The Bretton Woods system was intentionally set up to funnel monetary convertibility through official channels. The primary characteristic of any true gold standard is that any person who wishes can change paper claims into hard money. It was as much true in any one country as between those bound by the same legal framework (property). What might differ were the standards for satisfying those claims (“good delivery”...

Read More »Where There’s Smoke…

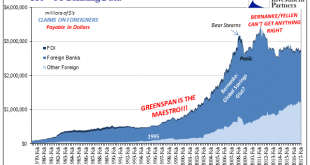

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we’ll present the data and evidence that they’ve not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we’re talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that...

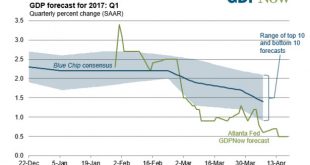

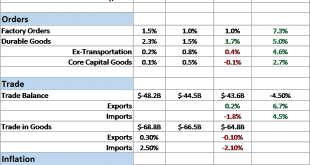

Read More »Bi-Weekly Economic Review

It wasn’t a very good two weeks for economic data with the majority of reports disappointing. Most notable I think is that the so called “soft data” is starting to reflect reality rather than some fantasy land where President Trump enacts his entire agenda in the first 100 days of being in office. Politics is about the art of the possible and that is proving a short list for now. Republicans can’t agree among...

Read More »Money In America

In 1830, France was once more swept up in revolution, only this time at the end of it was installed one king to replace another. Louis-Phillipe became, in fact, France’s last king as a result of that July Revolution. The country was trying to make sense of its imperial past with the growing democratic sentiments of the 19th century. Despite being one of the richest men in all Europe and aligned with the Bourbons, he...

Read More »New Patterns of Disturbance

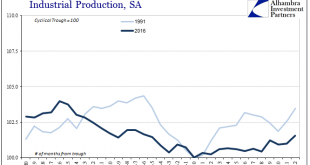

Having finally established that the economy of the “rising dollar” was appreciably worse than first estimated, we can turn our attention back toward figuring out what that means for the near future and beyond. According to the latest estimates for Industrial Production, growth has returned but in the same weird asymmetric sort of way that is actually common for the past decade. Year-over-year IP expanded by 1.5% in...

Read More »Now You Tell Us

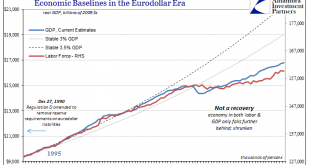

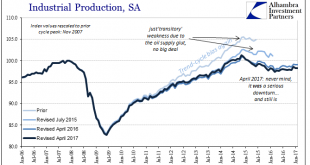

As we move further into 2017, economic statistics will be subject to their annual benchmark revisions. High frequency data such as any accounts published on or about a single month is estimated using incomplete data. It’s just the nature of the process. Over time, more comprehensive survey results as well as upgrades to statistical processes make it necessary for these kinds of revisions. There is, obviously, great...

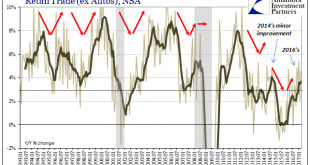

Read More »The Expanded Retail Sales Gap

Retail sales growth in February 2017 was going to be low by virtue of its comparison to February 2016 and the extra day in that month. The Census Bureau’s autoregressive models are supposed to normalize just these kinds of calendar irregularities so that we can make something close to apples to apples comparisons. The seasonally-adjusted estimate for February, however, was calculated to be less than the one for January...

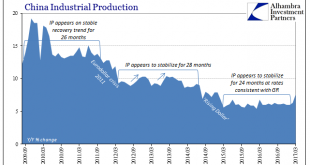

Read More »Assessing China’s Economic Risks

First quarter GDP in China rose 6.9%, better than expected and above the government’s target (6.5%) for 2017. It stands to reason, however, that if Communist officials thought they could get 6.9% to last for the whole year they would have made it their target, especially since 6.5% would be less than the GDP growth rate for 2016 (6.7%). In only that one way is China’s GDP statistic meaningful. Due to unanswered...

Read More »What Was Chinese Trade in March?

As with all statistics, there are discrepancies that from time to time may obscure the meaning or validity of the particular estimate in question. For the vast majority of the time, any such uncertainties amount to very little. Overall, harmony among the major accounts reduces the signal noise from any one featuring a significant inconsistency. There are, of course, various economic areas where estimates are going to...

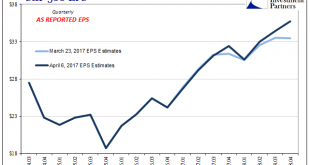

Read More »Earnings per Share: Is It Other Than Madness?

As earnings season begins for Q1 2017 reports, there isn’t much change in analysts’ estimates for S&P 500 companies for that quarter. The latest figures from S&P shows expected earnings (as reported) of $26.70 in Q1, as compared to $26.87 two weeks ago. That is down only $1 from October, which is actually pretty steady particularly when compared to Q4 2016 estimates that over the same time plummeted from $29.04...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org