The Federal Reserve is sowing the seeds for its central bank digital currency (CBDC). It may seem that the purpose of a CBDC is to facilitate transactions and enhance economic activity, but CBDCs are mainly about more government control over individuals. If a CBDC were implemented, the central bank would have access to all transactions in addition to being capable of freezing accounts. It may seem dystopian—something that only totalitarian governments would do—but...

Read More »Fiat and Gold: Two Fixes for a Broken US Monetary Base

In the laboratory of history, great inflation followed by great disinflation opens the road to monetary regime change. Sometimes the road leads to a better place. Think of the US return to gold in 1879 following the inflationary issue of greenbacks during the Civil War; or the era of the hard deutsche mark when the German Bundesbank responded to the great inflation and bust of the late 1960s and early 1970s by insulating its money from continuing US inflationary...

Read More »Do Falling Prices Cause or Predict a Recession?

In the midst of excessive US economic and geopolitical uncertainties due to rampant inflation and the continuing Russian invasion of Ukraine, the 7.7 percent October inflation report comes as a small relief. The unemployment rate touched 3.7 percent in October, remaining near the 3.5 percent prepandemic level and slightly above the 3.4 percent natural rate of unemployment of the fourth quarter of 2021. The Covid Inflation The general increase in price levels, most...

Read More »“Classical Liberalism” Will Never Satisfy the Left

“Today the tenets of this nineteenth-century philosophy of liberalism are almost forgotten. In the United States “liberal” means today a set of ideas and political postulates that in every regard are the opposite of all that liberalism meant to the preceding generations.” —Ludwig von Mises, 1962 (emphasis added) F.A. Hayek is back in the public eye, thanks to a promising and weighty new biography from Professors Bruce Caldwell and Hansjörg Klausinger. Predictably,...

Read More »Reflections upon the Centennial of Mises’s Socialism

Ludwig von Mises published Die Gemeinwirtschaft: Untersuchungen über den Sozialismus in 1922 (translated into English as Socialism: An Economic and Sociological Analysis, 1951). In more than five hundred pages, the most prominent representative of the Austrian school offers a comprehensive and deep analysis of the “socialist phenomenon.” Despite the catastrophes associated with the attempt to install a socialist system, this ideology has lost little of its appeal....

Read More »Economic Progress and Economic Decay: North versus South

They read like Civil War battlefields: Chattanooga, Tennessee; Tuscaloosa, Alabama; Greer, South Carolina; West Point, Georgia; Montgomery, Alabama; Tupelo, Mississippi; Smyrna, Tennessee. They are the towns and small cities in the Deep South where America now builds its cars and trucks. Take Greer, for example (population of thirty-five thousand as of 2020). Located in the foothills of the bucolic Blue Ridge Mountains in the northwest corner of South Carolina, it is...

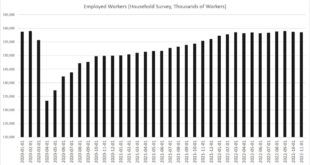

Read More »Total Employed Workers Fell Again in November as Savings and Incomes Fall

Total employed workers fell for the second month in a row in November, dropping nearly 400,000 workers below the pre-pandemic peak in February 2020. According to new employment data released by the Bureau of Labor Statistics on Friday, the current population survey shows employed workers fell to 158,470,000 in November, down 138,000 from October’s total of 158,608,000. This continues a nine-month trend in which the total number of employed persons has moved...

Read More »The Fed Is Not “a Good Idea that Became Corrupt”: It Always Was Corrupt

There’s an idea rooted among some libertarians that the Federal Reserve was originally a sound institution but has grown corrupt. As a bankers’ bank, it was fine, they believe, but not as the monster it has grown to be. If we could only go back to the Fed’s founding charter, all would be well. I’m thinking of two well-known financial analysts who are unsurpassed in their analytical brilliance and knowledge of markets and who rightly regard the bureaucratic Federal...

Read More »Renewables and EVs in the Grip of Lesseps Syndrome

Most people are familiar with the Panama Canal, but they probably don’t know the first effort to build the Panama Canal, spanning almost a decade, was by France. Facing considerable initial naysaying and ridicule, Ferdinand de Lesseps had the acumen and drive to construct the Suez Canal. Success was realized after overcoming many obstacles and difficulties. Naturally enough, France turned to him to build a sea-level canal in Panama. Minority technical reports...

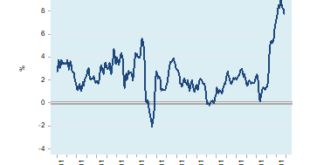

Read More »Deflation Is Not a Problem: Reversing It Is

The yearly growth rate of the Consumer Price Index (CPI) fell to 7.7 percent in October from 8.2 percent in September. Note that in October 2021 the yearly growth rate stood at 6.2 percent. Some experts are of the view that it is quite likely that the momentum of the CPI might have peaked. We suggest that the decline in the yearly growth rate of the CPI is from the sharp decline in the momentum of money supply. The yearly growth rate of our monetary measure for the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org