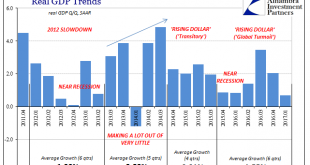

Read More »This Is Not Expansion

Back in October, the Bureau of Economic Analysis released GDP figures that suggested what those behind “reflation” had hoped. After a near miss to start 2016, the economy had shaken off the effects of “transitory” weakness, mainly manufacturing and oil, poised to perform in a manner consistent with monetary policy rhetoric. The Federal Reserve had been since 2014 itching to “raise rates” if for no other reason than to...

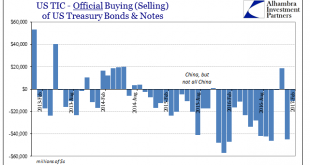

Read More »‘Dollar’ ‘Improvement’

According to the headline TIC statistics, foreign central banks have in the past six months sold the fewest UST’s since the 6-month period ended November 2015. That may indicate an easing of “dollar” pressure in the private markets due to “reflation” sentiment. They are, however, still selling. In February 2017, the latest month available, the foreign official sector disposed of another $10.7 billion (net) after -$44.9...

Read More »PBoC: Mechanical Tightening PBoC is China Central Bank

The mainstream narrative as it relates to Chinese money is “tightening.” Having survived the economic downturn last year, we are to believe that the PBOC is once again on bubble duty. They raised their reverse repo rates, considered to be their policy benchmarks, three times up to mid-March. The central bank also increased the rate on its Medium Term Lending Facility (MLF) which has been a main source of RMB liquidity...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org