Overview: Bonds and stocks are mostly heavier today and the dollar has turned mixed. Oil prices are consolidating after soaring to new highs since late last year on the longer than expected extension of Saudi Arabia's extra cut of one million barrels a day. Since July, it has been extending it by one month at a time. Yesterday, it extended it through Q4. Russia, who had previously indicated intentions on reducing its exports by 500k barrels, announced it was...

Read More »US Dollar Punches Higher

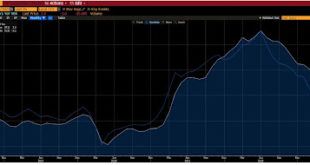

Overview: Disappointing data in Asia and Europe has sent the greenback broadly higher. The strong gains posted before the weekend were mostly consolidated yesterday when the US and Canadian markets were on holiday. The rally resumed today. The Antipodeans and Scandis have been hit the hardest (-0.7% to -1.25%) but all the G10 currencies are down. The Swiss franc and yen are off the least (-0.35%-0.45%), and the euro and sterling have taken out their recent lows....

Read More »September 2023 Monthly

There is a sense of new divergence. Most economists, including the staff at the Federal Reserve, no longer think the US is recession-bound. Unprecedented in modern times, inflation has fallen sharply, and unemployment has not risen, and the economy appears to be enjoying its third consecutive quarter, and the fourth in the past five, above what the Federal Reserve regards as the non-inflationary pace (1.8%). At the same time, and despite being among the fastest...

Read More »China’s Measures Begin to Find Traction, US Employment Report on Tap

Overview: Beijing's seemingly steady stream of measures to support the economy and steady the yuan are beginning to produce the desired effect. The yuan is snapping a four-week decline and the CSI 300 halted a three-week drop. Some economists estimate that the bevy of measures may be worth as much as 1% for GDP. The dollar is narrowly mixed ahead of the US employment data, which is expected to see the pace of job growth slow to around 170k. Of note, the Mexican peso...

Read More »The Greenback is Softer Ahead of CPI but Key Chart Points Remain Intact

Overview: The deluge of Treasury supply is nearly over for this week. On tap today are 4- and 8-week T-bills and $23 bln 30-year bonds to finish the quarterly refunding. The sales will come after the July CPI print that is expected to see the first year-over-year increase since last June. The market is going into the report with about a 15% chance of a Fed hike next month discounted. Meanwhile, September crude oil extended its recover from $80 seen on Tuesday to a...

Read More »After Strong Demand for US Three-Year Notes, Treasury will Sell $38 bln 10-year Notes

Overview: The first leg of the US refunding was well received, with the three-year note being scooped up by investors, driving the yield below it was trading in the when-issued market. Today, the Treasury sells $38 bln 10-year notes, whose auctions have been less than stellar recently. The US 10-year yield reached 4.20% last week and is now straddling 4%. Italian bonds are also firm as the Italian government clarifies the new tax on banks' windfall profits. Other...

Read More »Risk Appetites Squashed by Weak Chinese Imports/Exports and Moody’s Downgrade of 10 US Banks

Overview: The combination of falling Chinese imports and exports, Moody's downgrade of ten US small and medium-sized banks is serving to squash risk appetites. Equities are weak, but bond markets are strong despite the surprise tax on Italian banks announced yesterday and the kick-off of the US $103 bln refunding today. Outside of Japan and Australia, Asia Pacific equity markets were lower led by a 1.8% drop in the Hang Seng and a nearly 2.2% loss of the mainland...

Read More »Dollar Comes Back Bid

Overview: The US dollar is recovering today after it was sold following the jobs report before the weekend. It is enjoying a firmer bias against nearly all the G10 currencies. The dollar-bloc is faring best, while the Scandis are off close to 0.5%. Most emerging market currencies are also softer, with only a few Asian currencies edging higher today, including the South Korean won, Indian rupee, and Taiwanese dollar. With a stronger dollar and firmer interest rates,...

Read More »Week Ahead: Is the Dollar’s Run since Mid-July Over?

The US and China report July CPI figures in the coming days and they are likely moving in opposite directions. Headline US CPI is likely to rise for the first time since peaking in June 2022. China's CPI has been slowing and is likely to go negative on a year-over-year basis. It finished last year at 1.8% and in June was unchanged year-over-year. The divergence of policy is what is driving force of the exchange rate, and the question is not really so much why the...

Read More »US Jobs Report and OPEC Statement Featured Ahead of the Weekend

Overview: The capital markets are calmer today but the US (and Canadian) jobs data stand in the way of the weekend. While equity markets are firmer, the rise in yields continues with new highs for the week being recorded today. European benchmark yields are 2-3 bp higher and the US 10-year Treasury yield is approaching 4.20%. Most of the large market in the Asia Pacific region advanced, but South Korea and Taiwan where the superconductor fascination eased. The Stoxx...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org