The information set investors have is unlikely to substantively change in the coming days. The important macro points are known. The first part of February may be about digesting and making sense of that information rather than an incremental increase. Investors had been concerned about what has become known as “quantitative tightening” or “QT”. It is the opposite of QE. Collectively the central banks’ balance...

Read More »Short Note on Jobs Report

The January employment report was mixed. It is unlikely to have a material impact on expectations for Fed policy. However, it does suggest the downside risks may not materialize. The US economy grew 304k jobs, well above expectation. It is marred by a 70k net downward revision of the past two months, and notably a 90k cut in December’s estimate, which brings it to 222k (from 312k). The participation rate edged...

Read More »Two Brinkmanship Games and a Possible Third

Some historians give Adlai Stevenson credit for inventing the word “brinkmanship” as part of his criticism of US foreign policy under Dulles, who said that “if you are scared of going to the brink, you lost.” But surely we can agree that the tactic is as old as civilization. The idea is you take the issue to the very edge, risking a significant confrontation, to force a deal, is the way it may seem. The Cuban Missile...

Read More »FX Daily, February 01: Did the Fed Steal the Jobs Data Thunder?

Swiss Franc The Euro has risen by 0.24% at 1.1407 EUR/CHF and USD/CHF, February 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Weak manufacturing PMI readings are curbing risk appetites ahead of the US jobs report. Growth concerns are top and center after dovish Fed and the Bundesbank’s Weidmann warning that Germany may undershoot 1.5% growth this year, though...

Read More »FX Daily, January 31: Did Powell Toss in the Towel or was it a Tactical Retreat?

Swiss Franc The Euro has fallen by 0.08% at 1.14 EUR/CHF and USD/CHF, January 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Fed’s dovish tone and earnings news are the main drivers of the capital markets today, helping lift stocks, bonds, and currencies. Large equity markets in Asia, including Japan, Hong Kong, China’s CSI 300, India, and Indonesia, all...

Read More »FX Daily, January 30: She Can’t Accept No

Swiss Franc The Euro has risen by 0.27% at 1.1396 EUR/CHF and USD/CHF, January 30(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The UK Prime Minister has two weeks to strike a new deal with the EC over the Irish backstop or return to Parliament in mid-February to consider alternatives, six weeks before Brexit. Sterling has recovered about half of...

Read More »FX Daily, January 29: Fragile Tone Persists

Swiss Franc The Euro has risen by 0.19% at 1.1353 EUR/CHF and USD/CHF, January 29(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The positive impulse in the capital markets seen last week has faded. The gap higher opening ahead of the weekend by the S&P 500 was follow by a gap lower opening yesterday. The US threatened crackdown on Huawei disrupted...

Read More »Cool Video: Bloomberg Clip US Growth in Relative Terms

With a jam-packed week for investors, and several high profile earnings reports, first look at Q4 GDP, the resumption of US-China trade talks, the FOMC meeting, and US jobs, it was a good time to be invited on the set of Bloomberg TV, with David Westin and Lisa Abramowicz. The clip here is with Matt Winkler, Editor-in-Chief Emeritus. Winkler has a piece out today that compares the US economic performance under the...

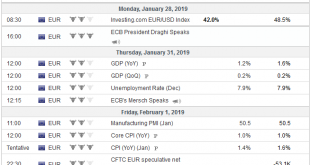

Read More »FX Daily, January 28: Getting Ducks Lined Up for Later in the Week

Swiss Franc The Euro has risen by 0.05% at 1.1331 EUR/CHF and USD/CHF, January 28(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are consolidating ahead of this week’s big events, which include the FOMC meeting, US jobs, an important Brexit vote in the UK parliament and the first look at Q4 EMU and US GDP. The US dollar is narrowly...

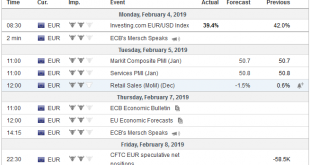

Read More »FX Weekly Preview: Divergence Reinvigorated

Eurozone Last week the focus was on Europe. Prospects of a delay in Brexit helped extend sterling’s gains to 11-week highs. Disappointing flash PMI for the eurozone and a dovish Draghi pushed the euro below $1.13 for the first time since mid-December. Speculation that the Reserve Bank of Australia would be forced to cut interest rates saw the Australian dollar punch through $0.7100. For its part, the yen was...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org