United States The drop in US yields and disappointing economic data weighed on sentiment and the dollar last week. Even weakness in equities, which had seemed to lend the greenback support, failed to do so at the end of last week. With the real Fed funds rate (adjusted for inflation) below zero, employment at 50-year lows, and some fiscal stimulus still in the pipeline, the doom and gloom cant of a recession next year seems misplaced. We too have been tracking late-cycle economic behavior, including weakness in the interest rate sensitive sectors, like housing, the 12-month moving average of non-farm payrolls peaked a couple of years ago, and some elevated measures of debt-stress. Moreover, the large dollop of

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Brexit, ECB, EUR, Featured, GBP, Italy, newsletter, Spain, USD, Yellow Vest

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

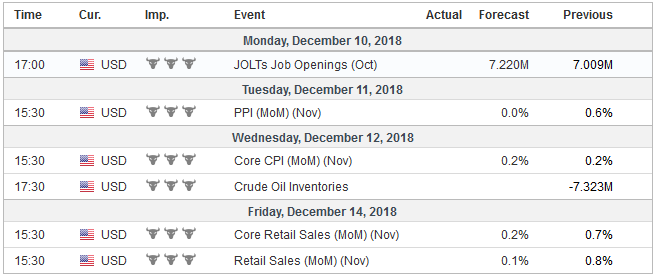

United StatesThe drop in US yields and disappointing economic data weighed on sentiment and the dollar last week. Even weakness in equities, which had seemed to lend the greenback support, failed to do so at the end of last week. With the real Fed funds rate (adjusted for inflation) below zero, employment at 50-year lows, and some fiscal stimulus still in the pipeline, the doom and gloom cant of a recession next year seems misplaced. We too have been tracking late-cycle economic behavior, including weakness in the interest rate sensitive sectors, like housing, the 12-month moving average of non-farm payrolls peaked a couple of years ago, and some elevated measures of debt-stress. Moreover, the large dollop of fiscal stimulus, which by some metrics was bigger than what was provided during the global financial crisis a decade ago, goosed the economy and there was little doubt that the 4.2% annualized pace of growth in Q2 was an anomaly and most certainly ought not to be used as a benchmark. Similarly, the fact that job growth this year is averaging better than last year may have lulled some into complacency from which they are over-reacting. The synchronized global expansion has been replaced with a synchronized downturn. Next week’s US data, including retail sales and manufacturing production, are expected to show an economy that is still expanding above what the Fed understands to be the long-term growth potential (given demographics and productivity), which is a little below 2.0%. Fed Chairman Powell’s assessment shared less than 24-hours before the November employment report that the “labor market was very strong by many measures” and that the economy was “performing well overall” is anchored into a larger view. It will not be challenged by the fact that a statistically noisy and volatile report, that is subject to revisions, disappointed median forecasts. |

Economic Events: United States, Week December 10 |

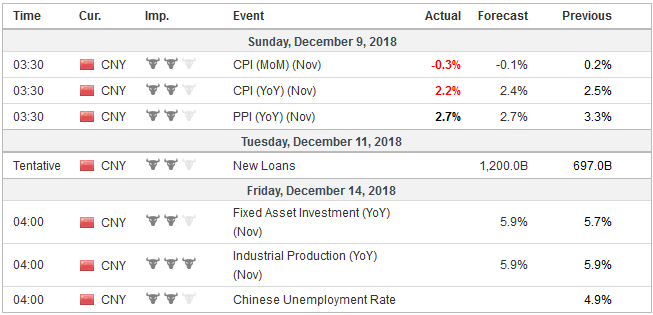

ChinaIt is going to take more than a week to assess what the US and China agreed to at the G20 meeting. There was not a joint statement. Each said claimed somewhat different takeaways. Yet each did seem to recognize some period that results are important. Chinese statements have not specified the period. The US has indicated 90 days for an escalation freeze. The US President and his top economic adviser disagreed on when the 90-day period begins. Of course, it must be immediately. Otherwise, there is no agreement this month, and ostensibly Trump could start the process toward making good his threat to slap a new tariff on the remaining $265 bln or so of Chinese goods the US imports. Investors learned several days after the fact that the CFO from Huawei had been detained in Canada at the request of the US for violating the embargo against Iran during the G20 meeting. It was immediately framed by the trade agreement and the threat to it. However, as more information has come out, it might not be the right lens. It appears that Canada’s Prime Minister Trudeau and US National Security Advisor Bolton knew of the plans several days earlier. Some in China have expressed their displeasure at these developments, but it has not come directly from the top. This is what one might expect if Xi and/or some of his senior advisers knew of the pending action as well. Chinese intelligence agencies, who are thought to monitor important Chinese nationals’ international travel, must have known. Since the incident has been publicized, Chinese officials have not backed away from whatever loose agreement was struck. The issue is not about trade. It is the US embargo against Iran and whether another Chinese company, which the US thinks is a subsidiary of Huawei, violated the agreement. Huawei says they are separate companies. The controlling framework is not trade law but the farthest application of US law. Huawei itself is banned in the US. It does not operate under US law. Despite the seeming falling out between the US and Canada, the Trudeau agreed to this is also revealing. This projection of US power may set a dangerous precedent. If news of the charges against Mery Wanzhou from Huawei added fuel to the market’s volatility, then look for another shoe to drop next week. The Wall Street Journal reports that federal prosecutors will unseal criminal charges against hackers linked to the Chinese government. The claim is that they were involved with a multi-year effort to hack into the tech service providers in “one of the most audacious and damaging” Chinese operations. |

Economic Events: China, Week December 10 |

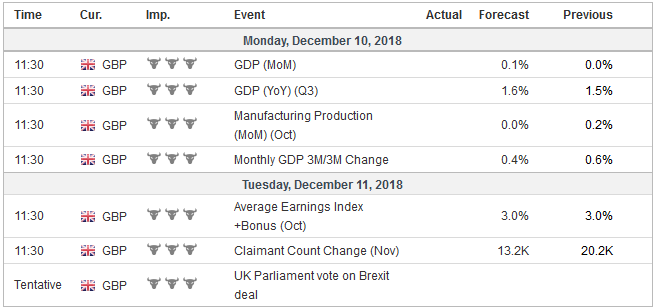

United KingdomThere are two events next week in Europe that will also command investors attention. The first is the UK parliament will have one more day of debate and then vote on December 11 whether to accept the Withdrawal Bill (and amendments). It had been looking like a binary outcome. It approves and sterling rallies. It doesn’t, and sterling sells off. This may still be fair to anticipation the headline impact, but the outcome is less binary than it may have appeared. What may be under-appreciated by investors is how much officials want to avoid the chaos that results not just on an exit from the EU without an agreement, but in the lead up to it. An extension to the end of March date might be granted, for example, to hold a second referendum (whose legitimacy is open to question–why note the best of three? and also seems to set a dangerous precedent), or as one European High Court judge opined, the UK should be able to take back the triggering of Article 50 unilaterally. The implication of this is to inject an asymmetry into the equation. If the House of Commons approves the Withdrawal Bill sterling will be repriced higher. The new trade relationship will have to be renegotiated, and those negotiations will also be fraught with difficulty, but that is for another day. As market participants often do, they risk jumping up rungs of escalation ladder prematurely If the bill is rejected, the downside may initially still be dramatic, but it may be tempered in price and/or time by the existence of other potential scenarios besides no-agreement, the last rung. The vol curve peaks now after two weeks. The one month implied volatility peaked in mid-November and finished last week below its 20-day moving average. |

Economic Events: United Kingdom, Week December 10 |

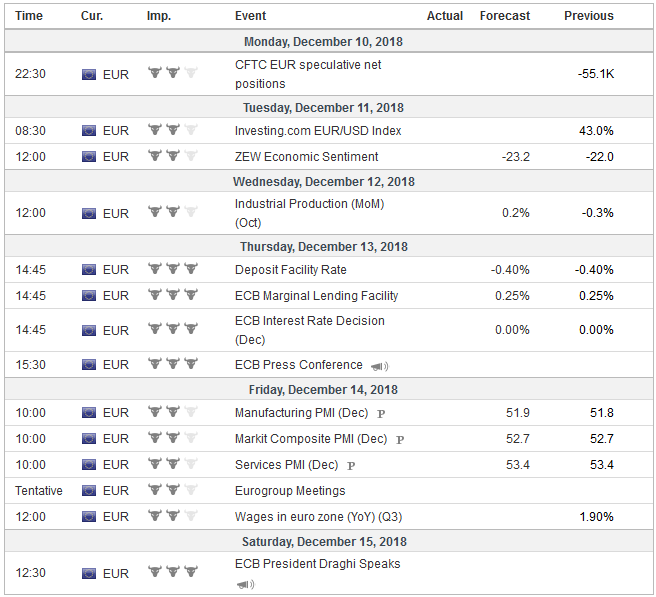

EurzoneThe other big event next week is the ECB meeting. There should be no doubt that the ECB will finish its bond purchases this month, and already corporate bonds spreads are back to where they were before the ECB’s purchases. At the same time, there should be no mistake about it: ECB monetary policy remains extraordinarily accommodative. The deposit rate is still negative (-40 bp), and this has served to drag down other rates into negative territory. The German curve is negative out seven years. Spain will sell negative yielding T-bills this week, and the two-year yield is minus 16 bp. The string of data suggesting the recovery from Q3, when Germany and Italy both contracted, is tepid will be expressed in the staff forecasts. The same holds true for the inflation forecast. The dramatic drop in oil prices warrants a re-think. However, it seems premature to expect the ECB to substantially change its economic assessment. Economic activity is disappointing, but news that Q3 wages across the EMU rose at 2.5% year-over-year pace, which is the most in a decade, will likely gird Draghi’s conviction. The first part of next year, the ECB will likely wrestle with the precise tactics and their calibration of the exit from easy monetary policy. There will be many ideas and suggestions, like staggering rate hikes, or a permanent floating rate TLTRO. There is no compelling reason for Draghi to say much about this, though some may be hoping he does. When the ECB met last month, there was much anxiety over the fiscal plans of the Italian government. Just like many seem not to recognize the extent to which Europeans on both sides of the channel want to avoid an exit without an agreement, it may not be fully appreciated the degree to which neither Italy nor Brussels wants a repeat of the Greek confrontation. To be sure, the growth and debt challenge Italy faces have not gone away. There does not appear to be easy answers. Boosting spending and cutting taxes appeal to some reformers, but the subsequent rise in yields would offset the positive economic impact. |

Economic Events: Eurozone, Week December 10 |

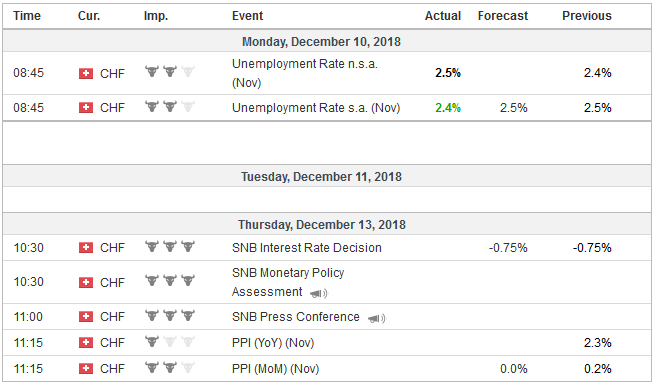

Switzerland |

Economic Events: Switzerland, Week December 10 |

Although Draghi’s famous, and perhaps impromptu pledge to “do whatever it takes” to preserve monetary may characterize the success presidency, his repeated calls for structural reforms have largely fallen on deaf ears. The so-called citizen’s income, which all citizens will not get and the tax cuts are not the structural reforms that Draghi is likely seeking. The one structural change, rolling back the retirement reform, is counter-productive.

That said, Italy’ 10-year yield has fallen about 50 bp since the ECB met last. Both Brussels and Rome appear to be softening their rhetoric. This will help ensure that Italy’s challenges return to be the manageable chronic state rather than an acute phase that threatens contagion, and apparently for some, redenomination risk.

In the immediate period ahead, France is more pressing. While the Italy-German 10-year spread is near its 100-day moving average, the French premium has been widening and finished last week near 18-month highs. Macron’s support rating is lower than Hollande’s was at the same point in his presidency. If Macron was both the cause and effect of the collapse of the political organizations of the elites, the Yellow Vest demonstrations are a movement, more like Occupy without a clear leader, which also makes it difficult to know the policies being advocated, which go well beyond the petrol tax.

The challenges of Spain’s minority Socialist government may come to a head before Italy’s. To pass the budget, the government needs to Catalonia and Basque support. So far, it has been unable to secure it. Spain has the benefit of a relatively robust economy, unlike Italy where a second contracting quarter is possible. This is going to move toward a climax next month. It could lead to early elections.

Tags: #GBP,#USD,$EUR,Brexit,ECB,Featured,Italy,newsletter,Spain,Yellow Vest