My grandfather used to sing to me, “Good, better, best / never let them rest / till the good is better / and the better is best.” I appreciated that lesson and have been applying it to try to make sense of a recent bill signed by California governor Gavin Newsom. While the bill may be the result of Newsom’s grandfather singing to him about “bad, worse, and worst,” I have determined it is more likely a case of bad/worse/worst economic thinking. It exposes a level of...

Read More »The Eurozone Disaster: Between Stagnation and Stagflation

The eurozone economy is more than weak. It is in deep contraction, and the data is staggering. The eurozone manufacturing purchasing managers’ index (PMI), compiled by S&P Global, fell to a three-month low of 43.1 in October, the sixteenth consecutive month of contraction. However, European analysts tend to ignore the manufacturing decline using the excuse that the services sector is larger and stronger than expected, but it is not. The eurozone Composite PMI is...

Read More »How Statism Leads to War

Mises' work explains how laissez-faire economies have incentives to be peaceful with each other, and how, inversely, tariffs and protectionism create isolation, instability, and war. His words are especially prescient today as conflicts rage and tensions between superpowers continue to rise—mirroring the rise in state power across the globe. Dr. Jonathan Newman joins Bob to break down the history of warfare, how states fund war, and why war is more destructive in the...

Read More »What the Technocrats Call “Economic Stability” Is Really Just Inflation

There’s a growing palpable sense of optimism among many economists and journalists that the United States economy is heading toward a growth phase while avoiding recession. They are in turn lauding the Federal Reserve for its strategic handling of inflation—with economic growth and low unemployment rates—as well as praising the efficacy of the Biden administration in reining in prices through social pressure on profit-making and through increases in production via...

Read More »The Dollar See-Saws between Two Views on Fiscal Explosion

As the Biden administration ramps up new government spending—and budget deficits—to unheard-of peacetime levels, reality sets in. No economy and no currency can withstand this explosive assault for very long. Original Article: The Dollar See-Saws between Two Views on Fiscal Explosion [embedded content] Tags:...

Read More »Exposing Our Fed-Driven Bubble Economy

The Great Money Bubble: Protect Yourself from the Coming Inflation Stormby David A. StockmanHumanix Books, 2022; 229 pp. David Stockman served for a short while as budget director during Ronald Reagan’s first term as president, but he soon resigned owing to Reagan’s refusal to cut government spending. He has since that time worked as a private investment adviser, at which difficult profession he has been highly successful, and he has written a number of books, among...

Read More »The Fed and the Fate of the Dollar

Recorded at the Mises Circle in Fort Myers, Florida, 4 November 2023. Special thanks to Murray and Florence M. Sabrin for making this event possible. Read Bob's book Understanding Money Mechanics: Mises.org/Mechanics The Fed and the Fate of the Dollar | Bob Murphy Video of The Fed and the Fate of the Dollar | Bob Murphy [embedded content]...

Read More »Are We Headed for a Recession in 2024?

Recorded at the Mises Circle in Fort Myers, Florida, 4 November 2023. Special thanks to Murray and Florence M. Sabrin for making this event possible. Are We Headed for a Recession in 2024? | Patrick Newman Video of Are We Headed for a Recession in 2024? | Patrick Newman [embedded content]...

Read More »The Dangers of a “Cashless” Economy

While the ruling elites and the Federal Reserve try to sell digital money as “modern” and “convenient,” it poses threats to financial privacy and civil liberties. Original Article: "The Dangers of a ""Cashless"" Economy [embedded content] Tags: Featured,newsletter

Read More »Four Economic Activities and the Wealth of Nations

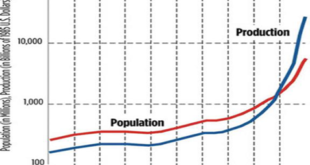

Trading, forecasting, aggregating, and innovating—referred to from here on out as the Four—are activities that people have engaged in since the beginning of humanity. They are part of the human fabric because they stem from mankind’s peculiarities—heterogeneity, inclination to forecast, sociality, and inventiveness. The Four are key social interactions in human life at both the individual and aggregate levels. In 2022, the value of worldwide global exports amounted...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org