Last week, Indiana Governor Eric Holcomb vetoed a bill that would limit gubernatorial authority in declaring emergencies. The bill would allow the General Assembly to call itself into an emergency session, with the idea that the legislature could then vote to end, or otherwise limit, a governor’s emergency powers. Although both the legislature and the governor’s office are controlled by Republicans, the legislature has apparently wearied of the governor’s repeated...

Read More »What Exactly Is Neoliberalism, and Is It a Bad Thing?

La verità, vi prego, sul neo-liberismo: Il poco che c’è, il tanto che manca (The truth, please, on neoliberalism) There are few things nowadays that ignite more hatred, especially within university campuses, than declaring oneself to be a neoliberal (if the reader is not convinced, he is invited to try it himself and see what happens). Both exponents from the Right and from the Left, in fact, view neoliberalism as the instrumentum regni with which global political...

Read More »Biden’s New Budget Plan Means Trump-Era Mega Spending Will Continue

The reality of federal spending under Donald Trump did much to put to rest the obviously wrong and long-disproved notion that Republicans are the political party of “fiscal responsibility.” With George W. Bush and Ronald Reagan, it was pretty much “full speed ahead” as far as federal spending was concerned. Under George W. Bush, some of the biggest budget-busting years were those during which the Republicans also controlled Congress. Trump, of course, carried the...

Read More »How Federal Funding Is Used to Control Colleges and Universities

The Washington Post reports that a group of thirty-three current and former students at Christian colleges are suing the Department of Education in a class action lawsuit in an attempt to abolish any religious exemptions for schools that do not abide by the current sexual and gender zeitgeist sweeping the land. The plaintiffs argue that by holding to orthodox Christian teachings on sexuality these universities are engaged in unconstitutional discrimination due to the...

Read More »The Property-Based Social Order Is Being Destroyed by Central Banks

Private property is an institution central to civilization and beneficial human interaction. When central banks distort this institution with easy money, the social effects can be disastrous. Original Article: “The Property-Based Social Order Is Being Destroyed by Central Banks” Readers of the Mises Wire are no doubt familiar with the negative consequences of central banking and the inflationary capacity of fiat currency and how such a system drives malinvestment...

Read More »Progressivism’s Failures: From Minimum Wages to the Welfare State

The empirical evidence shows that neither minimum wages or welfare reduce poverty. In fact, minimum wages tend to increase the cost of living while poverty rates have gone nowhere since the Great Society was introduced. Original Article: “Progressivism’s Failures: From Minimum Wages to the Welfare State” As I write, the Democratic Congress is contemplating various measures designed to alleviate poverty levels in the United States. They include: the doubling of the...

Read More »The Annapolis Convention: The Beginning of the Counterrevolution

[Chapter 12 of Rothbard’s newly edited and released Conceived in Liberty, vol. 5, The New Republic: 1784–1791.] By 1787, the nationalist forces were in a far stronger position than during the Revolutionary War to make their dreams of central power come true. Now, in addition to the reactionary ideologues and financial oligarchs, public creditors, and disgruntled ex-army officers, other groups, some recruited by the depression of the mid-1780s, were ready to be...

Read More »The Tyranny of the “Enlightened” Experts

If you were to stroll through any typical upper-middle-income American neighborhood in 2021, the odds are very high that you’d observe at least one yard sign exuberantly proclaiming something like this: “In this house, we believe that science is real, love is love, no human is illegal … ” and other banal tautologies. There are usually six or seven examples in this litany, but really, one of the main goals of the yard sign—aside from signaling virtue—can be...

Read More »Progressivism’s Failures: From Minimum Wages to the Welfare State

As I write, the Democratic Congress is contemplating various measures designed to alleviate poverty levels in the United States. They include: the doubling of the minimum wage; the expansion of child credits. Let’s review both. The Minimum Wage Hike Congress intends to raise the federal minimum wage from $7.25 to $15. This makes various assumptions: first, that minimum wage workers themselves are indeed poor. This is wrong: they come from families with a median...

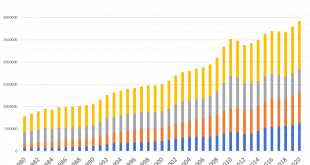

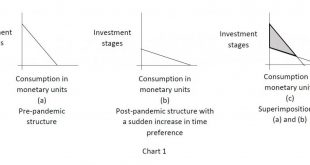

Read More »The Economic Effects of Pandemics: An Austrian Analysis

Traditionally, Austrian theorists have focused with particular interest on the recurrent cycles of boom and recession that affect our economies and on studying the relationship between these cycles and certain characteristic modifications to the structure of capital-goods stages. Without a doubt, the Austrian theory of economic cycles is one of the most significant and sophisticated analytical contributions of the Austrian School. Its members have managed to explain...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org