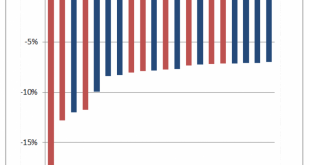

A Month with a Bad Reputation A certain degree of nervousness tends to suffuse global financial markets when the month of October approaches. The memories of sharp slumps that happened in this month in the past – often wiping out the profits of an entire year in a single day – are apt to induce fear. However, if one disregards outliers such as 1987 or 2008, October generally delivers an acceptable performance....

Read More »Switzerland, Model of Freedom & Wealth Moving East – Interviews with Claudio Grass

Sarah Westall Interviews Claudio Grass Last month our friend Claudio Grass, roving Mises Institute Ambassador and a Switzerland-based investment advisor specializing in precious metals, was interviewed by Sarah Westall for her Business Game Changers channel. Sarah Westall and Claudio Grass There are two interviews, both of which are probably of interest to our readers. The first one focuses on Switzerland with its...

Read More »US Equities – Approaching an Inflection Point

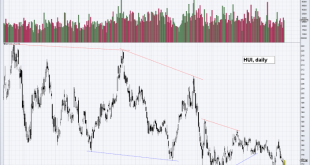

A Lengthy Non-Confirmation As we have frequently pointed out in recent months, since beginning to rise from the lows of the sharp but brief downturn after the late January blow-off high, the US stock market is bereft of uniformity. Instead, an uncommonly lengthy non-confirmation between the the strongest indexes and the broad market has been established. The chart below illustrates the situation – it compares the...

Read More »A Fake Brexit and the “Noble Dream” – Claudio Grass Speaks With Godfrey Bloom

Introductory Remarks: The “Anti-Politician” Godfrey Bloom, by PT Most of our readers will probably remember former UKIP chief whip and European Parliament representative Godfrey Bloom. As far as we know, he is the only politician who ever raised the issue of the workings of the fractionally reserved central bank-directed monetary system in the EU parliament. This system is of course central to the phenomenon of the...

Read More »Wall Street – Island of the Blessed

Which Disturbance in the Farce can be Profitably Ignored Today? There has been some talk about submerging market turmoil recently and the term “contagion” has seen an unexpected revival in popularity – on Friday that is, which is an eternity ago. As we have pointed out previously, the action is no longer in line with the “synchronized global expansion” narrative, which means with respect to Wall Street that it is best...

Read More »Gold Sector – An Obscure Indicator Provides a Signal

The Goldminbi In recent weeks gold apparently decided it would be a good time to masquerade as an emerging market currency and it started mirroring the Chinese yuan of all things. Since the latter is non-convertible this almost feels like an insult of sorts. As an aside to this, bitcoin seems to be frantically searching for a new position somewhere between the South African rand the Turkish lira. The bears are busy...

Read More »An Inquiry into Austrian Investing: Profits, Protection and Pitfalls

Incrementum Advisory Board Discussion Q3 2018 with Special Guest Kevin Duffy “From a marketing perspective it pays to be overconfident, especially in the short term. The higher your conviction the easier it will be to market your investment ideas. I think the Austrian School is at a disadvantage here because it’s more difficult to be confident about your qualitative predictions and even in terms of investment advice it...

Read More »Separating Signal from Noise

Claudio Grass in Conversation with Todd “Bubba” Horwitz Todd Horwitz is known as Bubba and is chief market strategist of Bubba Trading.com. He is a regular contributor on Fox, CNBC, BNN, Kitco, and Bloomberg. He also hosts a daily podcast, ‘The Bubba Show.’ He is a 36-year member of the Chicago exchanges and was one of the original market makers in the SPX. Before you listen to the podcast, I would like to provide...

Read More »A Scramble for Capital

A Spike in Bank Lending to Corporations – Sign of a Dying Boom? As we have mentioned on several occasions in these pages, when a boom nears its end, one often sees a sudden scramble for capital. This happens when investors and companies that have invested in large-scale long-term projects in the higher stages of the production structure suddenly realize that capital may not be as plentiful as they have previously...

Read More »Getting Their Pound of Flesh – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Regulated to Death The price of gold fell $13, and that of silver $0.23. Perspective: if you’re waiting for the right moment to buy, the market now offers you a better than it did last week. If you wanted to sell, this wasn’t a good week to wait. Which is your intention, and why? Obviously, last week the sellers were more...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org