Italian politics dominated Monday’s activity. Initially, the euro reacted positively in Asia to news that the Italian President had blocked the proposed finance minister. A technocrat government would be appointed to prepare for new elections. The euro reversed course by midday in Asia, several hours before European markets opened. The move accelerated and by midday in Europe, with London markets on holiday as well as...

Read More »America 2018: Dicier by the Day

Scrape all this putrid excrescence off and we’re left with a non-fantasy reality: everything is getting dicier by the day. If we look beneath the cheery chatter of the financial media and the tiresomely repetitive Russian collusion narrative (that’s unraveling as the Ministry of Propaganda’s machinations are exposed), we find that America in 2018 is dicier by the day. The more you know about the actual functioning of...

Read More »Emerging Markets: What Changed

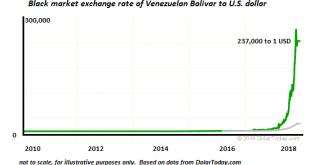

Summary President Trump canceled the planned summit with North Korea’s Kim Jong Un. Malaysia’s new Finance Minister Lim was sworn in along with 13 other cabinet ministers. Philippine central bank cut reserve ratios for commercial banks by one percentage point to 18% effective June 1. The United Arab Emirates opened up its economy to more foreign investment. Brazil state-run oil company Petrobras cut the price of...

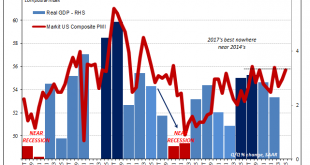

Read More »The Currency of PMI’s

Markit Economics released the flash results from several of its key surveys. Included is manufacturing in Japan (lower), as well as composites (manufacturing plus services) for the United States and Europe. Within the EU, Markit offers details for France and Germany. Given the nature of sentiment surveys, we tend to ignore these most months unless they suggest either pending changes or extremes. Beginning with the US,...

Read More »Globally Synchronized Asynchronous Growth

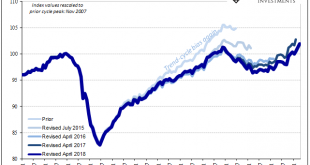

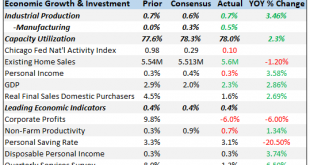

Industrial Production in the United States rose 3.5% year-over-year in April 2018, down slightly from a revised 3.7% rise in March. US Industrial Production, Jan 2006 - May 2018(see more posts on U.S. Industrial Production, ) - Click to enlarge Since accelerating to 3.4% growth back in November 2017, US industry has failed to experience much beyond that clear hurricane-related boost. IP for prior months,...

Read More »Sustainability Boils Down to Scale

Only small scale systems can sustainably impose “skin in the game”– consequences, accountability and oversight. Several conversations I had at the recent Peak Prosperity conference in Sonoma, CA sparked an insight into why societies and economies thrive or fail: It All Boils Down to Scale. In a conversation with a Peak Prosperity member who goes by MemeMonkey, MemeMonkey pointed out that social / economic organizations...

Read More »Anchoring Globally Synchronized Growth, Or We Gave Up Long Ago?

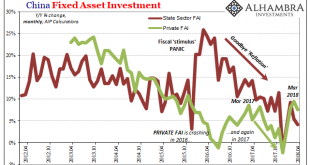

January was the last month in which China’s National Bureau of Statistics (NBS) specifically mentioned Fixed Asset Investment (FAI) of state holding enterprises (or SOE’s). For the month of December 2017, the NBS reported accumulated growth (meaning for all of 2017) in this channel of 10.1%. Through FAI of SOE’s, Chinese authorities in early 2016 had panicked themselves into unleashing considerable “stimulus.” There...

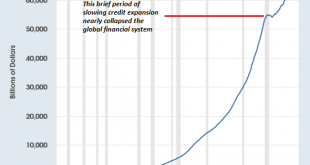

Read More »The Next Recession Will Be Devastatingly Non-Linear

The acceleration of non-linear consequences will surprise the brainwashed, loving-their-servitude mainstream media. Linear correlations are intuitive: if GDP declines 2% in the next recession, and employment declines 2%, we get it: the scale and size of the decline aligns. In a linear correlation, we’d expect sales to drop by about 2%, businesses closing their doors to increase by about 2%, profits to notch down by...

Read More »Emerging Markets: Week Ahead Preview

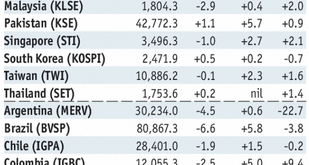

Stock Markets EM FX ended Friday on a weak note and extended the slide. For the week as a whole, the best EM performers were PHP, TWD, and SGD while the worst were ARS, ZAR, and TRY. With US rates continuing to move higher, we believe selling pressures on EM FX will remain in play this week. Our recently updated EM Vulnerability Table supports our view that divergences within EM will remain. Stock Markets Emerging...

Read More »Bi-Weekly Economic Review: Growth Expectations Break Out?

There are a lot of reasons why interest rates may have risen recently. The federal government is expected to post a larger deficit this year – and in future years – due to the tax cuts. Further exacerbating those concerns is the ongoing shrinkage of the Fed’s balance sheet. Increased supply and potentially decreased demand is not a recipe for higher prices. In addition, there is some fear that the ongoing trade...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org