Both US manufacturing PMI’s underwhelmed just as those from China did. The IHS Markit Index was lower than the flash reading and the lowest level since last September. For May 2017, it registered 52.7, down from 52.8 in April and a high of 55.0 in January. Just by description alone you can appreciate exactly what pattern that fits. The ISM Manufacturing PMI was slightly higher in May than April, 54.9 versus 54.8, but...

Read More »Pay No Attention To 50

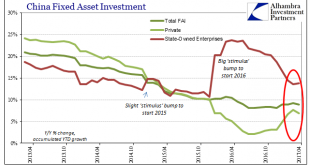

China’s PMI’s were uniformly disappointing with respect to what Moody’s was on about last week. Chinese authorities expended great effort and resources to get the economy moving forward again after several years of “dollar”-driven deceleration. There was a massive “stimulus” spending program where State-owned FAI expenditures of about 2% of GDP were elicited to make up for Private FAI that at one point last year was...

Read More »Remembering A Still Falling Hero: Small Business

On this holiday weekend known here in the U.S. as Memorial Day, I would like to make a slight turn in the narrative that many give little to no attention too, yet, is one of the most important underlying principles or fundamentals which helped shape, lift, mold, sustain, and create one of the world’s greatest economic powerhouses bar none. That “turn” is in remembering: The liberty to create, and own, one’s own...

Read More »Not Do We Need One, But Do We Need A Different One

On March 24, 2009, then US President Barack Obama gave a prime time televised press conference whose subject was quite obviously the economy and markets. The US and global economy was at that moment trying to work through the worst conditions since the 1930’s and nobody really had any idea what that would mean. As President, Obama’s main task was not to deliver specifics about auto lending or the inner workings at...

Read More »FX Daily, May 24: Dollar Consolidates, While Market Shrugs Off China Downgrade

Swiss Franc EUR/CHF - Euro Swiss Franc, May 24(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Labour gains ground The Conservatives were in a very strong position following the election announcement. A snap election historically causes the currency in question to weaken, but on this occasion the opposite occurred. A Torie victory is deemed to be positive for the UK economy. Investor confidence grew and...

Read More »Trying To Reconcile Accounts; China

Chinese economic data for April 2017 has been uniformly disappointing. External trade numbers resembled too much commodity prices, leaving an emphasis on them rather than actual economic forces. The latest figures for the Big 3, Industrial Production, Retail Sales, and Fixed Asset Investment, unfortunately also remained true to the pattern. Industrial Production had seemingly accelerated in March, rising to a 7.6%...

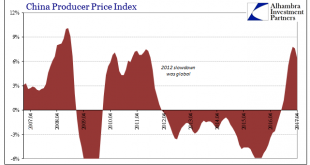

Read More »China Inflation Now, Too

We can add China to the list of locations where the near euphoria about inflation rates is rapidly falling apart. This is an important blow, as the Chinese economy has been counted on to lead the world out of this slump if through nothing other than its own sheer recklessness. “Stimulus” was all the rage one year ago, and for a time it seemed to be producing all the right effects. This was “reflation”, after all....

Read More »The Chinese Consumer in 2017: The Lifestyle Upgrade

Chinese consumers are shifting their pattern of spending to discretionary items. They are spending less on housing and food, but more on travel and entertainment compared to other emerging markets. Observing monthly spending by category, the CSRI analysts find that Chinese consumers are spending...

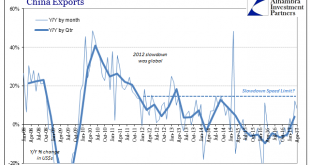

Read More »Lackluster Trade, China April Edition

China’s trade statistics for April 2017 uniformly disappointed. They only did so, however, because expectations are being calibrated as if the current economy is actually different. It is instead merely swinging between bouts of contraction and low-grade growth, but so low-grade it really doesn’t qualify as growth. Positive numbers do get the mind racing, but since the end of 2011 there is almost a speed limit on how...

Read More »Lackluster Trade

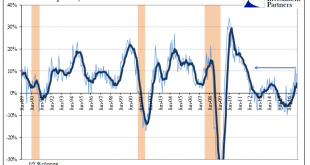

US imports rose 9% year-over-year (NSA) in March 2017, after being flat in February and up 12% in January. For the quarter overall, imports rose 7.3%, a rate that is slightly more than the 2013-14 comparison. The difference, however, is simply the price of oil. Removing petroleum, imports rose instead 6.3% in March and just 4% for the first quarter overall. The value of inbound crude oil expanded by more than 70% for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org