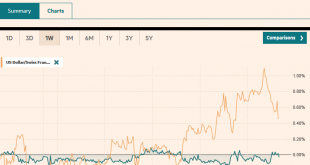

Swiss Franc The Euro has risen by 0.42% to 1.0572 EUR/CHF and USD/CHF, April 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are beginning the new week on an upbeat note. All the markets in the Asia Pacific region rallied, led by more than 2% gains in the Nikkei and Taiwan. European bourses are higher. All the industry groups are participating and financials and consumer discretionary...

Read More »FX Daily, April 24: Markets Limp into the Weekend

Swiss Franc The Euro has risen by 0.05% to 1.052 EUR/CHF and USD/CHF, April 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The reversal in US equities yesterday set the stage for today’s losses. All the Asia Pacific bourses fell today but Australia. For the week, the regional index is off more than 2%. Europe’s Dow Jones Stoxx 600 was flat for the week coming into today’s sessions. It is off around 0.5% in...

Read More »FX Daily, April 23: Investors Take PMI Crash in Stride

Swiss Franc The Euro has risen by 0.06% to 1.0517 EUR/CHF and USD/CHF, April 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors have remained fairly calm in the face of flash April PMI crashes and an increase of virus cases in several European countries. Most equity markets in the Asia Pacific region rose, with the notable exceptions of China and Australia. The Nikkei rose for the first time this...

Read More »FX Daily, April 22: Investors Catch Collective Breath, but Sentiment remains Fragile

Swiss Franc The Euro has risen by 0.09% to 1.0562 EUR/CHF and USD/CHF, April 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk-appetites appear to have stabilized for the moment. Most equity markets are higher. Japan and Malaysia were exceptions, but the MSCI Asia Pacific Index rose for the first time this week. In Europe, the Dow Jones Stoxx 600 is recouping about a third of yesterday’s loss. The S&P...

Read More »FX Daily, April 21: Oil Drilled Below Zero, Equity Rally Stalls, Greenback Advances

Swiss Franc The Euro has risen by 0.05% to 1.0516 EUR/CHF and USD/CHF, April 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Oil’s wild ride has been joined by two other developments that are keeping investors off-balance. First, reports suggest that North Korea’s Kim Jong-Un maybe in critical condition after surgery. He apparently was absent from last week’s events celebrating his grandfather. The concern is...

Read More »FX Daily, April 16: Markets Brace for another Jump in US Weekly Jobless Claims

Swiss Franc The Euro has fallen by 0.06% to 1.0513 EUR/CHF and USD/CHF, April 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equity losses in the US appeared to drag most Asia Pacific markets lower today, with China and India the notable exceptions. European bourses are higher, and the only energy sector is a drag on the Dow Jones Stoxx 600, which is around 1% higher in late morning turnover, while US shares...

Read More »FX Daily, April 15: Dollar Rises as Equities Slump

Swiss Franc The Euro has fallen by 0.12% to 1.0528 EUR/CHF and USD/CHF, April 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The recovery in equities stalled, and the risk-off mood has helped lift the US dollar, which had been trending lower. Taiwan and Malaysia were notable exceptions in the Asia Pacific regions to the heavier equity tone. The Nikkei gave back almost 0.5% after surging more than 3% on...

Read More »FX Daily, April 14: Equities are Firm but New Developments Needed or Risk Appetites may Become Satiated

Swiss Franc The Euro has fallen by 0.16% to 1.0538 EUR/CHF and USD/CHF, April 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk appetites have returned today after taking yesterday off. The MSCI Asia Pacific Index advanced every day last week, slipped yesterday, and jumped back today. Most of the national benchmark advanced at least 1.5%, and the Nikkei led the way with a 3% rally to reach its best level...

Read More »What to Expect from the World Bank and IMF

The spring meetings of the World Bank and IMF will be held virtually this week amid a profound economic crisis spurred by a novel coronavirus. Unlike previous such viruses, this went global in such a destructive way that many countries have responded the same way. Encouraging social distancing, closing non-essential businesses, and enforcing lockdowns. The economic contraction that has begun is beyond what has been seen since the Great Depression. Even before the...

Read More »Cool Video: CNBC Asia

As the markets were re-opening in Asia earlier today, I joined Martin Soong and Sir Jegarajah on CNBC Asia. I had returned from a business trip and visited our summer house on the Jersey shore for what I thought was going to be a weekend more than a month ago. Oil prices had initially reacted positively to the OPEC+ agreement. Still, I was skeptical as the cuts seemed inadequate to meet the dramatic compression in demand, let along the notorious non-compliance by...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org