I joined Chris Wolfe from First Republic Wealth Management on the set of Bloomberg’s Daybreak to discuss market developments and the outlook for the US economy. We generally agreed that while the economy is slowing it is doing so from unsustainably strong levels. We also are both highly convinced that the Fed will increase rates later this month, and anticipate two hikes next year. Investors, understandably with scar...

Read More »FX Daily, December 10: Lack of Closure Weighs on Sentiment

Swiss Franc The Euro has fallen by 0.01% at 1.1267 EUR/CHF and USD/CHF, December 10(see more posts on EUR/CHF and USD/CHF, ) - Click to enlarge FX Rates Overview: Investors angst over trade tensions and Brexit continue remains elevated, and poor Chinese and Japanese economic news played on global growth fears. Equities continue to slog lower. Bond yields are little changed, and the dollar is lower against most...

Read More »FX Weekly Preview: The Week Ahead: Don’t Skip Steps on Escalation Ladders

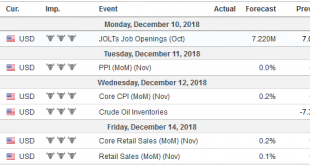

United States The drop in US yields and disappointing economic data weighed on sentiment and the dollar last week. Even weakness in equities, which had seemed to lend the greenback support, failed to do so at the end of last week. With the real Fed funds rate (adjusted for inflation) below zero, employment at 50-year lows, and some fiscal stimulus still in the pipeline, the doom and gloom cant of a recession next year...

Read More »FX Daily, December 07: A Couple More Events before Seeing the End of Difficult Week for Investors

Swiss Franc The Euro has risen by 0.09% at 1.13 EUR/CHF and USD/CHF, December 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities have stabilized after US equities recovered yesterday, with the NASDAQ 100 staging its biggest reversal in eight months and the S&P 500 recouped almost three percent to close 0.15% lower. Asia Pacific equities were...

Read More »FX Daily, December 06: New Spanner in US-China Relations Weighs on Risk Appetites

Swiss Franc The Euro has fallen by 0.15% at 1.13 EUR/CHF and USD/CHF, December 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets were fragile amid trade uncertainty and economic slowdown fears. News that Canada arrested the CFO of Huawei on behalf of the US, ostensibly for violating the embargo against Iran triggered an almost immediate...

Read More »FX Daily, December 05: US Market Closure may be a Firebreak

Swiss Franc The Euro has risen by 0.06% at 1.132 EUR/CHF and USD/CHF, December 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The 3%+ drop in the S&P 500 yesterday kept global equities under pressure today, though losses in Asia and Europe were milder. In Asia, only Hong Kong and Taiwan benchmarks lost more than 1%. In Europe, the Dow Jones Stoxx 600 is...

Read More »The Dollar and Its Rivals

I was in graduate school, studying American foreign policy when I stumbled on Riccardo Parboni’s “The Dollar and Its Rivals.” This thin volume showed how the foreign exchange market was the arena in which capitalist rivalries were expressed. More than any single book, it set me on a more than 30-year path. The dramatic world of foreign exchange that Parboni depicted changed in a significant way in the mid-1990s. Led by...

Read More »FX Daily, December 04: Stock Rally Arrested, but Bond and Oil Advance Continues, leaving Dollar in a Lurch

Swiss Franc The Euro has risen by 0.12% at 1.1339 EUR/CHF and USD/CHF, December 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equity markets are unable to build on yesterday’s advance, but bonds and oil are extending gains. The dollar remains on the defensive and is off again all the major currencies. The lack of a joint statement over the weekend by the US...

Read More »Great Graphic: The Dollar Index Climbs a Wall of Worry

To be sure, the Dollar Index is not the dollar. It is not even a trade-weighted measure of the dollar. Two of America’s largest trading partners, China and Mexico, are not represented. It is heavily weighted to the euro and currencies that move in its orbit, like the Swiss franc Swedish krona, and arguably the British pound. It is primarily a speculative vehicle. Very few investors or businesses have exposure that...

Read More »FX Daily, December 03: G20 Fan Animal Spirits

Swiss Franc The Euro has risen by 0.14% at 1.1262 EUR/CHF and USD/CHF, December 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US and China kept their trade guns cocked at each other but offered the last opportunity for a negotiated settlement before escalation. What is billed as a 90-day freeze on tariff increases is really only 60 days beyond January 1...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org