Die Eidgenössische Finanzmarktaufsicht FINMA veröffentlicht den Risikomonitor 2020. Sie gibt damit einen Überblick über die aus ihrer Sicht aktuell bedeutendsten Risiken für die Beaufsichtigten und beschreibt den daraus abgeleiteten Fokus der Aufsichtstätigkeit. Die FINMA identifizierte im Corona-Jahr sieben Hauptrisiken. Neu auf der Liste sieht die FINMA drohende Ausfälle oder Korrekturen bei Unternehmenskrediten und -anleihen im Ausland. Das Jahr 2020 war klar von...

Read More »Romeo Lacher and Christoph Mäder nominated for election to the SNB Bank Council

Romeo Lacher ist Verwaltungsratspräsident von Julius Bär. Bild: ZVG At its meeting today, the Bank Council of the Swiss National Bank decided to propose to the General Meeting of Shareholders of 30 April 2021 that Romeo Lacher and Christoph Mäder be elected to the SNB Bank Council for the remainder of the 2020–2024 term of office. Romeo Lacher is Chairman of the Board of Directors of Julius Baer Group Ltd. and Bank Julius Baer & Co. Ltd. Christoph Mäder is...

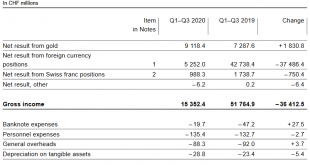

Read More »SNB Profit in Q1 to Q3 2020: CHF 15.1 billion Despite Covid19

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money...

Read More »2020-10-30 – Swiss Financial Accounts: quarterly data published for first time

The Swiss National Bank is expanding its data offering with respect to Switzerland’s financial accounts. It will now publish quarterly as well as annual data, and the time to publication will be shortened from ten to four months. Today the SNB is releasing quarterly data for the period from Q4 2014 to Q2 2020. Annual data are available for the period 1999 to 2013. The data can be accessed in the form of charts and configurable tables on the SNB’s data portal...

Read More »FINMA-Aufsichtsmitteilung 08/2020: LIBOR-Ablösung im Derivatebereich

Die Eidgenössische Finanzmarktaufsicht FINMA empfiehlt den von der LIBOR-Ablösung betroffenen Beaufsichtigten, das neue Rückfallprotokoll der International Swaps and Derivatives Association (ISDA) frühestmöglich zu unterschreiben. Der Wegfall des LIBOR rückt näher. Der volumenmässig grösste Anteil der weiterhin an den LIBOR gebundenen Verträge sind Over-the-Counter-Derivate (OTC-Derivate). Die FINMA hat im Juni 2020 in einer Erhebung bei Schweizer Instituten hierzu...

Read More »Aktualisierte Sanktionsmeldung

Das Eidgenössische Departement für Wirtschaft, Bildung und Forschung WBF hat eine Änderung des Anhangs 3 der Verordnung vom 27. August 2014 über Massnahmen zur Vermeidung der Umgehung internationaler Sanktionen im Zusammenhang mit der Situation in der Ukraine (SR 946.231.176.72) publiziert. Am 14. Oktober 2020 hat das Eidgenössische Departement für Wirtschaft, Bildung und Forschung WBF die Liste der in diesem Kontext sanktionierten Personen, Unternehmen und...

Read More »Swiss National Bank intervenes heavily to weaken Swiss franc

© Michael Müller | Dreamstime.com Official data recently released by the Swiss National Bank (SNB) show it sold 51.5 billion Swiss francs while acquiring US dollar and euro-denominated assets in a bid to weaken the franc over the first quarter of 2020. The data followed comments by SNB President Thomas Jordan signalling that even larger interventions may be on the cards in the future. Switzerland’s long-running battle with its overvalued currency has drawn criticism...

Read More »Central banks and BIS publish first central bank digital currency (CBDC) report laying out key requirements

Seven central banks and the BIS release a report assessing the feasibility of publicly available CBDCs in helping central banks deliver their public policy objectives. Report outlines foundational principles and core features of a CBDC, but does not give an opinion on whether to issue. Central banks to continue investigating CBDC feasibility without committing to issuance. A group of seven central banks together with the Bank for International Settlements (BIS) today...

Read More »How much blockchain does the financial world need?

Switzerland’s central bank is exploring the potential of blockchain but is in no rush to produce digital cash. © Keystone / Gaetan Bally Central Bank Digital Currency (CBDC) is the buzz-phrase of the moment. But the Swiss National Bank (SNB) says producing digital Swiss francs for the general public would create many problems with unclear benefits. The Swiss government has backed up the central bank word for word. And it turns out that an SNB issued digital Swiss...

Read More »Adjustments to publication of data on money and foreign exchange market operations

Additional data on money market operations and more frequent publication of volume of foreign exchange market interventions From 30 September 2020, the Swiss National Bank will be publishing more detailed data on its money and foreign exchange market operations on its data portal. Regarding money market operations, the SNB will now publish information on the conditions and volume of individual monetary policy-related transactions at the end of each month for the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org