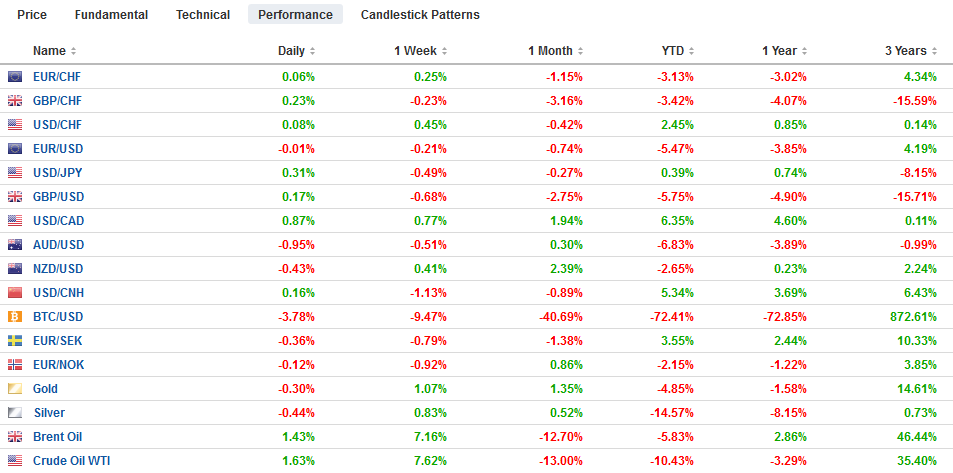

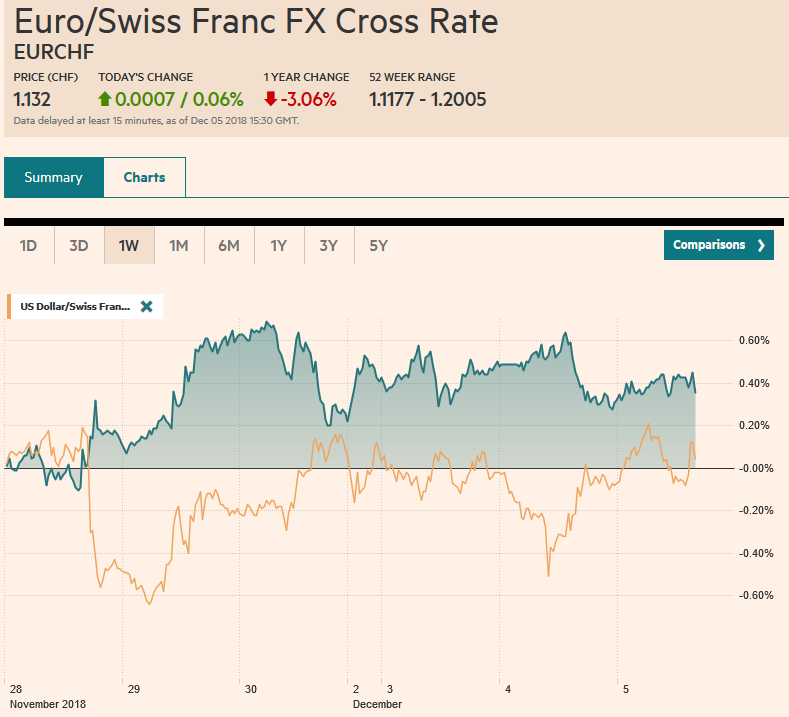

Swiss Franc The Euro has risen by 0.06% at 1.132 EUR/CHF and USD/CHF, December 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The 3%+ drop in the S&P 500 yesterday kept global equities under pressure today, though losses in Asia and Europe were milder. In Asia, only Hong Kong and Taiwan benchmarks lost more than 1%. In Europe, the Dow Jones Stoxx 600 is off about 0.8% in late morning turnover. Although US markets are closed today, in electronic trading the S&P 500 is up about 0.5%. The US 10-year yield is off 14 bp over the past five sessions to 2.91%. Asia and Pacific yields fell a few basis points, while the 10-year JGB yield fell to nearly five basis

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, MXN, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.06% at 1.132 |

EUR/CHF and USD/CHF, December 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The 3%+ drop in the S&P 500 yesterday kept global equities under pressure today, though losses in Asia and Europe were milder. In Asia, only Hong Kong and Taiwan benchmarks lost more than 1%. In Europe, the Dow Jones Stoxx 600 is off about 0.8% in late morning turnover. Although US markets are closed today, in electronic trading the S&P 500 is up about 0.5%. The US 10-year yield is off 14 bp over the past five sessions to 2.91%. Asia and Pacific yields fell a few basis points, while the 10-year JGB yield fell to nearly five basis points, a five-month low. European benchmark yields are slightly lower, while Italy’s yield is off four basis points to trade near 3.10%, the lowest in more than two months. The dollar is mostly a little softer against the major currencies and is largely consolidating yesterday’s gains. The Australian dollar is the biggest mover of the majors. It is off about 0.6% following a disappointing Q3 GDP. |

FX Performance, December 05 |

Asia Pacific

China has acknowledged the 90-day period that absent from its initial summary of the G20 meeting, but it is still not clear when the period begins. Trump has indicated that it began immediately, while Kudlow said the 90-days began January 1. Talk about which statement, the US or China’s, was more accurate miss two points. First, procedurally, with no joint statement, the meeting lends itself to “he said, Xi said.” Second, there are differences between the US team. Trump initially said there was an agreement on autos. Kudlow said no. It seems like it may have been an “aspirational truth” (what you wish) not what was agreed, and it now seems to be greater recognition of this. Meanwhile, reports suggest that China may have already begun buying US LNG and soy. There is talk too that China was buying US Treasuries.

Many investors are suspicious of the accuracy of Chinese economic data, and often prefer private sector data, though the private sector in China is a bit blurry, with informal state influence too. The Caixin PMI is thought to offer a more accurate picture than the official measures. The official measures showed weakness while Caixin measures showed improvement. The better than expected manufacturing PMI has been followed with a jump in the Caixin non-manufacturing PMI to 53.8 (a five-month high) from 50.8, led by new orders. The composite rose to 51.9 from 50.5.

Australia disappointed. At 0.3%, growth in Q3 was half of what economists expected. It was the weakest performance for 2.5 years. Ironically, household consumption (0.3% vs. 0.9%) and savings fell (2.4% vs. 2.8%). On top of this, house prices are falling the most since the Great Financial Crisis (-9.5% in Sydney since July 2017. The completion of mining and energy projects also was a drag on growth. Most participants did not expect the RBA to hike rates next year, but any further economic weakness is likely to renew thoughts about a possible cut.

The Australian dollar gapped higher on Monday. It filled the gap on Tuesday and is seeing follow-through selling today. The Aussie stalled in front of $0.7400 in the past two sessions and has neared $0.7280 today. Initial support now is seen in the $0.7270 area where the 20-day moving average and retracement objective is found. It may take a break of $0.7250, where a trendline off the late October lows and another retracement objective are found.

The dollar held support we identified near JPY112.50 yesterday and is straddling the JPY113.00 in the European morning. Getting a foothold above JPY113.00 would target the JPY113.40 area. Tomorrow, there is a $1.1. bln option at JPY113.00 and a $1.4 bln option at JPY113.80 that expire. The US dollar fell about 1.8% against the Chinese yuan over the past two sessions but is about 0.35% higher today near CNY6.86. Thoughts of a test on CNY7.0 are being pushed out into next year.

Europe

The UK government was defeated in three votes in Parliament yesterday. The most important was an amendment, sponsored by a Tory supporter of a second referendum that gives Parliament considerable more say if the Withdrawal Bill is defeated next week. The debate continues today and tomorrow. The odds the bill passes seem slight, but there are hurdles to a Plan B is a no-agreement exit is to be avoided. The opinion that the UK can unilaterally rescind the triggering of Article 50 is interesting, but how can it be operationalized without a second referendum? And how can a second referendum overcome questions of legitimacy (why not the best of three then?) and practical questions (what could be the voters’ choices? The current withdrawal bill and no deal?).

Separately, the UK reported its weakest services PMI in more than two years. The November services PMI unexpectedly fell to 50.4 from 52.2 (expected to be 52.5). This put the composite reading at 50.7 (from 52.1), which is the lowest since right after the referendum in July 2016, when it briefly fell below the 50 boom/bust threshold.

The EMU economy is not doing quite as poorly as the flash November PMI suggested. Earlier this week, the manufacturing PMI was revised a little higher, and today the service reading was, and this pared the composite’s loss. The services PMI was revised to 53.4 from the 53.1 flash report. It stood at 53.7 in October. The composite reading rose to 52.7 from 52.4 (flash) but is still off from October’s 53.1 report. The composite PMI has averaged 54.3 over the past three months and 54.9 for this year after averaged 56.4 in 2017.

The national reports saw the German and French flash composites revised slightly higher. Italy’s services were at 50.0, which was better than expected, but the composite was unchanged at 49.3, which plays on fears that it is neither the bond market nor Brussels that offer Italy the biggest challenge, but the economy itself. Spain’s composite rose to 53.9 from 53.7and separately, it reported a dramatic jump in October industrial output. The 1.2% gain was more than double what economists expected and follows a 0.7% fall in September. The immediate political challenge for Spain is for the minority government to pass next year’s budget. It has a bit more than a month to accomplish it.

The euro extended yesterday’s decline, slipping a little below $1.1320 in Asia. A trend line off last month’s lows comes in near $1.1280, and a trend line off the recent highs is found around $1.1450. Only a break of this range may be significant. Note there are 1.1 bln euros struck at $1.13 that expires tomorrow and 1.4 bln at $1.1380 that will also be cut. Sterling is holding above the marginal new low for the year set yesterday just below $1.2660. Some leveraged accounts appear to think the news cannot get much worse and may be trying to pick a bottom. Sterling is firm near midday around $1.2750. We suspect additional gains will be limited today.

North America

US markets are closed today in memorial of former President George H.W. Bush. The Bank of Canada meets today, and there is no doubt that rates are on hold. Similar to the idea of the Fed pausing next year, which we argue could be deduced from the September dot plot that implied only three hikes next year, many now are looking for the Bank of Canada to also pause. The underlying weakness of Q3 GDP is troublesome. The implied yield of the March BA futures contract has fallen nearly 20 bp over the past five weeks. Bloomberg estimates that using the OIS, the odds of a January hike has fallen from around 80% at the beginning of last month to a little more than 55% now.

The US dollar reversed Monday’s losses against the Canadian dollar in full yesterday, and follow-through buying saw it close the gap created by Monday’s lower opening. The greenback is challenging the CAD1.33 level again. It has traded above there half a dozen times over the last few weeks but closed above it only once. The intraday technicals warn that the greenback may work its way lower. The US dollar jumped from MXN20.00 on Monday to close above MXN20.50 yesterday, transversing its entire range. Despite the dollar’s strong finish yesterday, it is pulling back today. It may find a bid ahead of MXN20.40.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,$AUD,$CAD,$EUR,$JPY,Featured,MXN,newsletter