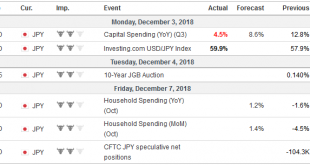

Overview: There is an eerie calm in the capital markets today as the G20 meeting gets underway. There is much uncertainty, and the event calendar is chock full next week, with the Brexit debate getting underway in the UK Parliament, the CDU picks a new leader to replace Merkel, possible partial US government closure, Powell’s testimony before Congress, OPEC+ meeting, and US employment data. In Asia, the rise of Japanese...

Read More »Cool Video: Santa Claus Rally and Trade

I was on Fox Business today. Stuart Varney introduced me by asking me about my forecast for a Santa Claus rally–a year-end recovery in equities. From a technical perspective, I liked the fact that the S&P 500 successfully retested last month’s lows last week. I liked that the price action made last Friday’s price action into an island bottom, with a gap lower opening followed by Monday’s gap higher opening. In terms...

Read More »Great Graphic: Weekly Jobless Claims and the S&P 500

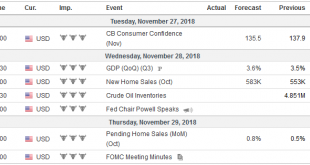

The softer than expected PCE deflator today plays into the dovish market mood. There may be little that can resist it until next Friday’s employment data, which should be another robust report with hourly earnings holding above 3% year-over-year. Last November, average hourly earnings rose by 0.3%. As this drops out of the year-over-year comparison, even a healthy bounce back from the 0.2% drop skewed by the hurricane...

Read More »FX Daily, November 29: Reluctant to Extend Dollar Losses

Swiss Franc The Euro has risen by 0.39% at 1.1337 EUR/CHF and USD/CHF, November 29 Source: markets.ft.com - Click to enlarge FX Rates Overview: The biggest US equity advance since Q1 has helped lift global markets today. The MSCI Asia Pacific Index rose for the fourth session, and nearly all the bourses in the region rallied with the notable exception of China and Hong Kong. Almost all the sectors in Europe are...

Read More »FX Daily, November 28: Powell Awaited

Swiss Franc The Euro has fallen by 0.10% at 1.1262 EUR/CHF and USD/CHF, November 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global capital markets are relatively calm as investors gird for drama. The Bank of England reports its assessment of the impact of Brexit and the stress tests a little before Fed Chair Powell speaks at midday in NY. The G20 meeting...

Read More »FX Daily, November 27: Market Shrugs Off Latest US Tariff Provocation

Swiss Franc The Euro has fallen by 0.12% at 1.1293 EUR/CHF and USD/CHF, November 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets have taken the US latest tariff threats in stride. Most of the Asian equity markets advanced, including Japan, Korea, Taiwan, India, and Australia. China and Hong Kong were exceptions with marginal losses....

Read More »Near-term Outlook

There are three key scheduled events between now and the end of the year. In chronological order, this weekend G20 meeting is first. It will shape expectations for trade tensions between the US and China, with extensive secondary impact. Saudi Arabia and Russia’s meeting may help shape expectations for the price of oil, which has collapsed here in Q4 18. The ECB meets on December 13 with new staff forecasts (likely...

Read More »FX Weekly Preview: Powell and Draghi, Xi and Trump

The investment climate will be shaped by three events next week. ECB President Draghi’s testimony before the European Parliament to kick-off the week. Fed Chairman Powell speaks to the NY Economic Club in the middle of the week. Presidents Trump and Xi are to meet at the G20 meeting to end the week in hopes of dialing back the escalating trade conflict. Also at the G20 summit, the NAFTA2.0 is expected to be signed, and...

Read More »FX Daily, November 23: Friday

Swiss Franc The Euro has fallen by 0.27% at 1.1311 EUR/CHF and USD/CHF, November 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is firmer against most of the major currencies. Japanese and Indian markets were closed for holidays and a weaker than expected flash EMU PMI helped keep the euro pinned near this week’s lows. Although the EU seemed...

Read More »Cool Video: CNBC Squawk Box

I was part of the “Trading Block” on CNBC earlier today. The sharp fall in stocks and oil would have led many, like Joe, to anticipate dollar weakness. Instead, the dollar rallied. Perhaps, I suggested, the dollar was acting like a safe haven. Bill yields are high enough to make cash a reasonable alternative to park one’s savings. Even though the US economy is slowing from the fiscal goose of more than 4% in Q2 and more...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org