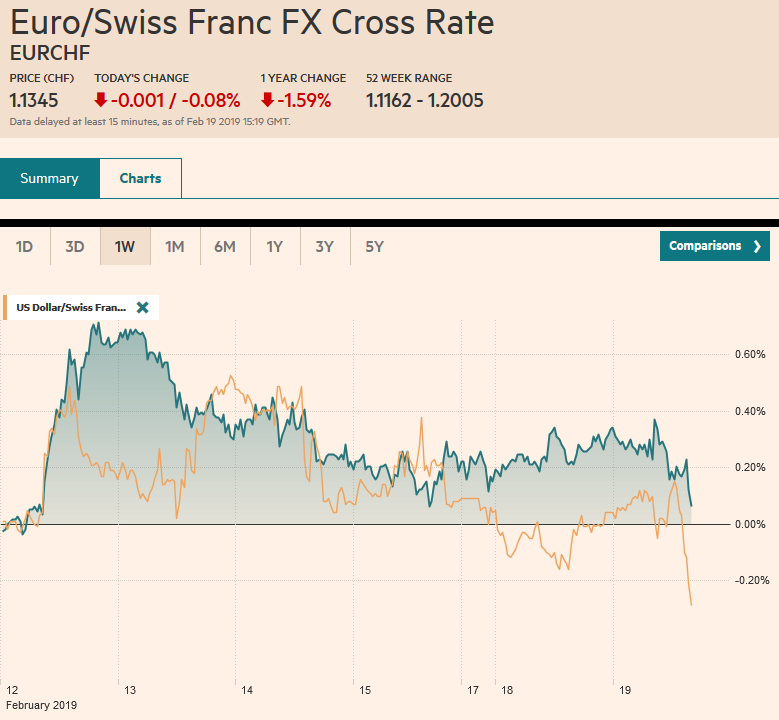

Swiss Franc The Euro has fallen by 0.08% at 1.1345 EUR/CHF and USD/CHF, February 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Activity in the global capital markets is subdued as investors await fresh developments. New wording for the Irish backstop apparently is being drafted. US-China trade talks resume. No decision has been made on US auto tariffs, but European and Japanese officials seem to be playing down the threat. Separately, BOJ’ Kuroda said there was more room to lower rates or buy more assets if needed, while the minutes from the Reserve Bank of Australia confirmed the shift to a neutral stance. Sweden’s soft than expected CPI weighed on the

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, brl, CAD, EUR, Featured, GBP, JPY, MXN, newsletter, SEK

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.08% at 1.1345 |

EUR/CHF and USD/CHF, February 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

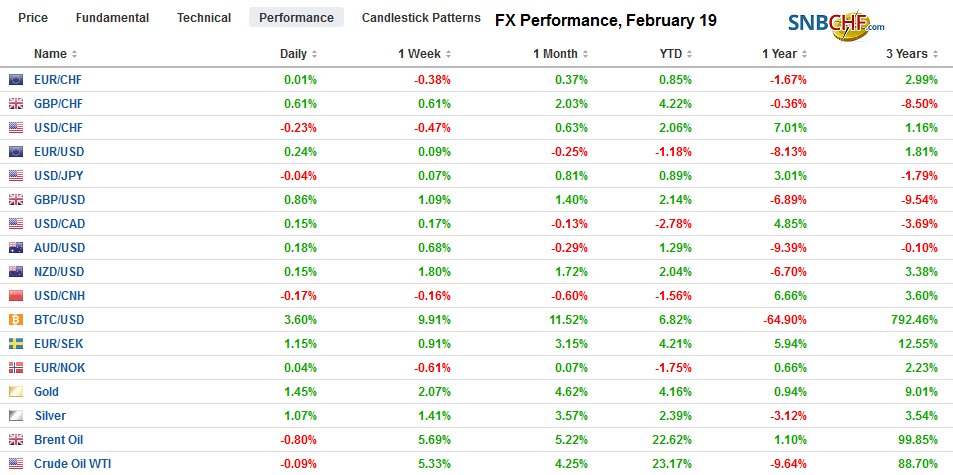

FX RatesOverview: Activity in the global capital markets is subdued as investors await fresh developments. New wording for the Irish backstop apparently is being drafted. US-China trade talks resume. No decision has been made on US auto tariffs, but European and Japanese officials seem to be playing down the threat. Separately, BOJ’ Kuroda said there was more room to lower rates or buy more assets if needed, while the minutes from the Reserve Bank of Australia confirmed the shift to a neutral stance. Sweden’s soft than expected CPI weighed on the krona. The dollar is sporting a firmer profile against most of the major and emerging market currencies. Global equity markets are narrowly mixed, and benchmark 10-year yields are mostly a little softer. Gold has edged higher to trade at fresh 10-month highs, while oil firms to a new three-month high. |

FX Performance, February 19 |

Asia Pacific

Bank of Japan Governor Kuroda took a dovish tact and warned that although the yen is not targeted if yen appreciation knocks the economy, more assets could be bought and rates could be lowered. This would be a policy reversal insofar as the BOJ has been slowly reducing the amount of bonds it buys. Note that the generic 10-year yield has not been above zero this month and the bid-cover at today’s 20-year bond auction (4.67x) was the strongest in five years. Japan’s economic minister was quoted in the press playing down the likelihood of auto targets while US-Japanese trade talks have just begun. Lastly, Prime Minister Abe indicated this will be his last term as head of the LDP (and prime minister).

The minutes from the Reserve Bank of Australia meeting early this month confirmed a shift to neutrality. Going forward, investors may be sensitive to consumption data as this is the concern of officials. Weakening property prices, high household debt, and weak income growth work their way through the economy, in part, by weakening consumption.

The People’s Bank of China is still expected to ease policy in the near-term. There had been talk of another cut in required reserves, but some participants are now looking for a cur in the reverse repo rate.

The dollar traded higher against the yen after Kuroda’s comments. The intraday technical readings suggest that a push toward last week’s highs near JPY111.15 may be too far today. The downside may be protected by a $780 mln option struck at JPY110.60, expiring today, and trendline support near JPY110.45. The RBA minutes stopped the Australian dollar’s rally in its tracks. The strong pre-weekend recovery saw follow-through buying that lifted the Aussie to $0.7160 yesterday, its best level in a couple of weeks. However, it closed poorly, and selling has taken it to almost $0.7100 today. A convincing break of this area would encourage a tested on the recent lows near $0.7050.

Europe

There have been two developments in the UK. First, reports indicate that there is some effort to redraft the language regarding the Irish backstop in the UK withdrawal agreement in hopes of finding a way forward. Meanwhile, Prime Minister May is under pressure from within her party to stop using the no-deal exit as a threat. Second, the UK employment data was in line with expectations. The December unemployment rate was unchanged (ILO measures 4.0%), and weekly earnings averaged 3.4% with and without bonus payments. The January claimant count rose 14.2k, after a 20.2k increase in December.

The German ZEW survey showed the while the assessment of the current conditions is still deteriorating, there might be light at the end of the tunnel. The expectations component rose for the fourth consecutive month. The current situation worsened to 15 from 22.6. It is the fifth month it has trended down. Last February it stood at 92.3. The expectations ticked up to -13.4 from -15.0. It is the best since last September. A year ago it was at 17.6.

Sweden’s January CPI disappointed, and this will keep the Riksbank on the sidelines after hiking the repo rate last month. Headline CPI fell 1.0% in the month. This translates into a 1.9% year-over-year pace. The median forecast in the Bloomberg survey was for a 2.2% pace. The CPI measure that uses fixed rate mortgages eased to 2.0%, the lowest in nine months. At the end of the week, the Riksbank will publish the minutes from the February 12 meeting.

Turkey announced a cut in its reserve requirement for the first time in six months. The goal is to spur credit growth and ostensibly frees up around TRY3.3 bln (~$625 mln). Separately, Turkey sold a record TRY3.4 bln of debt to state entities in a non-competitive auction.

The euro has no momentum to speak of, and it has been unable to build on the gains the carried it back above $1.13. The $1.1280 area may offer support while the $1.1335-$1.1340 may provide the cap. There is an option for almost 520 mln euros struck at $1.13 that expires today. Sterling is also trading within yesterday’s range as it straddles the $1.29 area.

America

The US and Canadian economic calendars are light today. The FOMC minutes from the January meeting will be released tomorrow. Canada reports December retail sales on Thursday. The Fed’s Mester speaks today on the US economy, but her views are clear. She is part of the median.

Canada’s Trudeau was dealt a setback in his bid to be re-elected later this year. One of his top aides and principal secretary Gerald Butts resigned, over accusations of that the government pressured the attorney general to drop a case. The attorney general (Wilson-Raybould) resigned last week. The polls show a tight race between Trudeau’s Liberal and the Conservatives ahead of the October election.

A scandal in the new Brazilian government has forced President Bolsonaro to accept the resignation of a close political ally (Bebianno) over campaign financing irregularities. Bebianno may be sorely missed as the government tries to ensure that pension reform stays on track. Pension reform is seen as key to a host of other reforms, but in order to secure it, the government is willing to tactically retreat on measures so as not to antagonize the needed support. This includes shelving plans to cut subsidies and open the economy to more foreign competition. The pension reform may be submitted as early as tomorrow to the lower house.

The US dollar found support last week near CAD1.3200 and recorded a high in the second half of last week near CAD1.3330. The US dollar has not gotten much traction from the widening two-year US-Canada differentials. We look for an eventual upside break for the US dollar. The dollar appears to be moving in a higher range against the Mexican peso. It had been mostly MXN19.00-MXN19.25. Now it seems more comfortable in an MXN19.20-MXN19.50 range. The Dollar Index posted a key downside reversal at the end of last week, but the follow-through selling has been limited. Yesterday’s low was near 96.65. The 97.25-97.50 offers resistance in front of last year’s high set in December near 97.70. We see the dollar testing BRL3.80 after forging what appears to be a good base near BRL3.70.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,$AUD,$CAD,$EUR,$JPY,brl,Featured,MXN,newsletter,SEK