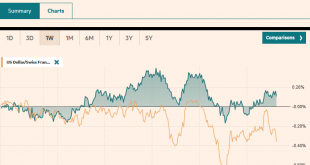

Swiss Franc The Euro has risen by 0.02% at 1.1353 EUR/CHF and USD/CHF, March 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are on edge. The week’s big events lie ahead. The Bank of Canada meets today and the ECB tomorrow, followed by US (and Canada) employment data on Friday. The equity markets are mixed. While Japan and Korean equities...

Read More »Thoughts about the ECB and Euro

Mario Draghi’s term at the helm of the ECB is winding down. He will step down in October. It has not been an easy job. The light at the end of the tunnel in 2017 turned out to be another train in 2018. The eurozone enjoyed 0.7% quarterly growth every quarter in 2017. The ECB was able to outline an exit from its asset purchases. The debate began over sequencing and when the first rate hike could be delivered. But alas,...

Read More »FX Daily, March 05: Dollar Remains Firms as China Cuts Growth Target and Taxes, while EMU PMI Surprises on Upside

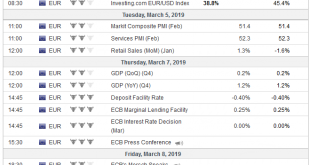

Swiss Franc The Euro has risen by 0.04% at 1.1328 EUR/CHF and USD/CHF, March 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is an eventful day, but the capital markets are taking it in stride. Equity markets are mixed. Asia may have been weighed down by China’s shaving its growth target and announced around CNY2 trillion (~$300 bln) in tax cuts to support...

Read More »FX Weekly Preview: Dovish Hold by the ECB and Uptick in US Wages will Underscore Divergence

The important events take place in the second half of the week ahead: the ECB meeting and the US employment report. A dovish hold by the ECB is the most likely outcome. US jobs growth is bound to slow from the heady 304k gain in January, but there won’t be anything in it that lends credence to ideas that the world’s largest economy is on the precipice of a recession. The Brexit drama could be moving into its...

Read More »FX Daily, March 01: Could the Worst be Behind China and Germany? Or Hope Springs Eternal

Swiss Franc The Euro has risen by 0.14% at 1.1364 EUR/CHF and USD/CHF, March 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that MSCI plans to substantially boost China’s equity weighting in its indices and a better than expected Caixin manufacturing PMI and some easing of India-Pakistan tensions helped bolster the risk-taking appetite going into the...

Read More »FX Daily, February 28: Trump Walks Away from North Korea. Should Beijing Worry?

Swiss Franc The Euro has fallen by 0.39% at 1.134 EUR/CHF and USD/CHF, February 28(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that the US-North Korean summit ended abruptly without an agreement spurred losses in equities and gains in the Swiss franc and Japanese yen. US President Trump willingness to walk away from the talks is important in and of...

Read More »CNBC Clip: February 24 Brexit

We tried a CNBC hook-up in Asia via Skype on February 25. I did not think there would be a clip, but I stumbled on it looking for something else. Click here for the roughly 2.5-minute interview done from my apartment in NYC. The discussion is on Brexit and sterling. [embedded content] Related posts: Cool Video: Clip from CNBC Squawk Box FX Daily,...

Read More »FX Daily, February 27: Dollar Trades Heavily, While Prospects of a Softer and Later Brexit Send Sterling Higher

Swiss Franc The Euro has fallen by 0.21% at 1.1366 EUR/CHF and USD/CHF, February 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: As the North American session is about to begin, the markets await developments in the UK House of Commons where a vote is expected today on Prime Minister May’s proposal to hold votes on around March 12 on the Withdrawal Bill and no...

Read More »FX Daily, February 26: Brexit Dilution Lifts Sterling, while Yesterday’s Equity Rally Fades, Powell Awaited

Swiss Franc The Euro has fallen by 0.02% at 1.1363 EUR/CHF and USD/CHF, February 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The increased likelihood that Brexit is delayed and the possibility of a second referendum is helping lift sterling. As has been the case for most of the time since the June 2016 referendum, the prospects of a softer and/or later...

Read More »FX Daily, February 25: Dollar Thumped on Confirmation of Tariff Delay while Stocks Advance

Swiss Franc The Euro has risen by 0.18% at 1.1358 EUR/CHF and USD/CHF, February 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The extension of the US-China tariff freeze had been telegraphed, but the confirmation is the single biggest driver of the day. Equities, led by a 5%+ advance in China, have rallied in Asia and Europe. Benchmark 10-year bond yields are...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org