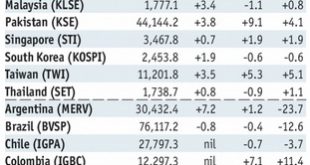

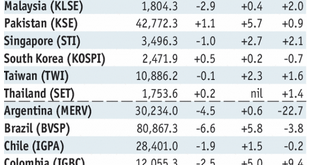

Summary The Reserve Bank of India hiked rates for the first time since 2014. Malaysia’s central bank governor resigned. Czech central bank tilted more hawkish. Russia central bank tilted more dovish. Argentina got a $50 bln standby program from the IMF. Brazil central bank signaled more aggressive FX intervention ahead. Mexico trade tensions with US are rising. Peru has a new Finance Minister. Stock Markets In the EM...

Read More »The Three Crises That Will Synchronize a Global Meltdown by 2025

We’re going to get a synchronized global dynamic, but it won’t be “growth” and stability, it will be DeGrowth and instability. To understand the synchronized global meltdown that is on tap for the 2021-2025 period, we must first stipulate the relationship of “money” to energy:“money” is nothing more than a claim on future energy. If there’s no energy available to fuel the global economy, “money” will have little value....

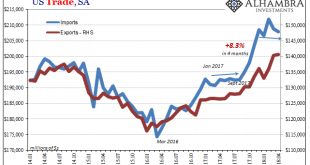

Read More »US Trade Settles Down Again

US trade is further leveling off after several months of artificial intrusions. On the import side, in particular, first was a very large and obvious boost following last year’s big hurricanes along the Gulf Coast. Starting in September 2017, for four months the value of imported goods jumped by an enormous 8.3% (revised, seasonally-adjusted). Most of the bump related to consumer and capital goods. Since December,...

Read More »Does Anyone Else See a Giant Bear Flag in the S&P 500?

We all know the game is rigged, but strange things occasionally upset the “easy money bet.” “Reality” is in the eye of the beholder, especially when it comes to technical analysis and economic tea leaves. It seems most stock market soothsayers are seeing a breakout of the downtrend that erupted in early February, and so the path to new all-time highs is clear. Does anyone else see a giant bear flag pattern in the...

Read More »Bi-Weekly Economic Review: As Good As It Gets?

In the last update I wondered if growth expectations – and growth – were breaking out to the upside. 10 year Treasury yields were well over the 3% threshold that seemed so ominous and TIPS yields were nearing 1%, a level not seen since early 2011. It looked like we might finally move to a new higher level of growth. Or maybe not. 10 year yields fell nearly 40 basis points in a matter of days as did TIPS yields. The...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX put in a mixed performance Friday, and capped off an overall mixed week. Over that week, the best performers were IDR, TRY, and INR while the worst were BRL, MXN, and ARS. US yields are recovering and likely to put renewed pressure on EM FX. Stock Markets Emerging Markets, May 30 Source: economist.com - Click to enlarge Indonesia Indonesia reports May CPI Monday, which is expected to rise...

Read More »Bi-Weekly Economic Review – VIDEO

[embedded content] Interview with Joe Calhoun about BiWeekly Economic Review 01/06/2018. Related posts: The Currency of PMI’s Why The Last One Still Matters (IP Revisions) The Dismal Boom Central Bank Transparency, Or Doing Deliberate Dollar Deals With The Devil What About 2.62 percent? More Pieces of Impossible Not Do We Need One, But Do We Need...

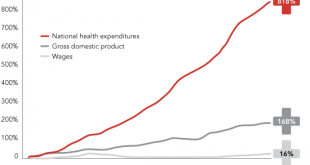

Read More »Burrito Index Update: Burrito Cost Triples, Official Inflation Up 43 percent from 2001

Welcome to debt-serfdom, the only possible output of the soaring cost of living. Long-time readers may recall the Burrito Index, my real-world measure of inflation. The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016). The Burrito Index tracks the cost of a regular burrito since 2001. Since we keep detailed records of expenses (a necessity if you’re a self-employed free-lance writer), I can...

Read More »Emerging Market Preview: Week Ahead

Stock Markets EM FX has started the week mixed. Some relief was seen as US rates stalled out last week, but this Friday’s jobs number could be key for the next leg of this dollar rally. On Wednesday, the Fed releases its Beige book for the upcoming June 13 FOMC meeting, where a 25 bp hike is widely expected. We believe EM FX remains vulnerable to further losses. Stock Markets Emerging Markets, May 23 Source:...

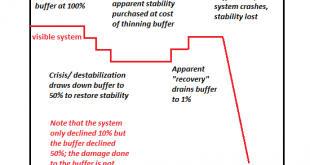

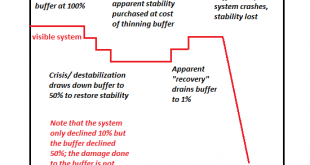

Read More »How Systems Collapse

This is how systems collapse: faith in the visible surface of abundance reigns supreme, and the fragility of the buffers goes unnoticed. I often discuss systems and systemic collapse, and I’ve drawn up a little diagram to illustrate a key dynamic in systemic collapse. The key concepts here are stability and buffers. Though complex systems are never static, but they can be stable: that is, they ebb and flow within...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org